Paymob Raises $50M in Series B Funding Round Led by PayPal Ventures

Paymob intends to use the $50 million raised from the funding round to expand operations and offerings across Africa and the Middle East.

The word “fintech” is derived from “financial technology” which means the integration of technological tools and innovations into financial operations in order to enhance and automate the financial processes. Fintech is used to assist financial institutions, businesses in the management of their operations to provide better services to their customers. As the industry of fintech is actively evolving, there is no surprise at all that the news from this sphere can attract wide attention.

Adoption of fintech by a company would mean a significant change to their mode of operations as it involves the use of specialized algorithmic models, mobile applications and dedicated computer software packages.

At its initial introduction stage, companies from a range of industries including banking, education, fundraising, health, venture management, etc. only used fintech for back end systems where they get absolute and full control. Nowadays, most industries have started using the innovation for consumer-oriented services in an attempt to serve their clients better while increasing the transparency in their operations.

As we move towards a significantly digitized world, from the introduction of the internet to social media, smartphone evolution and now blockchain technology, the need for adoption of cryptocurrency cannot be overemphasized. As the underlying framework of pioneer cryptocurrency bitcoin, the blockchain is a vital part of fintech. We’ve seen a number of blockchain-powered fintech apps being employed by banking industries and data inclined platforms.

Fintech has become a major part of the finance space in recent years, this points to the fact that major conglomerates have identified and prioritized its importance in growing their businesses. Fintech works closely with other new technologies such as data-driven analytics and marketing, machine learning, artificial intelligence, etc.

Coinspeaker presents the best and latest Fintech news, ranging from its use in cross border payments, startup business fundraisers, venture management, credit application, to remote banking, as investors and stakeholders’ awareness about the innovation continues to rise daily.

Paymob intends to use the $50 million raised from the funding round to expand operations and offerings across Africa and the Middle East.

Calgary neobank Neo Financial joined a handful of tech companies with unicorn status in Alberta following a round led by Valar Ventures.

Refugees who are verified by local non-profit organizations and apply for the Binance Refugee Crypto Cards will receive 75 BUSD, which is equivalent to $75, per month for three months.

As a multi-billion dollar conglomerate, Tencent is spreading its tentacles to a number of emerging technologies to boost its role as a pioneer in the Chinese internet ecosystem.

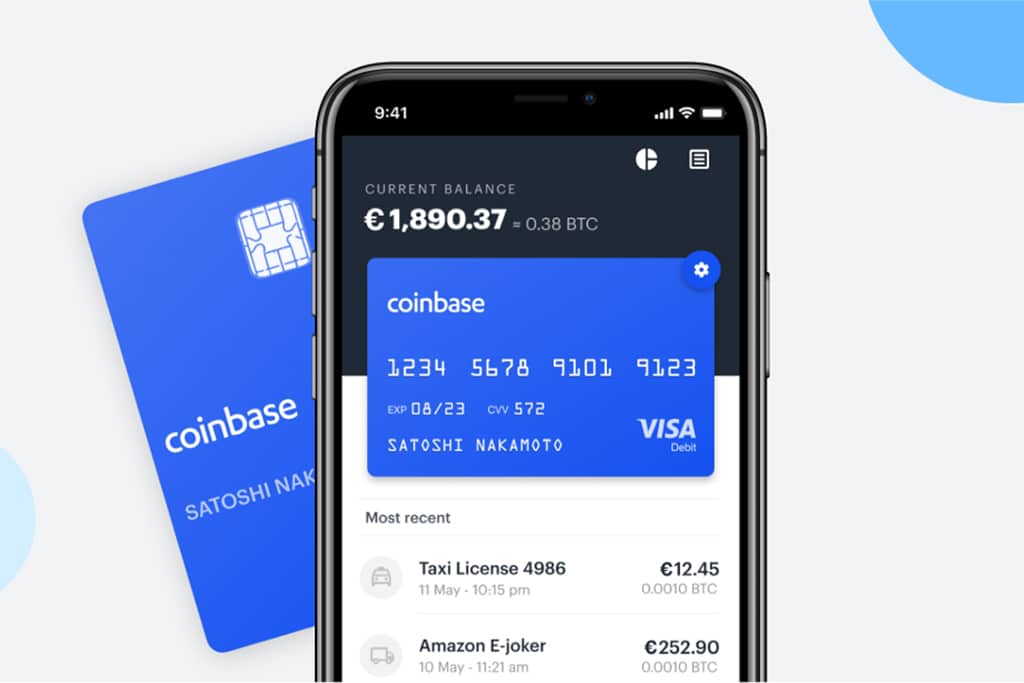

The Card had already been a success in the United Kingdom where it was launched back in April 2019 which led to Coinbase spreading its reach across the European continent.

The recent acquisition will help Robinhood expand its footprint in the UK and European market as well as further its growth prospects.

Since the invasion of Ukraine by Russia and with the ensuing sanctions on the latter, fintech firms have been particularly under pressure to bar accounts that have been flagged.

The new cards can be used for payments at more than 90 million merchant locations worldwide where Mastercard is accepted.

According to MoonPay’s press release, consumers are looking for better ways to use entertainment and involve themselves with their preferred creators.

Voyager is now the second fintech unicorn in the Philippines and is looking to enhance products offered by its digital payments app PayMaya.

Meta will begin a test of its readiness for the emerging metaverse as the company builds products and service tools for related projects.

The payment method will allow US Shopify merchants to accept Bitcoin transactions from clients internationally as US dollars.

Should the acquisition be finalized, Bolt Financial will be in the best position to deploy its resources to help expand the scope of Wyre’s offerings as more people are warming up the embracing digital currencies.

The Lightning Network as a Bitcoin Layer 2 protocol allows BTC holders to form private payment channels between each other.

Despite its relative newness, the lemon.markets platform has notably received as many as 50 proposals from fintech startups to build trading systems through the API it is providing.