With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.

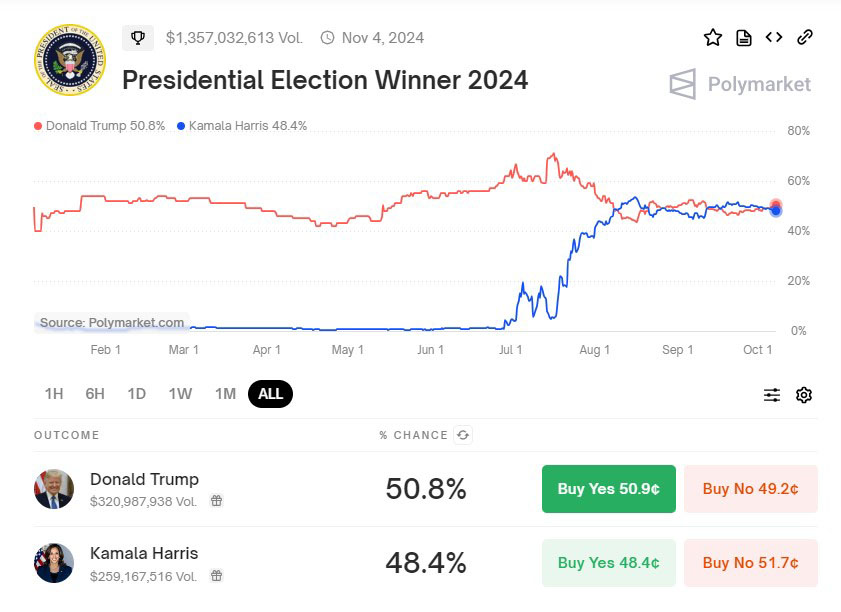

Despite Trump’s recent 50.8% chance of winning, Harris’s odds surged from 5% to 54% between July 1 and August 14, reducing Trump’s from 66% to 44%.

Edited by Julia Sakovich

Updated

3 mins read

Edited by Julia Sakovich

Updated

3 mins read

Former US President Donald Trump has seen a sharp rise in his election chances on Polymarket, a decentralized betting platform. By October 7, 2024, Trump’s chances of winning the upcoming presidential race reached 50.8%, up from the formal Vice President Kamala Harris standings of 48.4%, showing the significant shift in betting trends since President Joe Biden left the race in July.

Source: Polymarket

Polymarket, valued at $1.3 billion, has experienced varying stakes for both Trump and Harris throughout the campaign. Harris led much of September, but recent bets have swung in Trump’s favor. Significantly, from July 1 to August 14, Harris’s chances to win the election significantly rose from 5% to 54%, pushing Trump’s from 66% to 44% on the platform.

Tesla CEO Elon Musk recently commented on X (formerly Twitter) regarding Polymarket’s predictions:

“Trump now leading Kamala by 3% in betting markets. More accurate than polls, as actual money is on the line.”

Musk’s statement clearly supports polymarket prediction platforms over traditional polling, which can differ in reliability due to varied methods and sample sizes.

Polymarket’s recent data contrasts with the national polling average from The New York Times, where Harris leads with 49% compared to Trump’s 47% chance of winning. This gap differs from Polymart’s forecast favor in Trums of 50.08%. Musk put his stance that bettors’ financial stakes may offer more reliable and accurate predictions over traditional polls methods.

On Saturday, Elon Musk made his first appearance at a Trump rally in Butler, Pennsylvania, where Trump survived an assassination attempt. Wearing a “Make America Great Again” hat, Musk openly backed Trump, calling him the sole candidate “to preserve democracy in America”, according to AP News. Endorsement from a major figure like Musk could shift voter sentiment and increase Trump’s poll numbers.

Cryptocurrency has become a key issue in the 2024 election. Trump actively supports digital currencies, NFTs, and decentralized finance, appealing to voters who value technological innovation. On the other hand, Harris has been more hesitant, recently expressing plans to encourage the growth of “digital assets” after a prolonged silence on the topic.

Last week, Matt Hougan, Bitwise’s Chief Investment Officer, said that Kamala Harris brings added ambiguity to the crypto space, despite her hopeful claim that “crypto wins no matter what” in the election. Harris’s cautious stance approach comes from potential regulatory shifts and the absence of a clear plan for integrating digital assets into the broader economy. Hougan suggests that while both presidential candidates recognize cryptocurrency’s significance, their approaches and effects on the market could vary widely.

The US presidential election is set for November 5, 2024. As the campaign heats up, prediction markets, key endorsements, and emerging technologies like cryptocurrency will likely play a vital role in shaping voters’ choices. With Polymarket showing a slight lead for Trump and figures like Elon Musk backing the platform’s accuracy, the outcome of the elections will definitely impact crypto’s future.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.