100 Days after Bitcoin Halving 2024, What’s Ahead for BTC in H2 2024?

As the Bitcoin miner capitulation post the BTC halving comes to an end, market analysts are predicting the bitcoin price to reach $100K by the year-end.

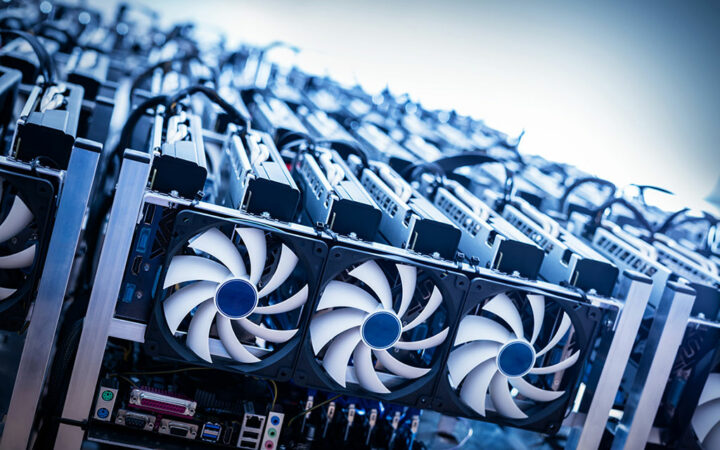

Bitcoin mining reward has been halved for the second time in its history.

As the Bitcoin miner capitulation post the BTC halving comes to an end, market analysts are predicting the bitcoin price to reach $100K by the year-end.

Analysts suggest Bitcoin’s current consolidation phase could be beneficial for the bull run.

Marathon Digital said that the company won’t be raising funds to achieve its target of 50 EH/s and that it would be fully self-funded.

The altered dynamics, as many point out, to be caused by Bitcoin halving might introduce shifts that might be difficult for new crypto adopters to grasp and understand.

Bitcoin miners saw a significant increase in earnings due to the Runes protocol. On the halving day, miner revenue soared to a record $107 million despite the 50% reduction in block rewards.

According to a recent Bitfinex market report, the Bitcoin supply squeeze has already begun following the recent halving event.

As the NYSE conducts its survey, US regulators are closely scrutinizing an application for the establishment of a 24/7 stock exchange.

Since the halving event, Stacks (STX) token surged by 20%, Elastos’ ELA token has surged by 11%, while SatoshiVM’s SAVM has seen a 5% increase in value.

The Bitcoin race to $100K and beyond was triggered by the BTC halving event 2024 over the weekend amid heightened demand from institutional investors.

The price trajectory of Bitcoin has remained little unchained despite speculations and projections by different analysts before the halving.

Richard Teng cautioned that the extent of future growth will depend on various factors, including overall market sentiment and rates of adoption.

As Bitcoin price rebounded prior to options expiry, traders took advantage of negative funding rates to initiate long positions, leading to a recovery.

With Bitcoin’s recent price surge, it can be inferred that Schiff’s post questioning the leading cryptocurrency’s safe haven status may have been premature.

Breaking down the losses across different blockchains, BTC traders took the highest hit, with $4 million liquidated in the network in the last 24 hours.

Bitwise CEO Hunter Horsley said that several RIAs and multi-family offices have been exploring Bitcoin investments while staying low-key and conducting research silently.