Vini Barbosa has covered the crypto industry professionally since 2020, summing up to over 10,000 hours of research, writing, and editing related content for media outlets and key industry players. Vini is an active commentator and a heavy user of the technology, truly believing in its revolutionary potential. Topics of interest include blockchain, open-source software, decentralized finance, and real-world utility.

Key Notes

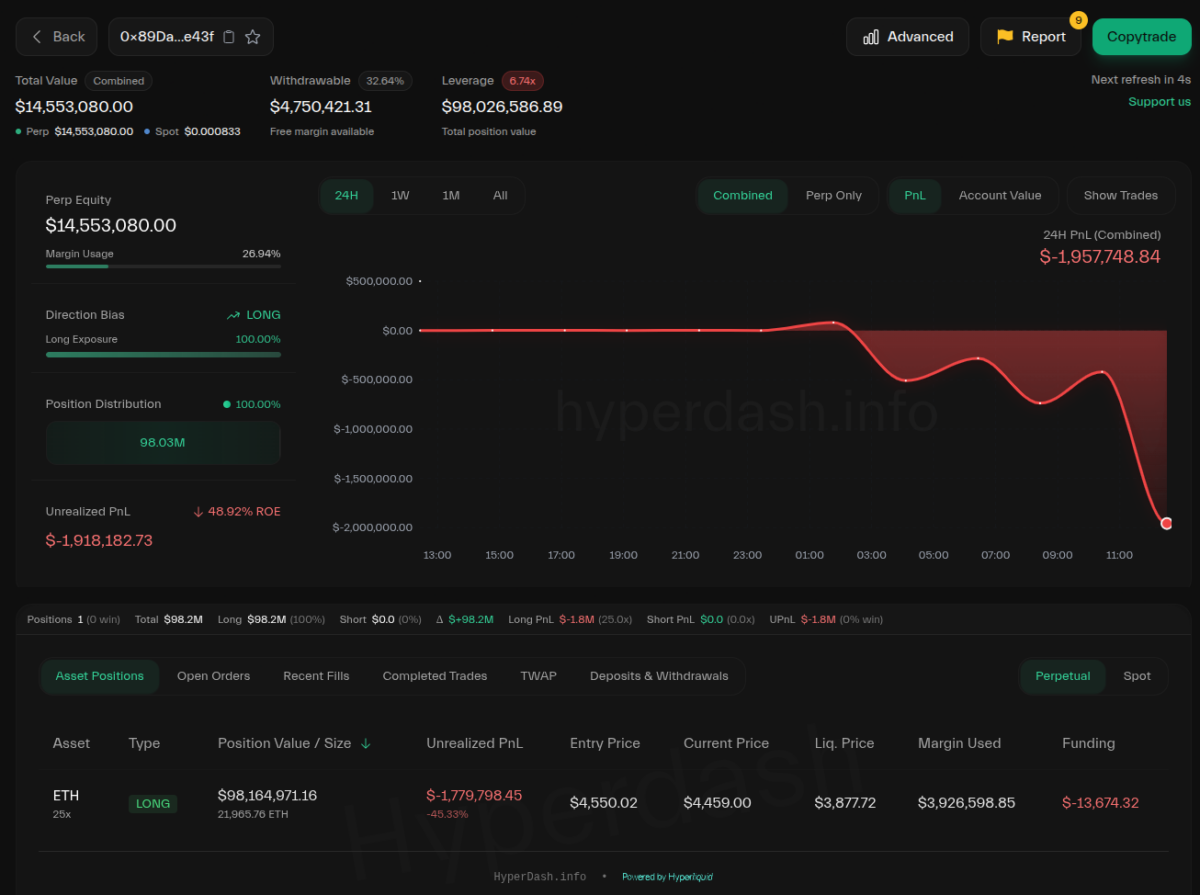

- Whale trader purchased 21,966 ETH at $4,550 using $3.99 million margin for nearly $100 million exposure position.

- Despite 81% historical win rate, some analysts report this could be a delta-neutral trading strategy rather than directional.

- Ethereum shows mixed signals with cooling momentum and conflicting whale activity creating market uncertainty.

A smart whale—a large trader with a solid winning track record—is bullish on Ethereum ETH $2 286 24h volatility: 0.0% Market cap: $276.36 B Vol. 24h: $36.71 B , opening a nearly $100 million long position on ETH with 25x leverage via HyperLiquid. The position, however, is currently losing around $2 million, as the ETH price has fallen below the trader’s entry point.

Notably, this whale (0x89D…) has concluded 53 trades, closing 43 of them in profit for an 81.13% win rate. In particular, their most recent trade purchased 21,966 ETH at $4,550.02, worth $99.95 million, using a $3.99 million margin. At the time of this writing, the position was down close to $2 million.

While this trader’s winning history makes them a smart whale, the account has already received nine reports of being a “Delta Neutral Trader” on the analysis platform. A delta-neutral trader is someone who employs strategies to keep a net delta close to zero. This strategy can be used while seeking profit from other sources rather than the trade itself—for example, from funding rates—or as part of a hedge strategy to eliminate directional risks. Yet, anyone can open these reports, lacking conclusive evidence.

Ethereum address 0x89Da4BAEC446F35a1cbE17a9d1EE5C70B05Ee43f on Hyperliquid | Source: HyperDash

Smart whales are usually seen as an indicator of what is going to happen next, price-wise, and many traders could try to copy their strategies in an attempt to mirror the results. This, however, is risky, as copy traders often lack understanding of the reasoning behind each move and could be, for example, trapped into a delta-neutral trader’s incomplete strategy, making mistakes.

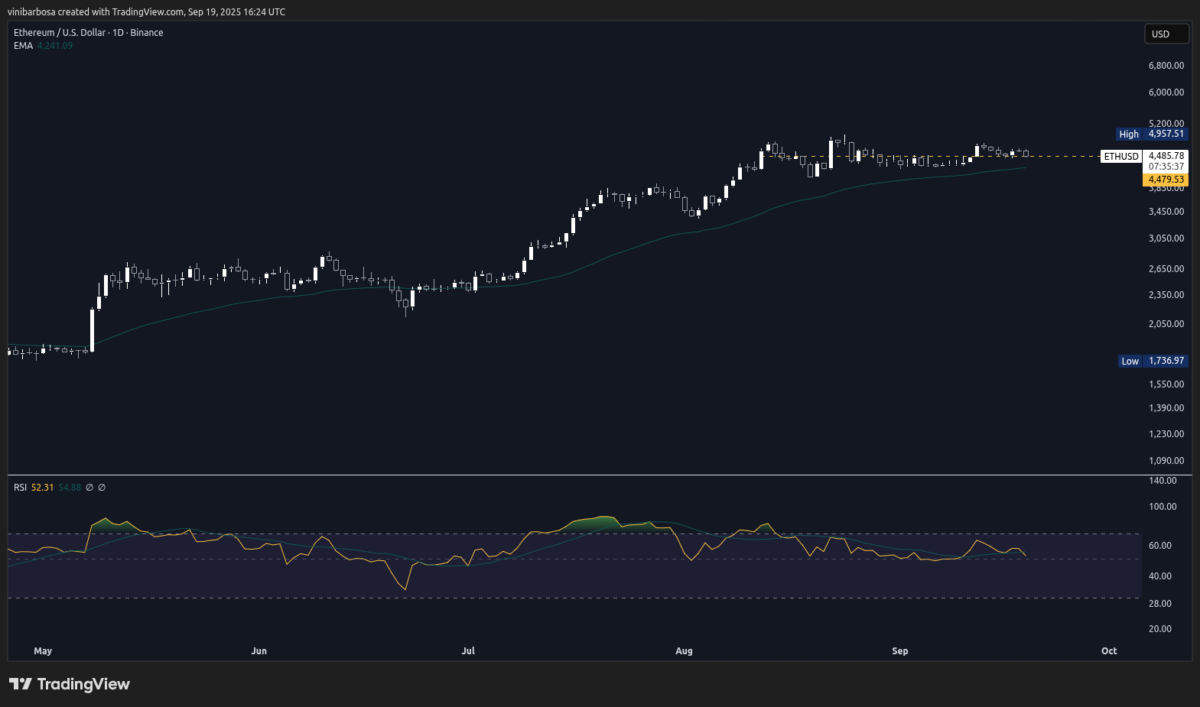

Ethereum (ETH) Price Analysis

Ethereum is the second-largest cryptocurrency by market capitalization and is currently trading at $4,485 per token, making it a $540 billion asset. With a current 24-hour volume of $33 billion, according to CoinMarketCap data, ETH tests a local price support while traders decide its next move.

Overall, ETH still shows some signs of strength, although the momentum is cooling off according to its daily relative strength index (RSI) of 52.24 points and is heading down to the neutral zone. From a higher time frame perspective, Ethereum sustains its trend above the 50-day exponential moving average, still in bull market levels.

Ethereum (ETH) daily (1D) price chart | Source: TradingView

On September 17, Coinspeaker reported Ethereum whales dumping 90,000 ETH, suggesting a bearish outlook, while staking inflows were increasing on-chain, suggesting a bullish outlook—resulting in conflicting indicators, which match the “neutral” momentum seen in the RSI.

Citigroup analysts issued a neutral-to-bearish price target for ETH of $4,300 by the end of the year, while the supposed infamous Coinbase hacker appears to be buying the asset.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.