Let’s talk web3, crypto, Metaverse, NFTs, CeDeFi, meme coins, and Stocks, and focus on multi-chain as the future of blockchain technology. Let us all WIN!

Square added a hidden code on its system that indicates the company seeks to venture into checking and savings accounts.

Square Inc (NYSE: SQ) stock closed Monday trading at $210.95, up 5.47% from the day’s opening price. During today’s pre-market session, SQ stock had added approximately 1% and was trading around $212.98 at the time of reporting. The spike in the last two days was triggered by a report that Square is planning on adding both checking and savings accounts in the near future.

According to the report, Square added a hidden code on its system that indicates the company seeks to venture into checking and savings accounts. Notably, the hidden code uses rhetoric that led Bloomberg to believe Square will offer a 0.5% interest rate for its savings account through 2021.

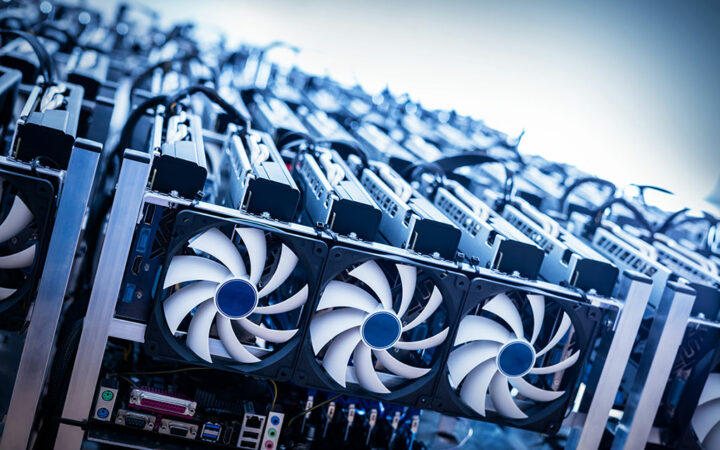

However, Square stock has recently shown notable correlations with Bitcoin market price. Apparently, the company has over 7000 Bitcoin units in its balance sheet according to filings with the United States Securities and Exchange Commission (SEC).

Additionally, Jack Dorsey the chairman and CEO of Square has been a huge proponent of the Bitcoin market and blockchain technology. The company stands to benefit from the Bitcoin future growth prospects, should the company hold its position or continue to add on the stake.

The payment company has seen its stock market grow exponentially in the past year, partially the growth has been attributed to the Covid-19 crisis. However, the company has been providing essential services with cutting-edge technology to businesses at a reasonable price. Thereby, the company’s stock could have still rallied over time based on strong fundamentals.

Competition in the payment industry has, however, compelled the company to start looking into other services that could keep the customers and simultaneously attract more customers. A decision to add checking and savings accounts would entail a huge inflow of customers. Furthermore, businesses would no longer require an extra bank account to save and spend cash.

The square stock added approximately 161% in the past twelve months through Monday according to market analytics provided by MarketWatch. However, the SQ stock market has dropped approximately 3.07%, 17.79%, and 16.88% year-to-date, three months, and one month respectively. A similar situation has been recorded in the Bitcoin market in the same period.

During the first quarter, the company reported a profit of 41 cents per share versus an expected profit of 16 cents per share according to a survey on different analysts by Refinitiv. Additionally, the company recorded a revenue of $5.06 billion versus an expected revenue of $3.36 by analysts according to Refinitiv.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Let’s talk web3, crypto, Metaverse, NFTs, CeDeFi, meme coins, and Stocks, and focus on multi-chain as the future of blockchain technology. Let us all WIN!