DoJ Arrests SafeMoon Executives on Account of Fraud

The SEC asserts that Karony and Smith inappropriately utilized funds to acquire SAFEMOON tokens with the intention of bolstering their price.

Blockchain news category covers the foundational technology powering the crypto world. Discover updates on scalability solutions, layer‑1 and layer‑2 protocols, decentralized apps (dApps), enterprise adoption, and how blockchain is reshaping sectors from finance to supply chain. A must‑read for understanding the infrastructure behind the headlines.

The SEC asserts that Karony and Smith inappropriately utilized funds to acquire SAFEMOON tokens with the intention of bolstering their price.

HSBC’s foray into blockchain technology differentiates it from previous attempts by other financial institutions to streamline gold investing.

Most predictions are optimistic about a Bitcoin bull run considering the expected spot ETF approval and the upcoming halving.

The partnership will allow Flare dApp developers to benefit from Elliptic’s real-time transaction screening and crypto wallet checks.

In addition to the Tangem Ring, Tangem will use the Cardano Summit 2023 as a platform to announce exciting details about Tangem Pay.

Turkish Finance Minister noted that work related to the crypto assets regulations is the final outstanding matter in order to achieve full compliance with FATF standards.

The rise of TON began gaining momentum in September, coinciding with the introduction of the TON wallet within the Telegram messenger platform.

The new developments come after a court-mandated phased liquidation process, enabling FTX to sell digital assets worth a total of $3 billion on a weekly basis.

BitGo confirms that it is delighted that its efforts to secure the new license have finally paid off.

The creator of the second largest stablecoin USDC with a market cap of about $24.7 billion announced that it will support only business institutional accounts.

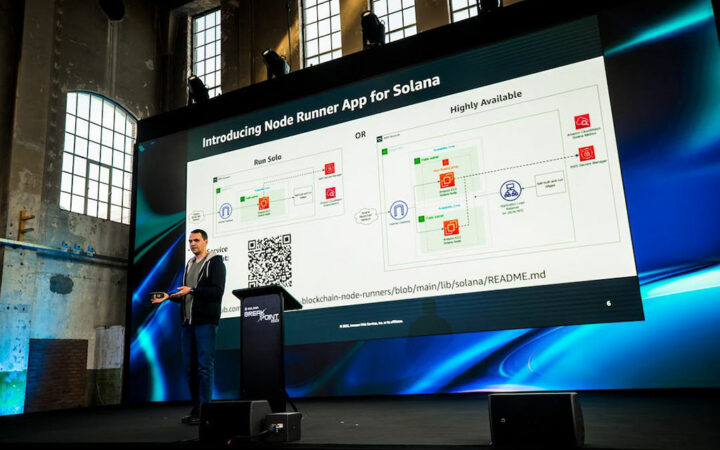

The AWS Blockchain Node Runners has so far integrated Ethereum (ETH) and Solana (SOL), thus making it a major step for the latter to become a Web 3.0 hub that supports scalable smart contracts.

The deployment brings DAS technology into play, which offers an innovative scaling approach. It allows blockchain nodes to verify data availability for specific blocks without the need to download the entire datase

The recently published Tether report for Q3 2023 show that the company’s cash reserves are healthy and secured loans have been reduced.

SBF faces a potential life imprisonment if found guilty, however, he pleaded not guilty to all the charges.

The integration aims to provide advanced blockchain analytics, offering a deeper understanding of what happens on-chain within the Solana ecosystem.