Solana Price Holds Steady amid SOL ETF Refilings, What’s Next Target?

Solana’s recovery from a recent dip, along with renewed ETF filings, has sparked optimism for a potential price surge.

Solana’s recovery from a recent dip, along with renewed ETF filings, has sparked optimism for a potential price surge.

Solana’s climb has now placed it as the fourth-largest cryptocurrency position, following only Bitcoin (BTC), Ethereum (ETH), and Tether’s USDT.

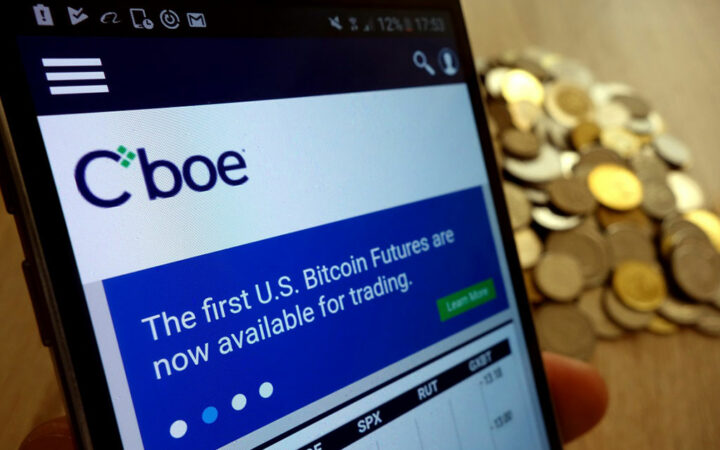

Forms for Solana spot exchange-traded funds (ETFs) filed by VanEck and 21Shares have been unexpectedly removed from the Chicago Board Options Exchange (Cboe) website, leading to speculation that these applications might face delays or even denial.

It is now a possibility that there is a postponement of the final deadline for a SEC decision.

The price action of Solana (SOL), the fifth-largest digital asset by market capitalization, jumped more than 7% in the past 24 hours after the news of the filing.

The SEC is yet to acknowledge the Solana ETF filings from both VanEck and 21Shares. ETF analyst Nate Geraci highlighted that when these acknowledgments finally come, the decision clock will begin to tick.

Monochrome emphasized that IBTC will be the first and only ETF in Australia to hold Bitcoin (BTC) directly.

The SEC has pushed making a decision on an application from the Cboe seeking to trade Bitcoin ETF Options. The agency will decide by April.

BlackRock’s existing spot BTC ETF stands out as the top-performing option in the market, contributing to the surge in demand for Bitcoin ETFs.

Operating within tightly regulated stock exchanges, ETFs ensure accessibility through existing retail investors’ brokerage accounts, subject to stringent supervision.

Recent meetings of major exchanges, including NYSE, Nasdaq Composite, the Chicago Board Options Exchange, and the SEC have sparked speculation about the timing and potential approval of a spot Bitcoin ETF.

Insiders familiar with the proceedings indicate that the SEC may begin notifying issuers of approval starting Friday, paving the way for potential trading to commence as early as the following week.

According to sources familiar with the ongoing ETF proceedings, an approval could be announced on Friday, with trading beginning as early as next Monday.

Fidelity Investments filed form S-1 with the US SEC on December 29, 2023, to offer the Fidelity Wise Origin Bitcoin Fund shares via Cboe BZX Exchange.

The latest amendment makes it the third time Grayscale has updated its Bitcoin spot ETF application following the SEC’s directive to submit revised documents by December 29, 2023.