Revolut Reportedly Working on Launch of Its Crypto Token

However, the timing for a Revolut crypto token is subject to approval from the United Kingdom’s regulators.

The word “fintech” is derived from “financial technology” which means the integration of technological tools and innovations into financial operations in order to enhance and automate the financial processes. Fintech is used to assist financial institutions, businesses in the management of their operations to provide better services to their customers. As the industry of fintech is actively evolving, there is no surprise at all that the news from this sphere can attract wide attention.

Adoption of fintech by a company would mean a significant change to their mode of operations as it involves the use of specialized algorithmic models, mobile applications and dedicated computer software packages.

At its initial introduction stage, companies from a range of industries including banking, education, fundraising, health, venture management, etc. only used fintech for back end systems where they get absolute and full control. Nowadays, most industries have started using the innovation for consumer-oriented services in an attempt to serve their clients better while increasing the transparency in their operations.

As we move towards a significantly digitized world, from the introduction of the internet to social media, smartphone evolution and now blockchain technology, the need for adoption of cryptocurrency cannot be overemphasized. As the underlying framework of pioneer cryptocurrency bitcoin, the blockchain is a vital part of fintech. We’ve seen a number of blockchain-powered fintech apps being employed by banking industries and data inclined platforms.

Fintech has become a major part of the finance space in recent years, this points to the fact that major conglomerates have identified and prioritized its importance in growing their businesses. Fintech works closely with other new technologies such as data-driven analytics and marketing, machine learning, artificial intelligence, etc.

Coinspeaker presents the best and latest Fintech news, ranging from its use in cross border payments, startup business fundraisers, venture management, credit application, to remote banking, as investors and stakeholders’ awareness about the innovation continues to rise daily.

However, the timing for a Revolut crypto token is subject to approval from the United Kingdom’s regulators.

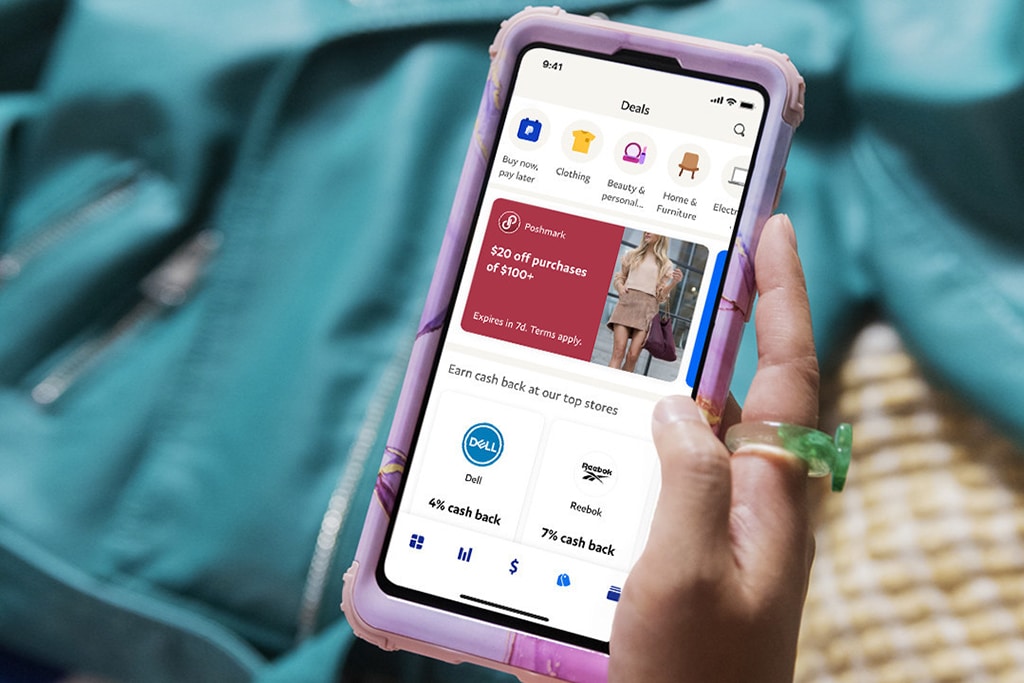

PayPal has revealed that the new app will enable consumers to earn up to 0.40% annual revenue on their savings if they decide to make use of the app’s new savings option.

The funding round is a big plus for the fintech startup, TrueLayer, and at the same time, it acts as a vote of confidence since Stripe is backing TrueLayer, even though Stripe is TrueLayer’s competitor.

The company added that its initial plan is to launch Assets for the business and personal customers in the United Kingdom.

Nicholas Racz noted that he will provide all the necessary support in areas such as monitoring the potential of all SSI deployed in different CeDeFi apps.

JPMorgan is looking to enter the UK booming FinTech market. However, it will be facing tough competition from FinTech challengers like Revolut, Monzo and Starling.

Chinese regulators have a bitter history with Ant Group beginning with Jack Ma’s criticism of national watchdogs, a trend that angered President Xi Jinping.

The platform plans to launch its first operation in the UK, starting with stable coins supported by the UK pound sterling.

El Salvador’s new wallet, the Chivo wallet, will cost Western Union and others a loss of over $400 million as adoption continues.

With this partnership, users of UATP’s network will enjoy faster, less expensive, and more secure transactions while booking their flights with their crypto holdings.

With the Paidy acquisition, PayPal gets a strong footing into the world’s third-largest e-commerce market. This deal will help PayPal to expand its capabilities, distribution and relevance in the domestic payments market in Japan.

Affirm already partners with Walmart, Shopify, Peloton, and other big e-commerce players.

The Reserve Bank of Australia revealed that payments made via digital wallets for in-person transactions grew to 8% in 2019, a 6% gain since 2016.

Traditional banks have objected to the demand from crypto firms citing that these players do not have right internal controls to handle illicit activities like money laundering.

A valuation of over $55 billion will make Nubank bigger than any other bank or fintech in Brazil.