March 5th, 2026

Menwhile, MoneyGram is facing several lawsuits in the United States that may damage its future growth prospects.

The US Securities and Exchange Commission (SEC) has been revealed to be on the verge of suing Ripple Labs for illegal sales of securities. This put them in the same bracket as companies that suffered a similar fate like Kik Interactive Inc.

Interestingly, Coinbase co-founder and board member Fred Ehrsam is a former trader at Goldman Sachs.

Bitcoin mining stocks shined bright soon after the BTC price crossed $20,000 levels on Wednesday. Bitcoin has surged over 20% in the last 24 hours and has moved past $23,500 levels hitting a new all-time high.

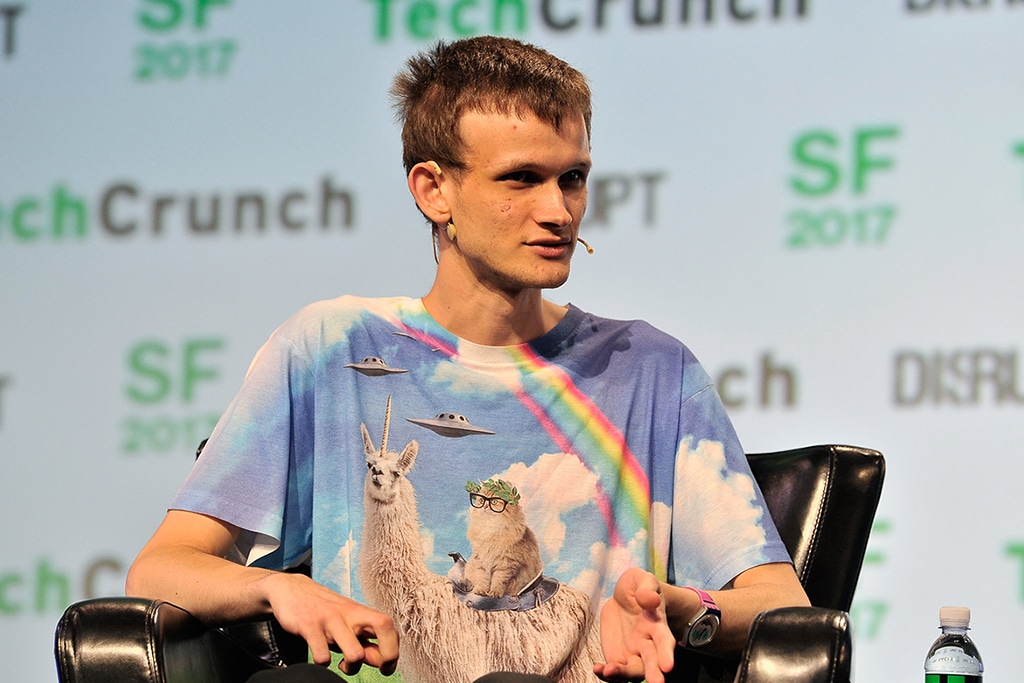

Buterin has asked users to maintain caution with the volatile asset class and revealed that he had sold half of his Bitcoin holdings in 2013 to avoid going broke.

From the time it began Bitcoin mining operation in 2016, Fidelity has been working to bring the future of cryptocurrencies into the legacy world.

Roblox has delayed its public listing for early next year explaining the massive IPO rush has made it difficult to determine the right price for its shares.

Despite that Robinhood had not officially announced the IPO, the sources stated that the trading company would go public before the end of 2021 Q1.

Tesla is all set to raise $5 billion by the fresh stock offering as it plans new gigafactories and production expansion in the next two years. The fundraise plan comes at a time when the TSLA has skyrocketed nearly 700% so far in 2020.

MobileCoin token (MOB) is viewed as one of the most secure crypto assets with high transaction speed and it is also fully environmentally-friendly.

Circle CEO Jeremy Allaire said that the creation of a central bank digital currency (CBDC) would not crowd out stablecoin.

The move by Airbnb and Doordash to boost their valuation with hiked share pricing is set to place the US IPO market on a climactic ending for the 2020 calendar year.

However, with most investors still speculating on the future growth prospects of the assets, Tom Jessop thinks Bitcoin has the chance to become an alternative store of value.

Ripple has oftentimes been embroiled in a regulatory impasse with US authorities particularly the Securities and Exchange Commission (SEC) as it relates with the XRP coin which is closely associated with the company.

According to reports, 98% of Raoul Pal’s liquidated net worth would be invested in Bitcoin and Ethereum in the ratio 80:20.