Pando Asset Becomes 13th Filer for US Spot Bitcoin ETF with Cboe

/Pando Group Holding/ – Pando Asset AG, a leading Swiss-based asset management company, has announced its expansion into the cryptocurrency market with the filing of a spot Bitcoin exchange-traded fund (ETF) named Pando Asset Spot Bitcoin Trust. The filing has been submitted to the US Securities and Exchange Commission (SEC) on behalf of the asset manager.

Pando Asset becomes the 13th company participating in the race of what the cryptocurrency world believes could become a multi-billion dollar product, SEC filings showed. Others range from asset management giants like BlackRock and Fidelity to more specialized ETF providers like ARK Investments.

The announcement of this filing has already had a significant impact on the market, as the price of Bitcoin surged to its highest level this year. This development highlights the growing demand for cryptocurrency investment opportunities and the increasing acceptance of Bitcoin as a valuable asset.

Pando Asset AG aims to make cryptocurrencies accessible to a broader range of investors. The company recognizes the potential of digital currencies like Bitcoin and believes that offering a spot Bitcoin ETF will pave the way for mass adoption. The trust will track the performance of Bitcoin, providing investors with direct exposure to the price of the digital currency.

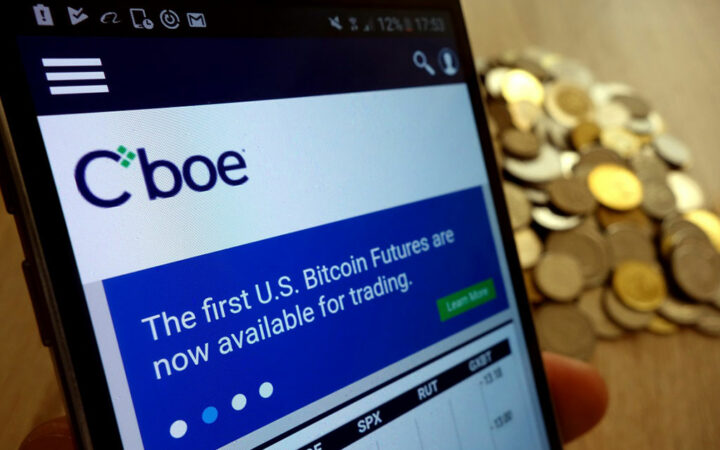

The asset manager plans to launch the Pando Asset Spot Bitcoin Trust on the Cboe BZX Exchange, trading under the ticker “PBTC”, with Coinbase as custodian. This move marks Pando Asset AG’s first Bitcoin product for US investors, expanding their existing offerings in Europe.

Junfei Ren, founder of Pando Asset AG, stated:

“We are excited to introduce the Pando Asset Spot Bitcoin Trust, which will bring Bitcoin to mass investors. Through this innovative instrument, retail investors will be able to easily invest in Bitcoin from their brokerage accounts. This eliminates the hassle of creating a separate crypto exchange account, setting up wallets, and dealing with other complex processes. We want to make the investment process as straightforward and accessible as possible.”

The spot Bitcoin ETF will be listed on CBOE BZX, making it convenient for investors to participate in the cryptocurrency market. By offering Bitcoin exposure through traditional brokerage accounts, Pando Asset AG aims to democratize the crypto investment landscape and remove barriers to entry for retail investors.

Pando Asset AG’s foray into the spot Bitcoin ETF market marks a significant milestone in the evolution of the cryptocurrency industry. The company’s expertise in asset management, combined with its commitment to accessibility and innovation, positions it as a key player in the emerging digital asset space.

About Pando Group Holding

Pando Group consists of Pando Finance – Hong Kong-licensed brokerage and public fund asset management, Pando Asset AG – Switzerland-based crypto ETF issuer, and Pando Trust provides custodian and segregated account management services. Pando Group offers comprehensive crypto trading, asset management, and custodian services to global investors with top priority in regulation and transparency.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.