MSFT Stock Slightly Up as Microsoft Acquires Nuance in $16 Billion Deal

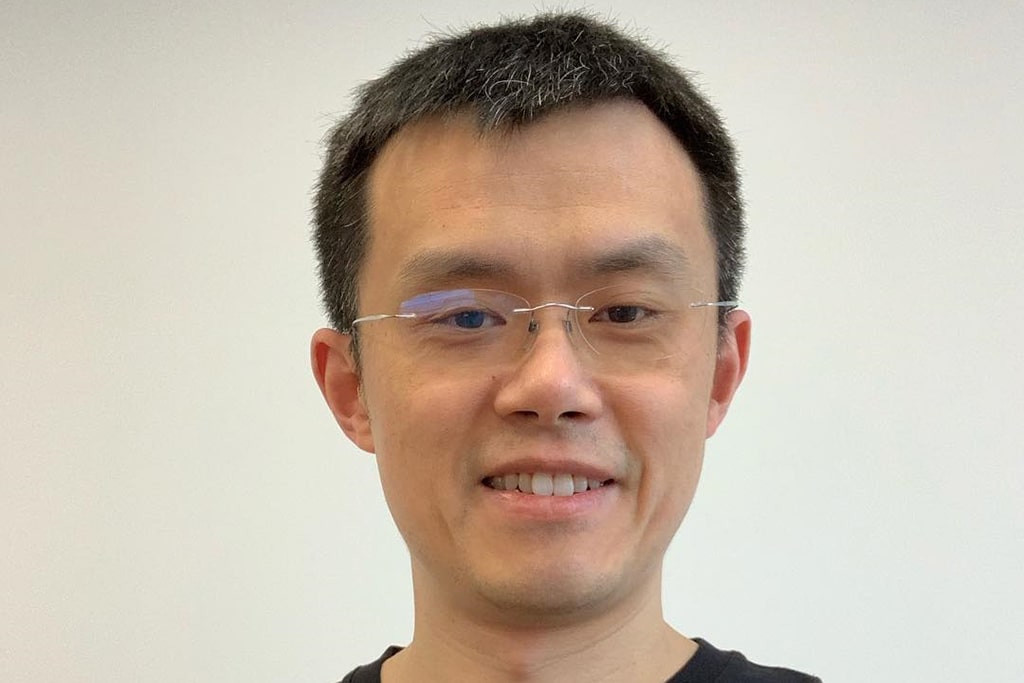

Satya Nadella, the CEO of Microsoft, explained that the high level of acceleration in the digital transformation influenced their acquisition as Nuance has a health care tool that can play a key role.