March 5th, 2026

The China Evergrande debt situation further develops as the embattled firm faces key upcoming bond interest payments scheduled for tomorrow.

Metrika, an operational monitoring tool company for blockchain networks, has decided to use this funding to help strengthen its platform and expand its existing blockchain intelligence technology.

Revolut has a lot to gain from the stock trading offering in the United States, as more people are getting increased education to commit their funds to work for them as traditional investment options are no longer attractive.

To avoid a further scuffle with the US SEC, Coinbase decides to drop its plan of crypto lending services with the USDC stablecoin.

The Coinbase Prime platform will handle large-sized orders and will serve as a one-stop solution for “advanced trading, battle-tested custody, and financing”.

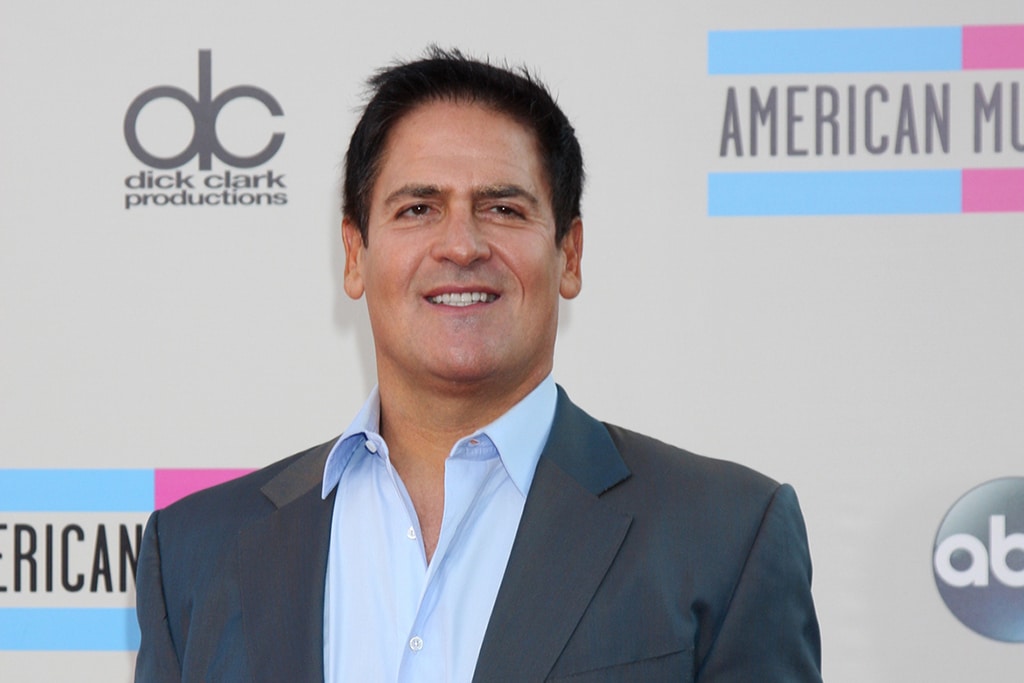

As SEC Chairman Gary Gensler affirmed that the commission is working extensively on creating a new set of rules for the crypto space, Cuban said he believes Stablecoins will be the first to be regulated while smart contracts are poised to be the primary source of fraud in the nascent ecosystem.

Dalio believes that while Bitcoin has no intrinsic value, it is a better alternative to cash.

Known for its funds cutting across the decentralized finance (DeFi) ecosystem, the Bitwise Bitcoin ETF product, if approved, will also explore investments in safer financial instruments.

Coinbase is now the second crypto-related junk bond issuer in the United States market as business intelligence and software developer, MicroStrategy Inc, sold $500 million of notes in June to fund the purchase of Bitcoin.

Fidelity executives also highlighted the massive adoption of Bitcoin across the world and, particularly, in the United States as another reason why the commission should be thinking of approving a Bitcoin ETF.

Wood remains confident that the Bitcoin trend will be majorly bullish in the next 5 years. She further forecasts a 10-fold increase in the price of Bitcoin.

The reduced institutional inflows have not impacted the price of Bitcoin as much as we would expect, as the cryptocurrency has sought a bullish fundamental in other aspects.

As an emerging growth company, Freshworks prides itself on over 52,000 global customers. Out of which, over 13,000 have a $5k APR.

The new crypto fund will help Bain Capital boycott needless stress, and still attract investors who wish to gain exposure to the digital currency world.

The US stock market remained timid on Wednesday for the third consecutive way. Wall Street investors are bracing for volatility ahead.