Spot ETH ETFs Could Worsen Concentration Risks on Ethereum Network, Says S&P Global Ratings

The S&P Global Ratings report states that using institutional custodians for staking on Ethereum ETFs could exacerbate network concentration.

The S&P Global Ratings report states that using institutional custodians for staking on Ethereum ETFs could exacerbate network concentration.

The Coinbase legal team argued that Ethereum is highly decentralized and viewed as a commodity as much Bitcoin, thus its spot ETFs should be approved soon.

The VanEck spot Bitcoin ETF (HODL) trading volumes spiked by 2,200% on Tuesday as it intends to lower its offering fees from 0.25% to 0.20%, as per regulatory filings.

The volume of VanEck’s ETF saw a significant spike following the firm’s preparation to reduce its fee, giving the product an advantage.

A network of RIAs will now begin allocating funds for investment to the Bitcoin market through BITB, the spot Bitcoin ETF from Bitwise.

Marketing for Bitcoin ETFs has taken some interesting turns since Bitwise released the first ad in mid-December 2023, close to a month before spot Bitcoin ETFs were approved.

The rising inflows coincide with an increase in the price of Bitcoin, which has surged nearly 25% year-to-date.

The majority of US spot Bitcoin ETF issuers have set their sponsor fee between 0.19% and 0.25%, but the high competition could easily cause further lowering in the near term.

While BlackRock’s Gold ETF has registered major outflows in 2024, its Bitcoin ETF stands tall at first place with $4.8 billion in flows so far in 2024.

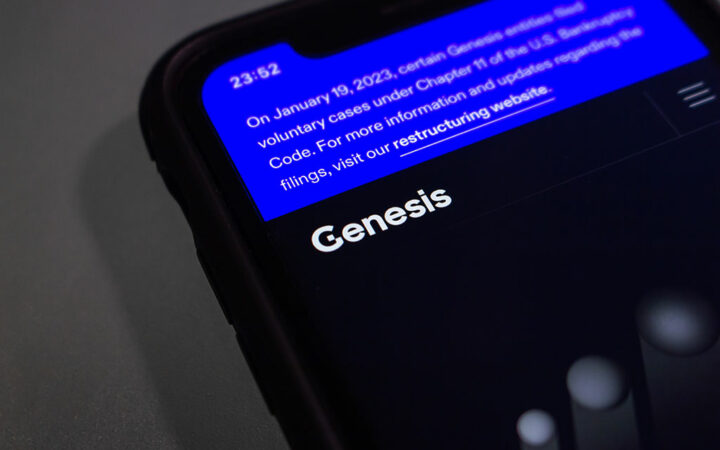

Genesis now has legal approval to sell $1.6 billion in Grayscale shares, including GBTC and ETHE, even though DCG disagrees.

Bitcoin is now poised to scale its all-time high as traders are bullish, and anticipate a price jump following the performance of spot ETFs.

The inflow recorded by spot Bitcoin ETFs nearly surged to $500 million yesterday, as the price of Bitcoin hit a level not seen for 2 years.

Franklin Templeton’s foray into the ETH ETF space comes on the heels of its recent launch of a spot Bitcoin ETF, among 10 other issuers.

The surge in net inflows into Bitcoin ETFs reflects a growing acceptance and integration of Bitcoin into mainstream investment portfolios.

The several spot Bitcoin ETFs excluding Grayscale Investments now hold about 192k Bitcoins compared to MicroStrategy’s 190k according to its latest quarterly report.