BlackRock BUIDL Tokenized Fund Nearing $500M Milestone

Through BUIDL, BlackRock has strengthened its entry into the digital asset industry.

This category covers crypto market news today, including crypto index trends, major exchange data, capital flows, sentiment shifts, regulation impact and crypto’s interaction with traditional finance. Designed to help you understand the forces driving valuation across tokens, sectors and regions.

Through BUIDL, BlackRock has strengthened its entry into the digital asset industry.

The decline in Bitcoin followed the movement of a substantial amount of BTC by Mt. Gox, the once-dominant crypto exchange.

CryptoQuant CEO Ki Young Ju stated that Bitcoin ETFs are slowly gaining maturity and currently contribute nearly 25% of the spot trading volumes in BTC.

Bitwise submits the revised version of the S-1 forms as several market analysts have already been predicting the spot Ethereum ETFs to go live for trading this month.

If all these processes go as planned, the anticipated spot Ethereum ETF could start trading three days after the final versions of these S-1 filings.

Bitcoin (BTC) price must defend the support level of around $60K in the coming weeks to avoid further crypto capitulation.

Hashdex submitted an application for the product on June 18, 2024, seeking to be the first to offer a combined spot Bitcoin and Ether ETF in the United States.

According to the Gemini report, if the Ether/Bitcoin ratio returns to its median value from the past three years, Ether could see a rally of almost 20% to 0.067.

None of the US-based spot Bitcoin ETFs registered negative cash flow on Monday as BTC price attempts to regain bullish momentum.

Formal federal prosecutors said that the plaintiff’s charges on Gill pulling off a fraud wouldn’t stand ground as it would be obvious that he was trying to profits from Gill’s hype over GameStop, thereby failing to prove himself as a reasonable investor.

It appears that from a legal standpoint, this entire lawsuit might not hold water.

The Bitcoin and Gold ETF will use leverage to “stack” the total return of its Bitcoin strategy holdings with the total return of its gold strategy holdings.

In addition to the “ghost pepper” ETF, T-Rex Group has also filed for other leveraged and inverse Bitcoin ETFs.

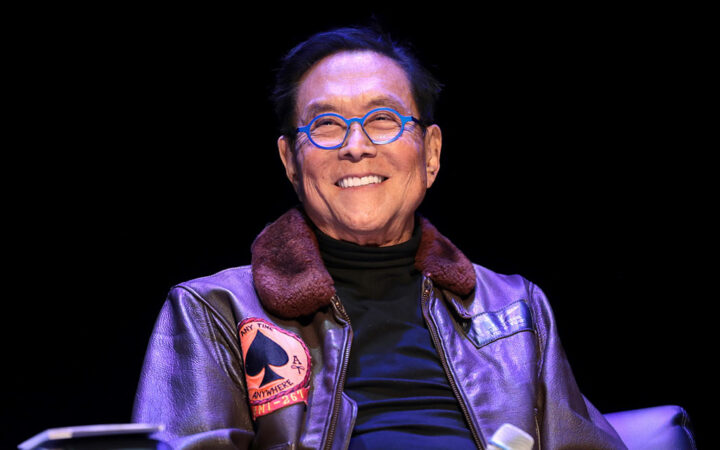

Recently, BTC has been demonstrating a downtrend with prices falling below $60,000. While many may perceive this sentiment as an opportunity to exit the market, Kiyosaki called it a perfect time to buy more of the coin.

The report suggests that the ETH/BTC ratio could strengthen to 0.065 later this year if these optimistic projections hold true.