Let’s talk web3, crypto, Metaverse, NFTs, CeDeFi, meme coins, and Stocks, and focus on multi-chain as the future of blockchain technology. Let us all WIN!

Rebranding from Riot Blockchain to Riot Platforms is meant to accommodate recent acquisitions including Whinstone US and ESS Metron.

Formerly known as Riot Blockchain Inc (NASDAQ: RIOT), one of the largest Bitcoin mining and publicly traded companies, has announced the rebranding of its corporate name to Riot Platforms Inc. According to the announcement, the rebranding is in line with the company’s mission to become the world’s leading Bitcoin-driven infrastructure platform. The company has morphed to accommodate recent company acquisitions.

Despite the name change, the company has announced that its common stock will continue to trade on NASDAQ Capital Market under the same ticker symbol RIOT. Following the announcement, RIOT shares gained approximately 1.78 percent to exchange at about $3.43 during Tuesday’s after-hours trading session.

Jason Les, CEO of Riot said:

“Our successful acquisitions of Whinstone US, which developed and operates North America’s largest dedicated Bitcoin mining data centre facility, and ESS Metron, which enhanced our electrical component engineering and supply chain capabilities, have formed the foundation on which our teams have built, and will continue to develop, business platforms for further growth.”

Bitcoin mining companies have struggled with liquidity during the past twelve months due to the ongoing bear market. Furthermore, RIOT shares have dropped approximately 85 percent and 53 percent in the past year and three months respectively. However, with a market capitalization of approximately $567 million and operating mining rigs, Riot Platforms is well-positioned to thrive in the coming quarters.

According to a survey conducted by MarketWatch, ten analysts’ ratings gave the RIOT market an average price target of $10.15 and an average recommendation of BUY. Some of the notable analytic firms that gave Riot Platforms ratings include Compass Point, Wells Fargo, B.Riley Securities, and HC Wainwright & Co.

The company has been extending its overall cryptocurrency mining capacity through increased electricity supply. For instance, the company is developing an initial 400 megawatts of capacity on a 265-acre site in Navarro, Texas in a bid to expand its capacity to 1.7 GW.

As a result, Riot Platforms will establish itself among the largest Bitcoin mining operations globally. Notably, the first phase of the Navarro, Texas project will cost about $333 million, which is scheduled to be invested gradually until the first quarter of 2024.

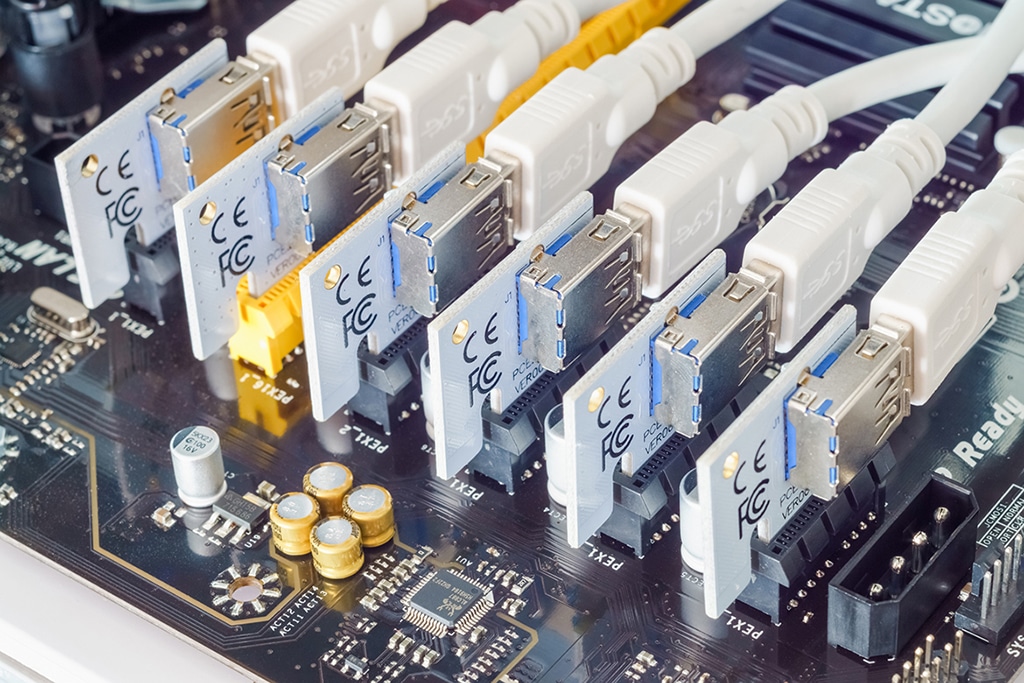

As for Bitcoin mining rigs, the company has announced that it purchased agreements for additional S19 miners scheduled for delivery and deployment by Q1 2023. Consequently, Riot Platforms’ Bitcoin hash rate is expected to increase to 12.6 EH/s. Notably. The current Riot hash rate stands at approximately 6.9 EH/s with 65,516 Bitcoin miners already deployed. Worth noting, the company hosts approximately 200 MW of institutional Bitcoin mining clients.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Let’s talk web3, crypto, Metaverse, NFTs, CeDeFi, meme coins, and Stocks, and focus on multi-chain as the future of blockchain technology. Let us all WIN!