Bitcoin Price Down 3% as US Spot BTC ETFs Turned Negative after Five Days of Cash Inflows

Bitcoin (BTC) price must defend the support level of around $60K in the coming weeks to avoid further crypto capitulation.

Bitcoin (BTC) price must defend the support level of around $60K in the coming weeks to avoid further crypto capitulation.

Hashdex submitted an application for the product on June 18, 2024, seeking to be the first to offer a combined spot Bitcoin and Ether ETF in the United States.

None of the US-based spot Bitcoin ETFs registered negative cash flow on Monday as BTC price attempts to regain bullish momentum.

Over the last two weeks, the ETH product outflows have now crossed $119 million. This also makes Ethereum the worst-performing asset year-to-date in terms of net flows.

The Bitcoin and Gold ETF will use leverage to “stack” the total return of its Bitcoin strategy holdings with the total return of its gold strategy holdings.

In addition to the “ghost pepper” ETF, T-Rex Group has also filed for other leveraged and inverse Bitcoin ETFs.

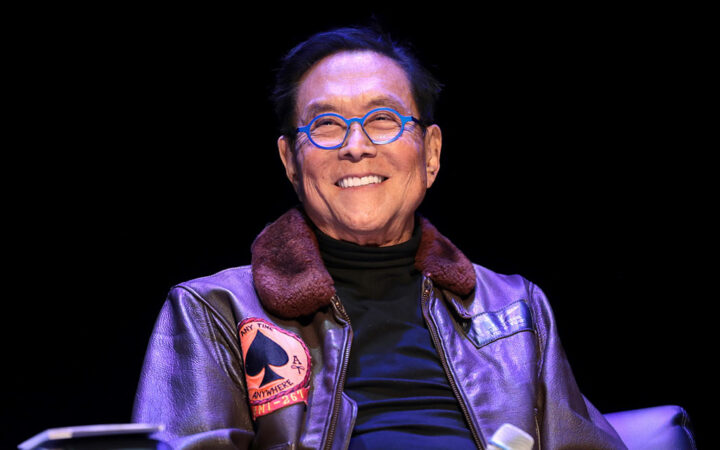

Recently, BTC has been demonstrating a downtrend with prices falling below $60,000. While many may perceive this sentiment as an opportunity to exit the market, Kiyosaki called it a perfect time to buy more of the coin.

The report suggests that the ETH/BTC ratio could strengthen to 0.065 later this year if these optimistic projections hold true.

The report comes amid rising investor demand for regulated exposure to Ether (ETH), the world’s second-largest cryptocurrency by market capitalization.

Although the intakes are currently happening at a much slower rate than before, these ETFs have still impressed so far.

A filing does not guarantee that the SEC would approve such a product that is tied to Solana, despite SOL being the fifth largest digital asset by market capitalization.

According to the announcement, State Street Bank and Trust will manage the day-to-day operations and administration of the new ETFs.

The effect of spot ETH ETFs on the price of Ether would be relatively smaller as compared to the approval of spot Bitcoin ETFs on BTC.

VanEck has revealed that from the outset, its spot Ethereum ETF product will not come with a sponsor fee to beat competition.

Despite the mixed performance of spot bitcoin ETFs, the overall outlook remains positive. As of June 26, 2024, the combined net inflows for these 11 funds since their January launch stands at $14.42 billion.