Spot Bitcoin ETFs See Largest Daily Net Outflows on May 1

The total April net outflows of $343.5 million has successfully broken the three months of consecutive inflow streak for the spot Bitcoin ETFs.

The total April net outflows of $343.5 million has successfully broken the three months of consecutive inflow streak for the spot Bitcoin ETFs.

Kiyosaki now has one of the market’s most bullish short-term Bitcoin predictions, while other analysts are play safe with their forecasts.

The introduction of spot Bitcoin ETFs triggered a massive retracement in the overall crypto market.

Fidelity Investments filed form S-1 with the US SEC on December 29, 2023, to offer the Fidelity Wise Origin Bitcoin Fund shares via Cboe BZX Exchange.

As the SEC engages in detailed discussions with investment giants like BlackRock and Fidelity, the potential approval of a spot Bitcoin ETF seems to be moving closer to reality.

Bloomberg ETF analyst James Seyffart estimates that the SEC’s decision deadline for Fidelity will likely be January 21, 2024, with the final decision expected on March 8, 2024.

The revised proposal allows the ETF to utilize both in-kind and cash mechanisms. The ETF plans to store Bitcoin in cold storage, with custody services provided by Coinbase Custody Trust.

The mere possibility of spot Bitcoin ETF approvals has injected fresh optimism into the crypto market.

As of late October, the SEC is reportedly reviewing eight to ten potential spot Bitcoin spot ETF filings.

The forthcoming MiCA regulation aims to introduce a uniform set of rules and guidelines for crypto assets that currently operate outside the scope of traditional financial regulations.

Bitcoin ETFs provide an easy way for investors to put their funds into the cryptocurrency market.

Following BlackRock’s growing chance of an approval, Fidelity Investments has submitted another application for a spot Bitcoin ETF.

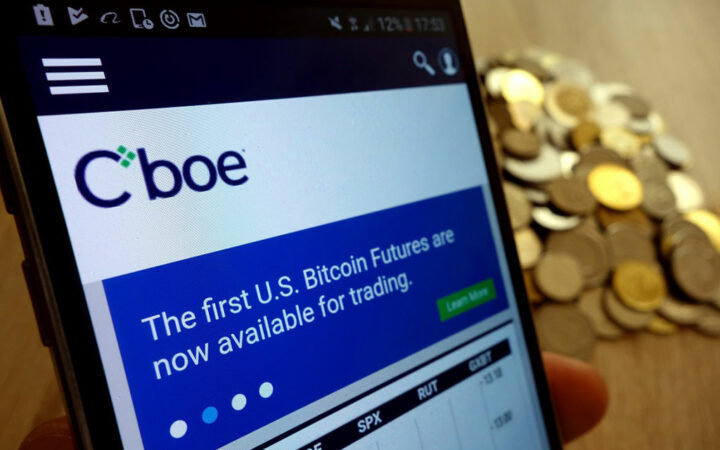

Cboe has amended its spot Bitcoin ETF proposal to include an SSA agreement for market surveillance, to prevent fraudulent activity.

Once the investment giant Fidelity files for a spot Bitcoin ETF with the US SEC, it will be the second time following the dismissal of the first one two years ago.

EDX Markets plans to step into the crypto space just when the regulatory developments are quite hot and the US SEC has been cracking hard on crypto firms.