Simple Google Search Can Now Show Ethereum Wallet Balances

In addition to this, Google has partnered with Coinbase and will allow its Cloud services customers to make payments in cryptocurrencies.

Focus on the ecosystem surrounding Ethereum, the second‑largest network by market cap. Get insights into network upgrades, smart‑contract innovations, DeFi and NFT trends, staking developments and other Ethereum news today.

In addition to this, Google has partnered with Coinbase and will allow its Cloud services customers to make payments in cryptocurrencies.

Polygon unveils the public testnet of its Layer 2 zkEVM scaling solution and would allow DeFi protocols Uniswap and Aave to test different functions.

Leading asset manager Fidelity reveals Ethereum Index Fund with $5 million in sales in less than month, and a $50K minimum requirement.

Binance announced support for the ETHW mining pool with a one-month promotional period wherein it will be no fees for participants of ETHW Pool.

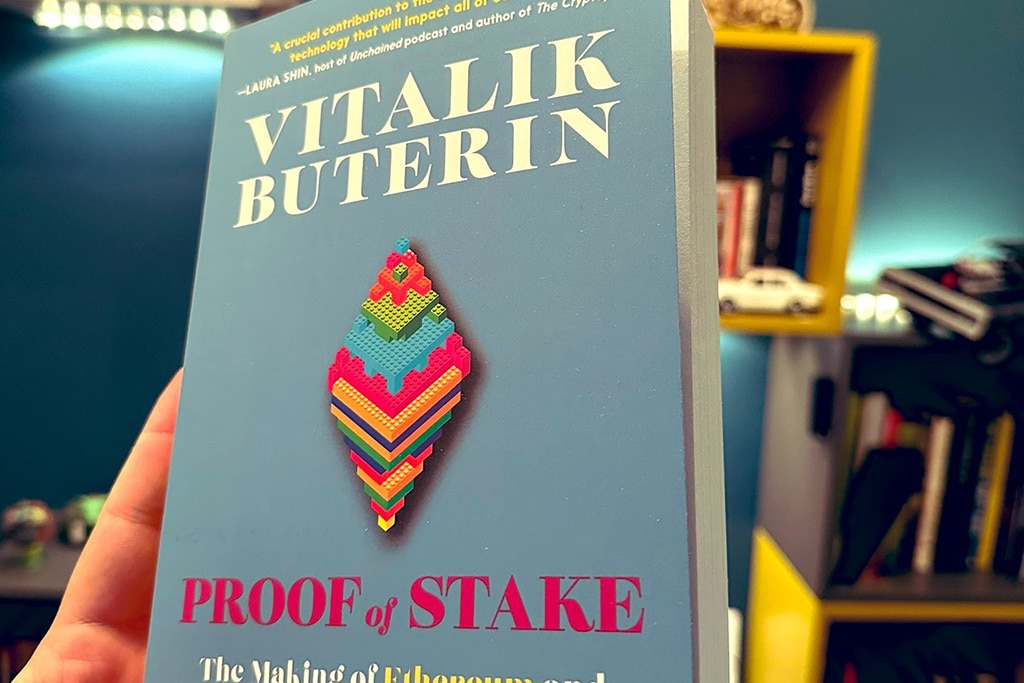

Vitalik Buterin recently announced the release of his new “Proof of Stake” book and intends to donate all sales proceeds to fund the web.

According to the report, Bitdeer Technologies, owned by Wu, will contribute $50 million to the $250 million fund.

Analysts hold a strong belief that the current market surge would be short-lived.

There has been a massive decrease in ETH issuance since the Ethereum network completed the Merge, transitioning to the POS mechanism.

The duo of Opera and Elrond are committed to the partnership and have pledged to continually build the product in a way that will draw more users to the Web3.0 ecosystem by lowering the most critical barriers to entry for all.

The Volmex Implied Volatility index, or the VIV will measure the constant 30-day forward projection of the volatility in the Bitcoin and Ether options market while using the real-time crypto call and put options.

With the US controlling 45% of the total Ethereum nodes, the SEC is claiming complete jurisdictional rights over the entire Ethereum network.

According to Citi analysts, the total number of tokens supplied on the first day of the Merge dropped as the fees burnt were more than the rewards issued to validators.

Following the Merge update, the Ethereum network wants to roll out other scaling upgrades.

The replay attack and some other factors are contributing to the downward spiral of the ETHW token.

The news of the attack has resulted in the price of the token plunging to thirty-five percent of its initial value.