Bitcoin Price Consolidates as Spot BTC ETFs Cash Inflows Registered $21M on Wednesday

Bitcoin price has established a robust support level between $60K and $61K, despite the accelerated selling pressure led by the US and the German government.

Everything you need for the flagship crypto: from price movements and halving cycles to institutional adoption, on‑chain metrics and market strategy around Bitcoin. Follow how Bitcoin’s narrative evolves, why it matters to global finance, and what shifts could impact its future role as digital gold.

Bitcoin price has established a robust support level between $60K and $61K, despite the accelerated selling pressure led by the US and the German government.

The cryptocurrency market continues to endure a severe downturn, resulting in the liquidation of 32,916 traders.

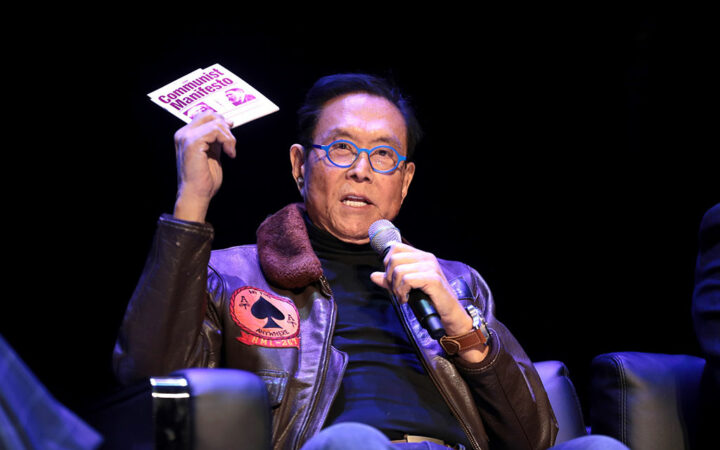

According to Kiyosaki, the Banana Zone will likely happen, in agreement with Pal’s forecast, especially since 2024 is an election year.

Jamaal Bowman, who was against crypto, lost the primary election for the 16th District in New York, showing that being against crypto may not be a good political position for the 2024 U.S. elections.

The United States Department of Justice (DOJ) has sentenced two men for orchestrating a multimillion-dollar cryptocurrency fraud scheme, marking a significant victory in the fight against financial crime in the digital asset market.

Despite the mixed performance of spot bitcoin ETFs, the overall outlook remains positive. As of June 26, 2024, the combined net inflows for these 11 funds since their January launch stands at $14.42 billion.

In order to double down on its Bitcoin investment strategy, Metaplanet Inc has announced the establishment of an offshore entity.

NGS Crypto, an Australian cryptocurrency company, has officially changed its name to “Hiddup” amid an ongoing investigation and legal action by the Australian Securities and Investments Commission (ASIC).

The German government has dumped 400 Bitcoins (BTC) on Kraken and Coinbase, an action that suggests investors should brace for impact. The 400 BTC, worth $24.4 million based on the cryptocurrency’s current price, were deposited at 15:38 UTC+8.

Popular Solana wallet Phantom might gradually be gravitating towards a multichain future following its recent announcement.

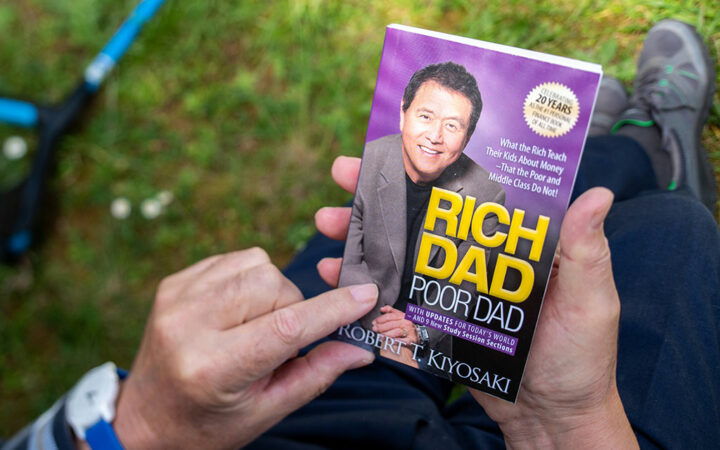

Robert Kiyosaki, the renowned author of the best-selling book “Rich Dad Poor Dad”, is urging investors to view the recent market dip as a prime buying opportunity rather than a cause for panic.

In a potential attempt to re-engage with the crypto industry, the White House has rehired cybersecurity advisor Carol House as the crypto advisor.

Bitcoin’s recent price drop to 3.34% triggers major outflows from leading Bitcoin ETFs, with Grayscale’s GBTC fund losing $90 million.

The meme coin crypto industry led by Pepe and Shib has dramatically reduced in valuation in the past four weeks to around $47 billion on Tuesday.

Alex Lab, a Bitcoin-based blockchain protocol for DeFi, revealed that the Lazarus Group, a notorious North Korean cybercriminal group, orchestrated a recent cyberattack causing a $4.3 million loss.