Analysts Identify 8-Day Window for 12 Spot Bitcoin ETF Approvals

The mere possibility of spot Bitcoin ETF approvals has injected fresh optimism into the crypto market.

The mere possibility of spot Bitcoin ETF approvals has injected fresh optimism into the crypto market.

While the crypto community eagerly awaits the SEC’s decision regarding Grayscale’s ETF application and others, SEC Chair Gary Gensler remains cautious in sharing specific details about the commission’s next steps.

While WisdomTree is expanding its investment options with Bitcoin, the asset manager has also decided to liquidate five of its ETFs.

With the US SEC edging closer to potentially approving a Bitcoin ETF, experts and industry leaders are offering their predictions on the potential impact of this milestone on the crypto market.

Hong Kong’s top financial regulator SFC shows willingness to allow retail players to gain access to spot crypto ETFs while ensuring that risks are addressed properly.

Hayes fears that most institutional entities are effectively controlled by governments, who will have to dance to the tune of the state when needed.

The Valkyrie CIO says that the SEC will ask for comments and possibly approve an ETF proposal this month after all issues are addressed.

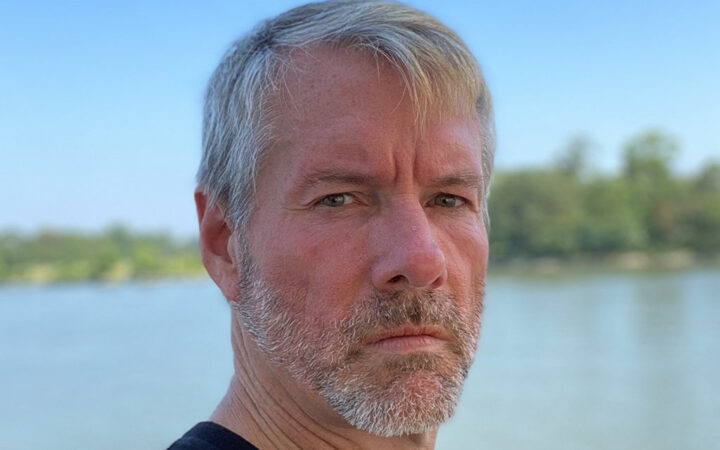

According to Michael Saylor, Bitcoin will pump significantly after the SEC approves a spot ETF and demand for the king coin spikes.

Fed chair Jerome Powell and the rest of the committee are convinced of slower economic growth in the coming quarters amid softening labor market conditions.

Most predictions are optimistic about a Bitcoin bull run considering the expected spot ETF approval and the upcoming halving.

Market makers, crucial components of ETF ecosystems, are responsible for the creation and redemption of new ETF shares, ensuring that the ETF’s market price remains in line with the underlying assets it represents.

Experts continue to speculate on what the SEC’s next course of action regarding crypto-based ETF applications could be.

As of late October, the SEC is reportedly reviewing eight to ten potential spot Bitcoin spot ETF filings.

Analysts expect 10-20% of the Gold ETF money moving into Bitcoin post the BlackRock ETF approval i.e. $12 billion to $14 billion worth of inflows in BTC.

Meanwhile, Galaxy Digital estimates that a spot Bitcoin ETF could attract enough capital to drive the price of Bitcoin up by 74%.