March 4th, 2026

Circle CEO Jeremy Allaire to save crypto following the collapse of some major mainstream banks, including Silicon Valley Bank.

Leading exchange KuCoin participated in a $10 million funding exercise for CNHC to support stablecoin adoption.

As unveiled by Circle, it has started processing its redemption through a new banking partner after it was able to access the funds worth $3.3 billion locked up in Silicon Valley Bank.

Christine Okike said BlockFi remains safe and looked to access significant cash held with Silicon Valley Bank yesterday.

Coinbase shares are up approximately 67 percent YTD, despite a 62 percent decline last year.

According to Circle, the bulk of its reserve for the USDC stablecoin is domiciled in US Treasury Bills.

USDC stablecoin issuer Circle has a staggering $3.3 billion of its total reserves with the Silicon Valley Bank. Circle has promised to cover any shortfall using corporate resources as well as external capital if required.

The US government appears to be solely focused on strengthening public confidence in its banking system.

A diversified portfolio is a crucial measure to mitigate risks, and also a safe way for newcomers to enter the crypto space.

As the Silvergate crisis spreads across the broader market, investors have been shoring up stablecoins with USDT and USDC witnessing a surge in trading activity.

Japanese banks Tokyo Kiraboshi Financial Group, The Shikoku Bank, and Minna no Bank are reportedly launching a stablecoin to enhance payments.

According to Armstrong, the crypto asset market is here to stay, thus the reason traditional financial services are integrating with the blockchain and cryptocurrency industry.

The RBA is set to explore various use cases for its central bank-issued digital currency (CBDC).

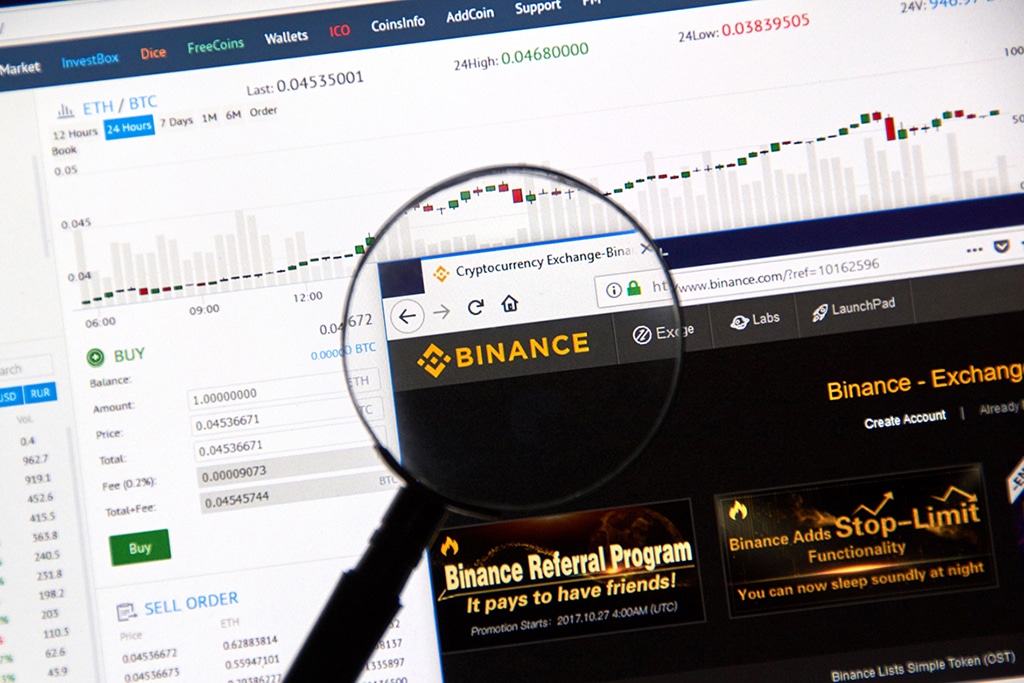

Leading exchange Binance claims that the Forbes collateral report relates to its internal wallet management and is thus unfounded.

Binance has indicated that the fund transfer was among its standard practices and did not create any problems for its traders.