Fluidity to Introduce Ethereum-Based Mortgages This Summer

Fluidity announced that it will launch the first ethereum-powered mortgages this summer in a project that will log mortgages onto the blockchain network offering better rates than banks.

The word “fintech” is derived from “financial technology” which means the integration of technological tools and innovations into financial operations in order to enhance and automate the financial processes. Fintech is used to assist financial institutions, businesses in the management of their operations to provide better services to their customers. As the industry of fintech is actively evolving, there is no surprise at all that the news from this sphere can attract wide attention.

Adoption of fintech by a company would mean a significant change to their mode of operations as it involves the use of specialized algorithmic models, mobile applications and dedicated computer software packages.

At its initial introduction stage, companies from a range of industries including banking, education, fundraising, health, venture management, etc. only used fintech for back end systems where they get absolute and full control. Nowadays, most industries have started using the innovation for consumer-oriented services in an attempt to serve their clients better while increasing the transparency in their operations.

As we move towards a significantly digitized world, from the introduction of the internet to social media, smartphone evolution and now blockchain technology, the need for adoption of cryptocurrency cannot be overemphasized. As the underlying framework of pioneer cryptocurrency bitcoin, the blockchain is a vital part of fintech. We’ve seen a number of blockchain-powered fintech apps being employed by banking industries and data inclined platforms.

Fintech has become a major part of the finance space in recent years, this points to the fact that major conglomerates have identified and prioritized its importance in growing their businesses. Fintech works closely with other new technologies such as data-driven analytics and marketing, machine learning, artificial intelligence, etc.

Coinspeaker presents the best and latest Fintech news, ranging from its use in cross border payments, startup business fundraisers, venture management, credit application, to remote banking, as investors and stakeholders’ awareness about the innovation continues to rise daily.

Fluidity announced that it will launch the first ethereum-powered mortgages this summer in a project that will log mortgages onto the blockchain network offering better rates than banks.

JPMorgan rapidly expands its Interbank Information Network (IIN) reporting a whopping 201 banks joining its blockchain. Meanwhile, IBM and Stellar also push it hard to win over leading banking institutions globally. Is it time for Ripple to move a bit?

Line, one of the most popular messaging apps in Japan and other Asian countries, is going to expand its business into e-payments and other fintech services.

The movement around decentralized finance (DeFi) is gaining swift traction, and many believe that it’s DeFi that will dominate blockchain space. Let’s find out what it is and why DeFi is such a big deal for the crypto community.

On Tuesday, a Judge from the International Trade Commission charged Apple of infringing the Qualcomm patent. The final decision from the ITC will come by July 18.

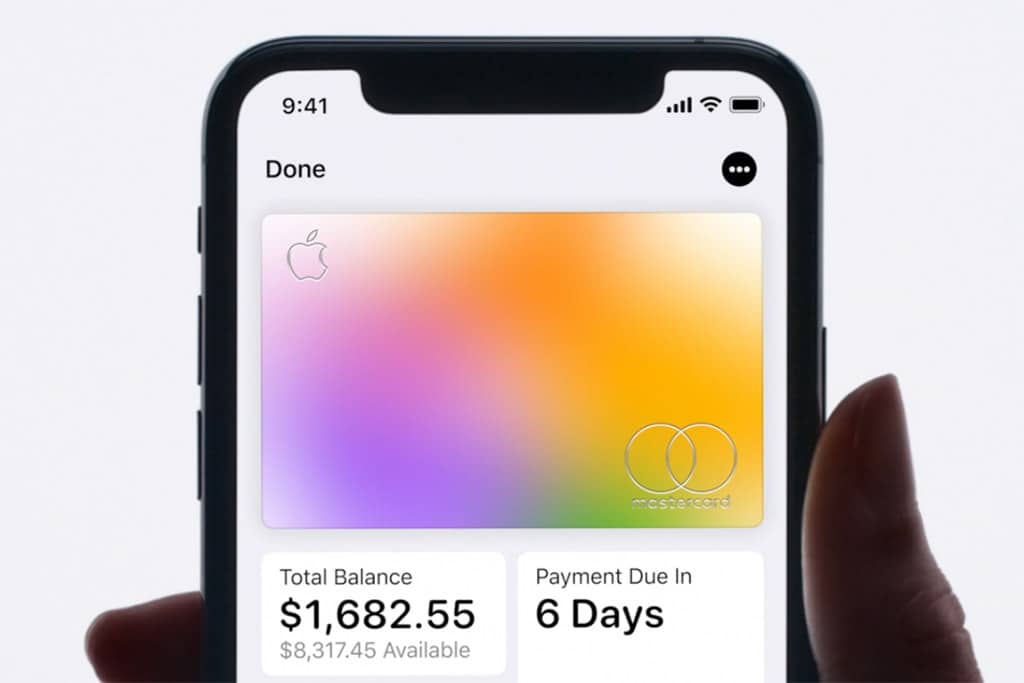

Apple ultimately plans a major disruption in the financial sector by introducing its new Apple Card that comes with interesting new features and machine learning smarts. However, it seems that Apple could have done much more.

It was expected that Apple’s Special Event would lead to sales increase and jump of shares’ price, but the effect was converse. The price decreased by 2 percent to $187,37 per share.

WorldPay has been bought by Florida-based Fidelity National Information Services (FIS) for $35bn in cash and shares, plus WorldPay’s debt.

Few months ago, we were witnessing the warnings from analysts that Visa and Paypal will possibly be squeezed out from the market from Bitcoin and other cryptocurrencies. Be as it may for Paypal, but VISA Inc. is building a new “Crypto Team”.

A shareholder complaint has been recently filed to the court claiming that Google made payouts to two former executives who had been accused of sexual harassment.

Samsung may have offered the entire crypto market a lifeline through the introduction of new devices with built-in crypto support features enabling users to transact using digital tokens.

Step by step cryptocurrency and blockchain are entering the football industry. And eToro believes that it is just a very beginning of their journey in the sports world.

SWIFT’s GPI riposte initiative reported growth from 15% to 56% representing a 270% year-on-year change enabling the company to shun its competitors and move at least $40trn in 2018.

Having entered in a partnership with Coinbase, fintech startup SoFi is going to launch crypto trading services which are said to become available by the second quarter of 2019.

Besides faster and low-cost global transactions, the CEO praises the ease of use of Ripple’s xRapid solution in making cross-border payments.