BNB Chain Suffers Copycat Attacks Worth $73,000 of Crypto

The copycat attacks on the BSC were attributed to a malfunctioning reentrancy lock in certain versions of the Vyper programming language.

Blockchain news category covers the foundational technology powering the crypto world. Discover updates on scalability solutions, layer‑1 and layer‑2 protocols, decentralized apps (dApps), enterprise adoption, and how blockchain is reshaping sectors from finance to supply chain. A must‑read for understanding the infrastructure behind the headlines.

The copycat attacks on the BSC were attributed to a malfunctioning reentrancy lock in certain versions of the Vyper programming language.

As per the preliminary audits, the estimated losses are already north of $42 million with assets worth $100 million under risk.

Hayes says ETH will skyrocket sometime in the next few years as the AI revolution strengthens and DAOs begin to form.

Crypto.com’s entrance to the Dutch market comes a few weeks after Binance exited the country due to regulatory hurdles.

eToro said that it will continue to empower our Spanish users by providing them with access to a diverse range of asset classes.

Meanwhile, the British Museum is not the only cultural institution engaging with the crypto ecosystem.

The prospective Phoenix Technology IPO is expected sometime this year in Abu Dhabi. However, there are no further details on size and price.

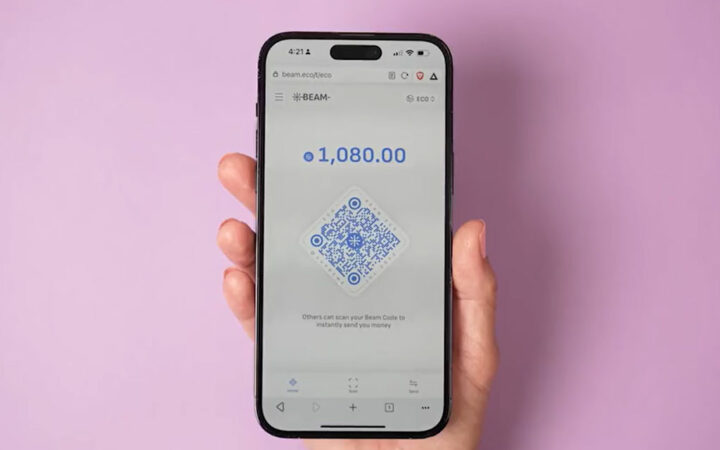

The Beam wallet has been designed atop Ethereum Layer-2 blockchains such as Coinbase’s Base and Optimism for facilitating faster crypto transactions at low cost.

Among the issues that Netting Manager aims to address are lack of transparency due to lack of centralization, payment date uncertainty, and unnecessary FX conversion and transaction costs.

The move is expected to boost the usage of non-fungible tokens (NFTs) within the gaming industry.

It is expected that both FTX and Genesis will soon file motions with the bankruptcy courts to seek approval of the deal.

The move comes after Securitize’s entry into the Spanish General Secretariat of the Treasury and International Finance’s sandbox for digital asset securities.

The motion to dismiss a lawsuit filed by Binance’s legal team highlights the argument that CZ is not subject to US jurisdiction as he resides in the United Arab Emirates.

Musk recently rebranded Twitter to the X platform in a bid to venture into global financial markets through modern technology like blockchain and AI.

Grayscale noted that the US SEC should maintain an equitable stand while approving the Bitcoin ETFs without any participant getting greater preference over the other.