Zenchain Protocol Diversifies Defi x NFT

Defi Space

Since early 2020, the DeFi trend has been recognized as the trend of wealth and transparency, it gives crypto investors abilities to borrow, lend, trade, and invest in a decentralized and transparent platform like a traditional financial bank.

Until mid of March 2021, a total of over 42 billion US dollars have been locked in many Defi protocols. Cryptocurrency and Decentralized Finance (DeFi) offer a way to start with a new system, circumventing the difficulties faced in changing the finance industry. While crypto has attracted billions in investments, decentralized financial services are lagging. When it comes to investment in cryptocurrency, crypto investors can buy and sell, but that’s it. The cryptocurrency itself cannot be invested in the same way fiat currency can be. Initial attempts to create peer-to-peer lending and asset tokenization so far have proven partial and unreliable, so investors have extremely limited options when it comes to an investment of their crypto assets. The potential is enormous to provide financial services in crypto, the same way they are offered in fiat currency.

First, we must be clear about what DeFi is. DeFi, in its ideal form, exhibits four properties.

- First, non-custodial financial services allow participants to exert full control over their funds at any point in time.

- Second, the permissionless nature of DeFi allows anyone to interact with financial services without being able to be censored or blocked access by a third party.

- Third, DeFi is openly auditable, which means that anyone has the ability to audit the state of protocols-e.g., that they are fully collateralized/healthy.

- Fourth, financial services can be arbitrarily composed such that new financial products and services can be created similar to how one is able to conceive new Lego models based on a few basic building blocks.

NFTs Born

Non-fungible tokens (NFT) are digital assets that represent a wide range of unique tangible and intangible items, from collectible sports cards to virtual real estate and even digital sneakers.

One of the main benefits of owning a digital collectible versus a physical collectible like a Pokemon card or rare minted coin is that each NFT contains distinguishing information that makes it both distinct from any other NFT and easily verifiable. This makes the creation and circulation of fake collectibles pointless because each item can be traced back to the original issuer.

Unlike regular cryptocurrencies, NFTs cannot be directly exchanged with one another. This is because no two NFTs are identical — even those that exist on the same platform, game, or in the same collection. Think of them as festival tickets. Each ticket contains specific information including the purchaser’s name, the date of the event, and the venue. This data makes it impossible for festival tickets to be traded with one another

Issue Came

Moreover, at a technical level, the blockchains underlying DeFi are facing significant challenges. Blockchain transaction fees have risen considerably during periods of congestion, with the fees for relatively simple smart contract operations running into the hundreds of dollars. Rising transaction costs price out small transactions, in turn restricting the set of transaction types for which the layer-one blockchain can be used.

In conclusion, since over 90% of DeFi projects are based on Ethereum blockchain, we will consider the challenges for Ethereum challenges as DeFi challenges:

Scalability

Another big problem with DeFi projects is the scalability of the host blockchain. Two major problems arise from the scalability problem:

- Transactions take a long time to be confirmed

- Transactions are extremely expensive at times of congestion

Ethereum at full capacity can process about 13 transactions per second, while centralized counterparts can process thousands and thousands of transactions. And Ethereum sing

Smart Contract Problems

Smart contract vulnerability is a major source of issues for many DeFi projects. If there is the slightest flaw in the code of a smart contract, it can lead to loss of funds.

Low Interoperability

There are different types of blockchains such as Bitcoin, Ethereum, Binance Smart Chain, each with its own DeFi ecosystem and community. Interoperability enables DeFi platforms, tools, DApps, and smart contracts on different blockchains to interact with each other. Until this becomes simpler, many projects are siloed.

Lack of Insurance

Insurance protects investors in the event of hacks or other fraudulent activities. Insurance plays a very important role in centralized finance while it is much rarer in DeFi.

ZenChain Solution

“The ZenChain Foundation is developing ZenChain, a blockchain specifically dedicated to decentralized financial (DEFI) applications and non-fungible tokens (NFTs). By focusing on the functionality of the blockchain and dedicating it specifically to DEFI and NFTs, ZenChain provides unparalleled high transaction throughput, reduced risk of errors, and intelligent feature development specifically for the fulfillment of financial services for both fungible token and non-fungible token (NFT) on the blockchain”

ZenChain gives some solution to resolve this problem:

- Scalable, high-throughput Blockchain with Tendermint Power

- Bridge from Etherum, Tron, Binance smart chain make cross-chain Defi and NFTs solutions.

- Decentralized pricing oracles built-in

- DeFi primitives built-in: Dex, Lending & Borrowing, token IDO, insurance.

- Non-fungible Token applications like mint, auction, rent NFTs

- NFTs X DEFI: bring the power of NFTs to Defi ecosystem and Defi to NFTs

NTFs X DEFI

Using NTFs as collateral in Defi

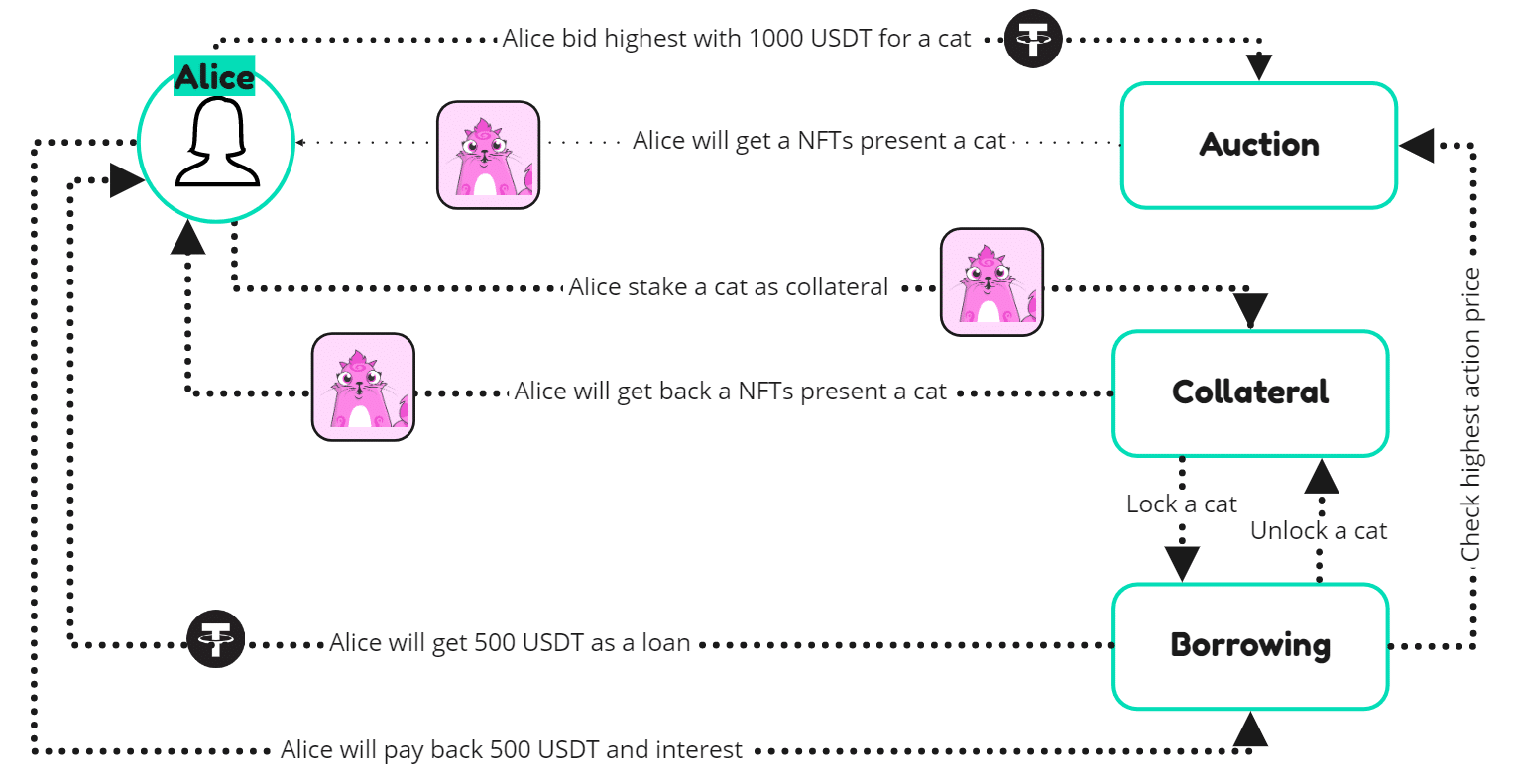

The special of ZenChain is full support cross-chain NFTs and Defi. ZenChain allow NFTs owners get more powerful with their NFTs, is just not collectible, user can stake their NFTs as collateral in lending & borrowing application, and can borrow some fungible token (ERC20, BEP20, TRC20 …) to using another defi strategy.

The price of NFTs is determined by the Auction system. That means just users and NFTs which using the ZenChain auction system can use their NFTs as collateral.

ZenChain allows users to borrow up to 50% of the highest auction price.

Use case with using NFTs as collateral to borrow money.

For more news and latest updates please feel free to join ZenChain community in Telegram, Twitter and Facebook.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.