Octav Raises 2.65 Million to Help Label DeFi Transactions

Octav, a DeFi labeling and tax reconciliation platform, raised a $2.65 million seed to help label the DeFi ecosystem and be the “Quickbooks of crypto”.

Mathieu Baril, Co-Founder & CEO of Octav, said:

“There hasn’t been a systematic way where the DeFi community can decipher all their transactions from block explorers and get their data in one convenient dashboard. So it became clear to us that data labelling is missing in DeFi”.

Octav is led by Mathieu Baril & Luc Blackburn, both of whom have previously worked at companies like Zapper, Accedian Network and Otodata before starting Octav. Octav boasts a variety of esteemed Investors including Nascent, Polymorphic Capital, Parallel Studio, Spaceship DAO, Investmeows, Possible Ventures, Speedinvest, ACET capital, Paul Desmarais, CEO of Sagard holdings, and Mark Zeller from AAVE.

Mathieu noted:

“We are building the platform that deciphers all DeFi transactions. Today, there’s a lot of companies building DeFi dashboards but I don’t think anyone is going deep to provide the end user with all the data in an easy way to understand and we think the right company will need to have a complete defined database of all DeFi transactions, not just a piece of it.”

“A lot of DeFi native tools like Etherscan and Dune Analytics give a lot of raw data which is great if you have the technical knowledge but not great for most DeFi enthusiasts.”

Mathieu added:

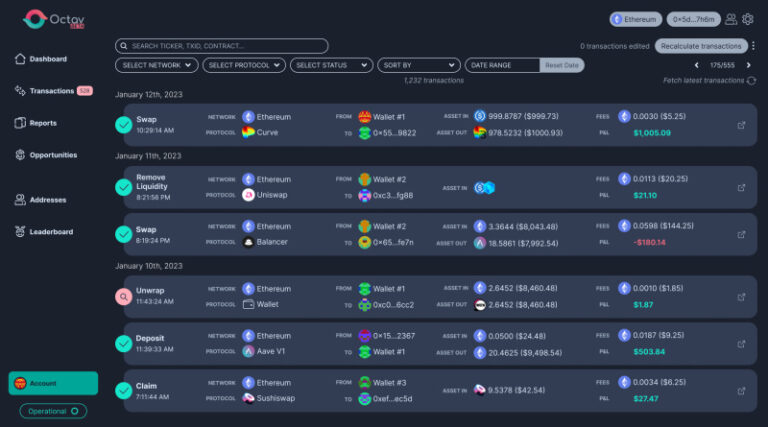

“Etherscan does not give you the ability to understand exactly what transaction you did and with what protocol you interacted with because it only provides the contract address and the transaction function directly from the smart contract code. So the entire ecosystem of tools is broken and DeFi enthusiasts are struggling with a lack of understanding and playbook. That’s really where the current state is and we’re trying to build something to solve this over time.”

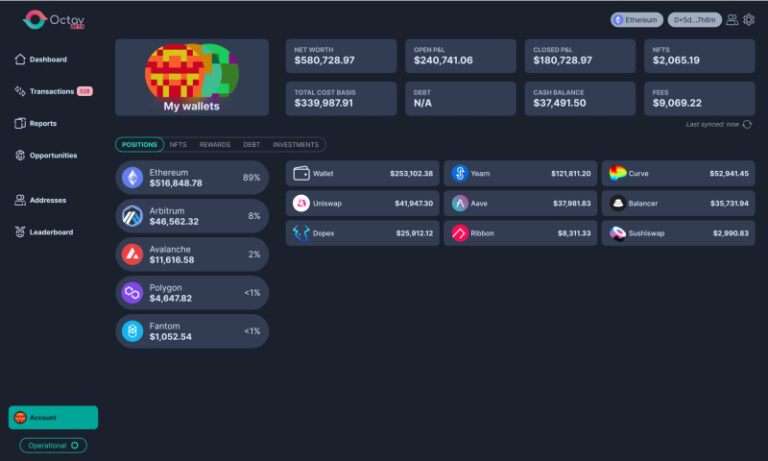

Octav’s DeFi labelling and tax reconciliation platform includes a DeFi labelling database, portfolio dashboard, and data analytics such as cost basis, profit and loss, and fees paid. It also allows anyone using the platform to contribute to the DeFi machine learning algorithm dubbed “The Brain” by labeling any unknown transactions that are not yet part of the database. Once user contributions are algorithmically verified the update is pushed automatically to all Octav users who interacted with the same smart contract.

Mathieu said:

“Octav is currently in beta with thousands of users, seven integrated chains, and over 100 million transactions indexed to date. While the first customers are DeFi power users, Octav’s client base is “anyone who has ever interacted with a DeFi protocol.”

Luc said:

“The capital will be used to integrate more chains to capture the entire DeFi ecosystem. New chains are launched throughout the year and new protocols launch weekly so we always have to be ahead to capture the latest protocols the DeFi community is interacting with. We both worked at startups before and understand the importance of delivering ambitious goals with a lean team.”

In the long term, the co-founders plan to focus on integrating with current crypto tax platforms where Octav’s database would help as a pre-tax facilitator, reconciling all of a user’s transactions before being ready for tax software.

Mathieu said:

“For us, it’s really twofold. We want to go from a small, tight-knit community of DeFi power users and grow that business. In parallel, we have an entire stream of accountants waiting to pay to use our platform to reconcile transactions for tax preparation for their clients, we believe that is where our breakthrough will happen.”

About Octav

Octav is a free and editable data analytics platform that helps decipher Decentralized Finance (DeFi) investment activity. Octav’s user-curated database simplifies DeFi for traders, tax professionals, and liquid asset management firms, serving as a pre-tax facilitator for cost-basis, profit & loss, and more.

For more information, visit: Website | Medium | X | Discord | Official Docs

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.