Bank of England to Hold UK Interest Rates Again as Manufacturing and Business Activity Falls

The market expects the UK’s apex bank to hold off on increasing or decreasing interest rates even as economic data is falling.

This category covers crypto market news today, including crypto index trends, major exchange data, capital flows, sentiment shifts, regulation impact and crypto’s interaction with traditional finance. Designed to help you understand the forces driving valuation across tokens, sectors and regions.

The market expects the UK’s apex bank to hold off on increasing or decreasing interest rates even as economic data is falling.

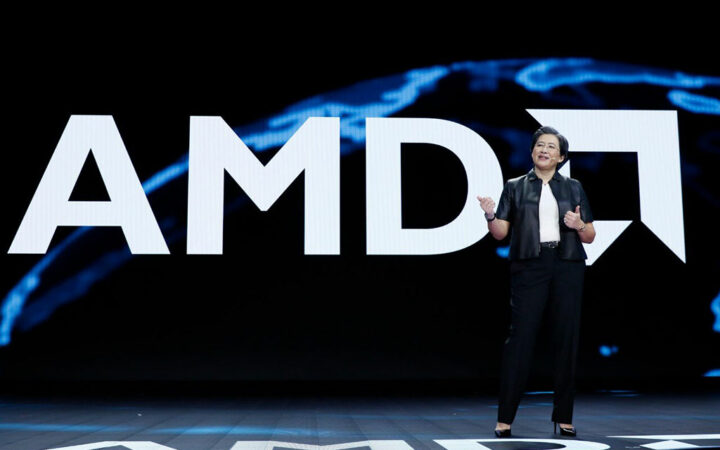

AMD hopes to generate about $400 million in sales from its graphics processing units for AI workloads in the fourth quarter2023, which will result in a rise to $2 billion in fiscal 2024.

Market makers, crucial components of ETF ecosystems, are responsible for the creation and redemption of new ETF shares, ensuring that the ETF’s market price remains in line with the underlying assets it represents.

Experts continue to speculate on what the SEC’s next course of action regarding crypto-based ETF applications could be.

Despite the varied economic performance across the 20-country common currency bloc, the challenges stemming from high inflation persist.

As of late October, the SEC is reportedly reviewing eight to ten potential spot Bitcoin spot ETF filings.

Analysts expect 10-20% of the Gold ETF money moving into Bitcoin post the BlackRock ETF approval i.e. $12 billion to $14 billion worth of inflows in BTC.

The new computers, including MacBook Pro and iMac models, are set to hit the market next week.

Meanwhile, Galaxy Digital estimates that a spot Bitcoin ETF could attract enough capital to drive the price of Bitcoin up by 74%.

With the US SEC opting not to appeal the Grayscale Investments case, amid ongoing application amendments, experts believe the approval of spot Bitcoin ETF is a matter of when and not if.

As a result of all the challenges faced by Tesla, its long-time partner Panasonic is also bearing losses. It has lowered its full-year operating profit forecast for its battery unit to ¥115 billion ($771 million) from ¥135 billion, as the demand for Tesla EVs in North America slowed down.

In anticipation of this pivotal event, there has been a substantial uptick in trading volume for products launched by ProShares and Grayscale.

The Bitcoin network has set a new historic mining hashrate record as the market prepares for next year’s halving.

In light of HSBC’s robust results, the banking giant’s board approved a third interim dividend of 10 cents per share.

The recent uptick in amendments to filings awaiting SEC approval could be a sign of progress in negotiations between asset managers and regulators.