Bitwise Drops 10 Predictions for Crypto in 2024

Bitwise has published 10 predictions for the crypto industry in 2024, including a fall in Ethereum transaction cost and the approval of Bitcoin ETFs.

Blockchain news category covers the foundational technology powering the crypto world. Discover updates on scalability solutions, layer‑1 and layer‑2 protocols, decentralized apps (dApps), enterprise adoption, and how blockchain is reshaping sectors from finance to supply chain. A must‑read for understanding the infrastructure behind the headlines.

Bitwise has published 10 predictions for the crypto industry in 2024, including a fall in Ethereum transaction cost and the approval of Bitcoin ETFs.

Cardano’s DeFi total-value-locked crosses a significant $450 million with its native stablecoin Djed contributing a significant portion. Smaller protocols like LendFi and Spectrum Finance recorded an impressive 90% surge in TVL.

DTCC data shows that the Wise Origin Bitcoin FD SHS is listed under the ticker BITB. Bitwise joins BlackRock, Invesco Galaxy, and Fidelity on the DTCC’s list.

The Santa Claus rally in the crypto market is likely to continue with analysts expecting the Bitcoin price to touch $48,000 during pre-spot ETF approval.

The Champions Tactics game itself will launch on Oasys, a separate chain from that of the Warlords NFTs – Ethereum.

The first reports said the SEC gave the green light but did not say “ETF”. This made people wonder if it was really an approval for a Bitcoin exchange-traded fund.

Coinbase said the launch of the international digital asset trading platform is part of its move for global expansion driven by regulatory uncertainties in the United States.

Buterin believes the enshrined zkEVM method, which returnes functions to L1, is the next course of action as “light clients” get stronger.

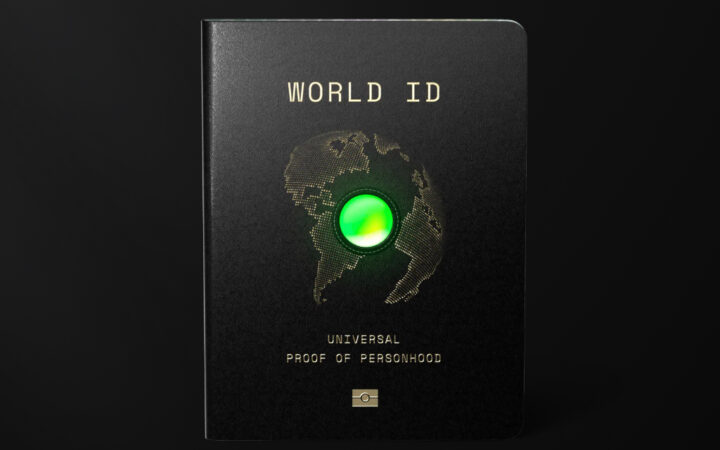

Riding in its current wave of success, Worldcoin has decided to spread its tentacles. Presently, the company is looking at expanding to Mexico and Singapore.

JPMorgan analysts predict that Ethereum will see massive growth in 2024, mostly thanks to its upcoming EIP-4844 upgrade. This upgrade will introduce improved sharding methods.

The collaboration not only supports traditional fundraising methods but also aligns with the changing digital ecosystem, challenges with governance, and the evolving nature of fundraising in the non-profit sector.

To uphold the token’s value, stablecoin issuers often reserve cash or liquid assets. Amid rising interest rates, DWS is poised to manage the reserves for the new stablecoin.

The revised spot Bitcoin ETF proposal from BlackRock provides access to banks, allowing them participate via broker-dealers.

S&P Global Ratings senior analyst Lapo Guadagnuolo believes that the growth of stablecoins does not mean that they are immune to risk factors.

Reacting to Coinbase’s announcement, BONK quickly took to its heels, gaining nearly 8% in value to reach $0.00001132.