Check out the report created by OK Blockchain Capital covering main trends of blockchain industry over June 6-15, 2018, with strong focus placed on the market overview, analysis of the newly listed and closed public sales projects, along with topical news on global governmental policies.

1. Market Overview

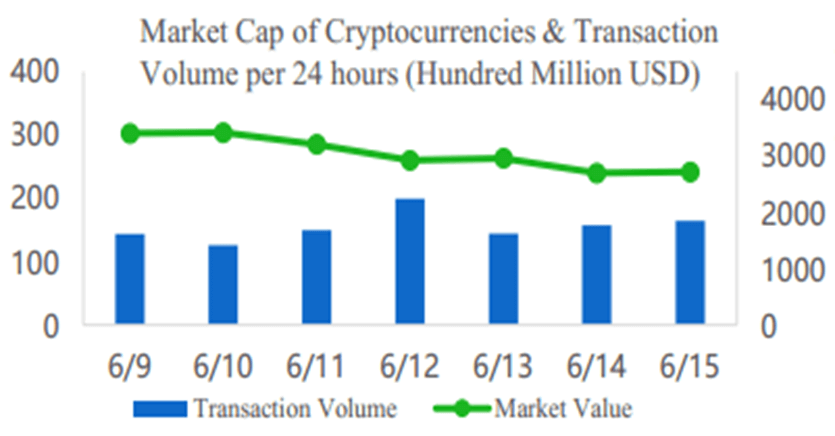

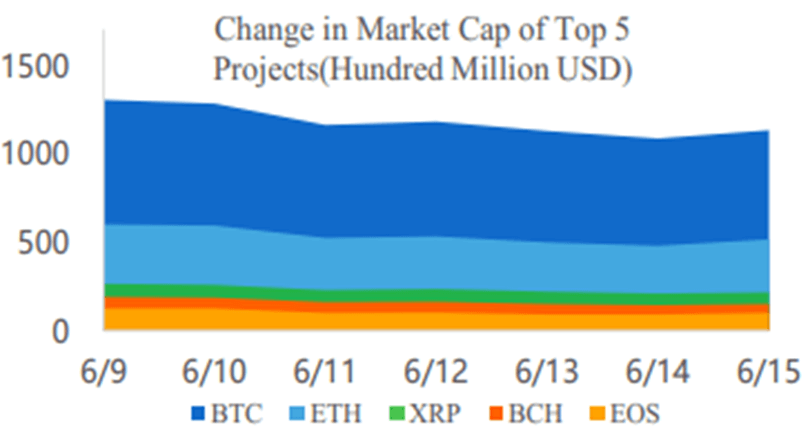

The past week’s daily average global market capitalization of cryptocurrency is $304.4 billion and the daily average transaction volume is $15.48 billion, indicating a decline of 10.99% and 4.51% respectively. The daily average market capitalization of the top five cryptocurrencies has decreased by 10.36% from the previous week. EOS has experienced the greatest price decrease in the past week with a low of $9.44, a decrease of 36.30%. BCH closely follows with a 28.02% price decrease with a low of $818.62 this past week.

Data source: Coinmarketcap.

Of the cryptocurrencies that increased, FirstCoin (a cryptocurrency and payment system) rose the most, increasing by 639.2%.

Table 1.1. Top 10 Project in terms of the amount token price increased (June 6-15, 2018)

| Ranking | Project | Token | Field | Brief description | Trading amount(24h) | Token price | Increase/7d |

| 1 | FirstCoin | FRST | Cryptocurrency and payment | FirstCoin is an efficient proof of equity/work encryption certificate | $306,040 | $0.08 | 639.20% |

| 2 | DigiCube | CUBE | Finance | All transactions on DigiCube are confirmed by the master node before they are considered valid | $1,413,150 | $0.00 | 159.18% |

| 3 | Infinity Economics | XIN | IoT | Infinity Economics deploys smart contracts to empower the IoT industry with blockchain technology | $2,809,060 | $0.01 | 74.18% |

| 4 | GINcoin | GIN | Wallet | GINcoin aims to provide users with a convenient and quick way to deploy nodes | $292,884 | $12.36 | 67.36% |

| 5 | GoByte | GBX | Public chain and protocol | GoByte is a new cryptocurrency based on Dash. | $472,470 | $4.67 | 29.42% |

| 6 | ZIP | ZIP | Payment | Zipper provides blockchain-based services to global financial institutions, delivering cross-chain information | $14,355,100 | $0.00 | 28.17% |

| 7 | Linda | LINDA | Anonymous token | Linda is a dynamic anonymous cryptocurrency that supports multi-currency wallets that can be cross-linked for instant transactions | $317,701 | $0.00 | 26.24% |

| 8 | Swarm | SWM | Asset management | Swarm is a fully decentralized, democratic and autonomous capital market platform based on blockchain technology. | $114,660 | $0.84 | 23.89% |

| 9 | Latium | LATX | Social network | Latium is a recruitment platform that publishes tasks on the platform and attracts participants with token rewards | $3,709,240 | $0.07 | 21.54% |

| 10 | DubaiCoin | DBIX | Asset management | ArabianChain will use blockchain technology to build a full-featured application platform. DubaiCoin is the currency of the platform. | $225,406 | $4.79 | 21.27% |

Data source: Coinmarketcap; retrieved at 11:00 on June 15th, 2018.

2. Analysis of Top 200 Market Cap Projects

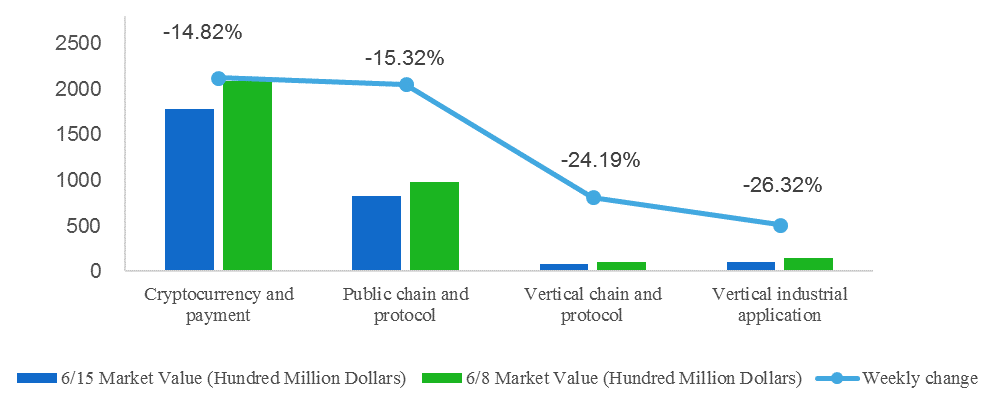

The market capitalization of top 200 projects decreased by 15.76% compared with that of last week. Based on the main categories of cryptocurrency and payment, public chain and protocol, vertical industrial chain and protocol, and vertical industrial application, the vertical industrial application decreased the most.

Data source: OK Blockchain Capital.

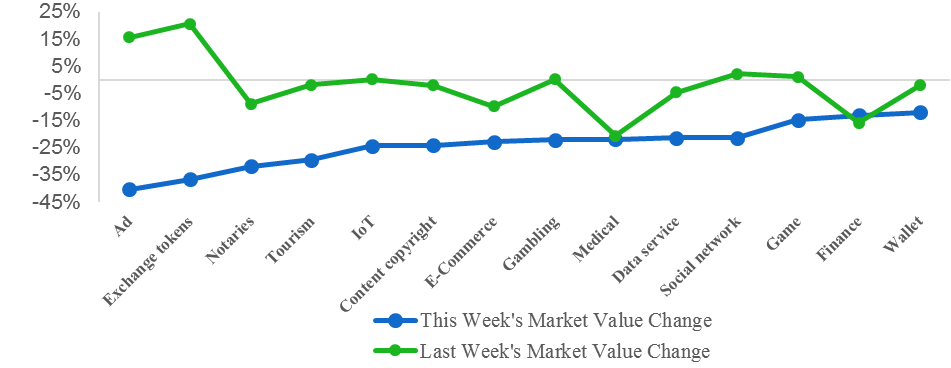

Through further classification of the public chain and protocol vertical, it was found that this week’s exchange platform tokens and advertising verticals were on obvious decreases at rates of 40.29% and 36.74%. In comparison to OK Blockchain Capital’s previous weekly report, the two greatest-increasing verticals last week saw the largest drop this week, indicating that the popular verticals are accompanied by a high risk of retracement.

Data source: OK Blockchain Capital.

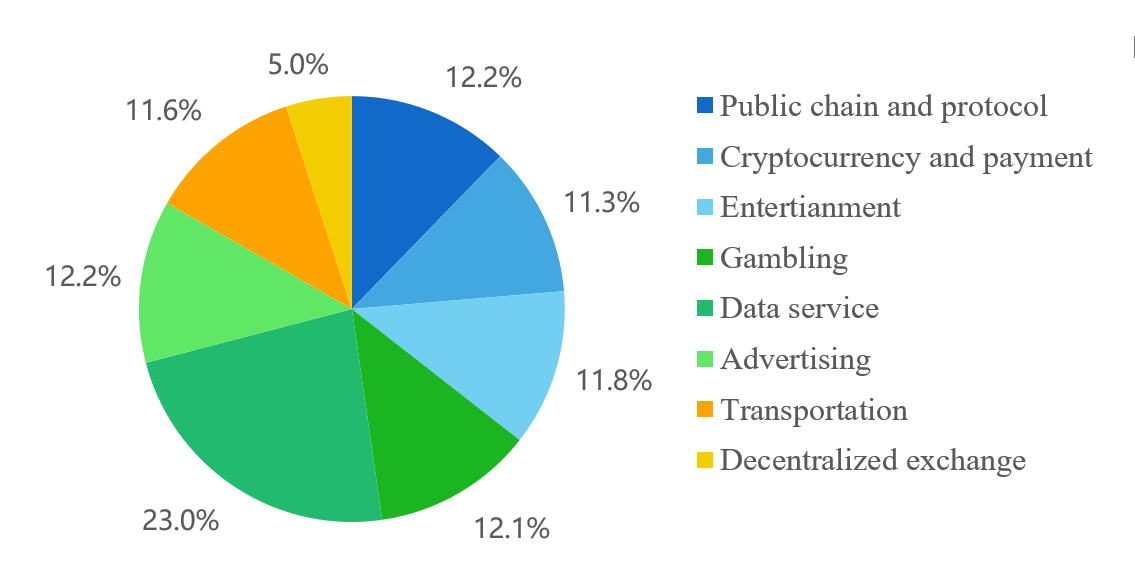

3. Analysis of Newly Listed Projects

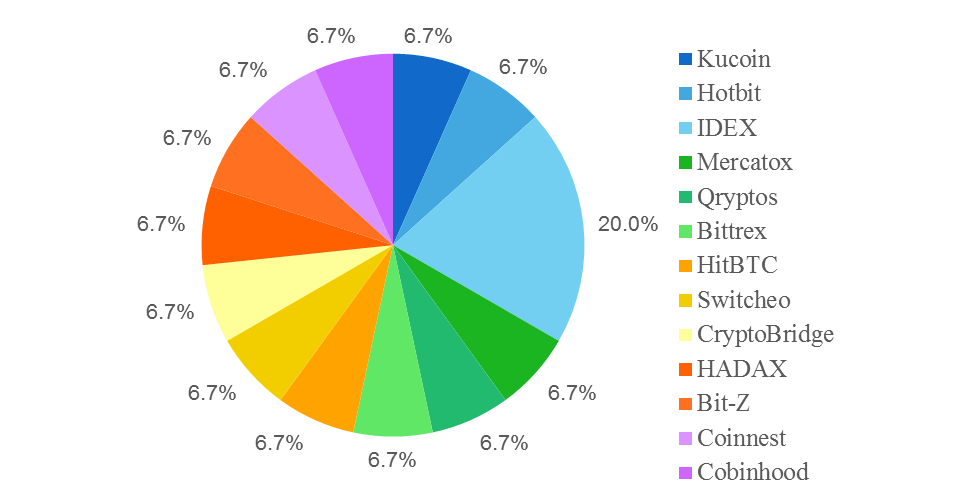

There are 11 new projects in the market last week, 72.72% of which dropped in price within 24 hours of launch. Among the new projects, vertical chain and protocol and gambling had relatively better price performance. Most of the newly issued tokens are listed in IDEX, HitBTC, and Hotbit.

New Projects Categories Ratio

Data source: Coinmarketcap, feixiaohao, OK Blockchain Capital analysis.

New Projects Listed Exchanges Ratio

Data source: Coinmarketcap, feixiaohao, OK Blockchain Capital analysis.

Table 1.2. Newly Listed Projects (June 6-15, 2018)

| Project | Token | Field | Exchange Platform | Initial Listed Price($) | Current Price($) | 24h Trading Volume($) | Launch Date |

| GoChain | GO | Public chain and protocol | Kucoin | 0.0342 | 0.02 | $2,376,060 | 6/14 |

| Couchain | COU | Data service | Hotbit, IDEX, Mercatox | 0.00021 | 0.00026 | $1,257,560 | 6/12 |

| SalPay | SAL | Cryptocurrency and payment | Qryptos, IDEX | 0.4 | 0.08 | $79,492 | 6/12 |

| CEEK | CEEK | Entertainment | Bancor, IDEX | 0.5 | 0.05 | $55,812 | 6/12 |

| CashBet Coin | CBC | Gambling | Bittrex, HitBTC | 0.5 | 0.25 | $132,983 | 6/12 |

| PikcioChain | PKC | Data service | Switcheo | 0.27 | 0.20 | $57,182 | 6/12 |

| MIRQ | MRQ | Advertising | CryptoBridge | 0.5 | 0.35 | $94,524 | 6/9 |

| Engine | EGCC | Transportation | HADAX, Bit-Z, Coinnest | 0.004 | 0.002 | $1,144,760 | 6/9 |

| CGC Token | CGC | Decentralized exchange | HitBTC, Cobinhood | 1.28 | 0.11 | $1,696 | 6/9 |

Data source: Coinmarketcap; retrieved at 11:00 on June 15th, 2018.

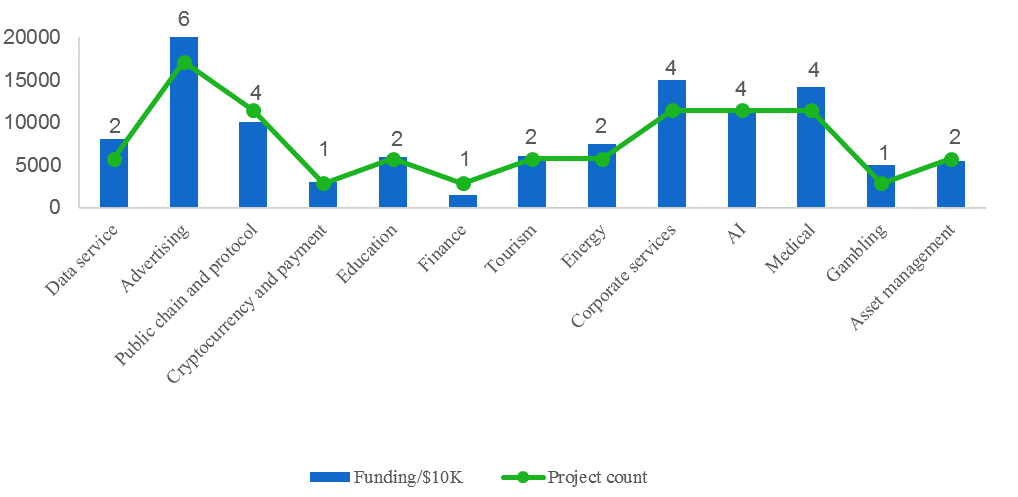

4. Analysis of Closed Public Sales Projects

There have been 35 closed public sales projects this week, totaling nearly 150 million USD. Among these projects, advertising and medical projects received most funding and were most prevalent.

Main categories of public sales project this week (fields with investment more than $5M)

Table 1.3 Closed Public Sales (June 6-15, 2018)

| Project | Token | Field | Platform | Soft Cap (USD) |

| Big Data Block | BDB | Data service | Ethereum | 3 million |

| CyteCoin | CTC | Data service | Ethereum | 5 million |

| Spotcoin | SPOT | Advertising | NEO | 5 million |

| HEROIC.com | HRO | Public chain and protocol | Ethereum | 2.5 million |

| Wizebit | WIZE | Public chain and protocol | WizeBit | 2.5 million |

| Loyakk | LYK | Public chain and protocol | Ethereum | 3 million |

| Payiza | PYZ | Public chain and protocol | Ethereum | 2 million |

| Greenish | GREE | Cryptocurrency and payment | X11 | 3 million |

| Vanywhere | VANY | Education | Qtum | 2 million |

| Tutellus | TUT | Education | NEM | 4 million |

| Zodiaq | ZOD | Finance | Ethereum | 1.5 million |

| ETH Travel | ETHTT | Tourism | Ethereum | 5 million |

| Smart Trip Platform | TASH | Tourism | Ethereum | 1 million |

| FTV Coin Deluxe | FTV | Advertising | Ethereum | 5.87 million |

| CRYSTALS | CRS | Advertising | Ethereum | 1 million |

| Monoreto | MNR | Advertising | Ethereum | 0.2 million |

| Slate | SLX | Advertising | Slatechain | 20 million |

| Switcoin | SWIT | Advertising | – | 30 million |

| Solarex | SRX | Energy | Ethereum | 5 million |

| ETHernitymining | ETM | Energy | Ethereum | 2.5 million |

| SupplyBloc | SUPX | Corporate services | Ethereum | 1 million |

| PAYERA | PERA | Corporate services | Ethereum | 8 million |

| Safe.ad | SAFE | Corporate services | Ethereum | 3 million |

| Swace | SWA | Corporate services | Ethereum | 3 million |

| NWPSolution | NWP | AI | Ethereum | 0.3 million |

| Box2Table | B2C | AI | Ethereum | 5 million |

| Swachhcoin | SCX | AI | Ethereum | 5 million |

| Baanx.com | BXX | AI | Ethereum | 1 million |

| Kuende | KUE | Medical | Ethereum | 2 million |

| Innovative Bioresearch | INNBC | Medical | Ethereum | 5 million |

| Superfruit | SFT | Medical | Ethereum | 0.1 million |

| FarmaTrust | FTT | Medical | Ethereum | 7 million |

| BotGaming | BOT | Medical | Ethereum | 5 million |

| DarcMatter Coin | DMC | Asset management | NEM | 5 million |

| ZNAQ | ZNAQ | Asset management | Ethereum | 0.53 million |

Main data sources: Icobench, Foundico, smith and crown, icodata, icodrops, icoadvert, Coinschedule.

Secondary data sources: Project websites.

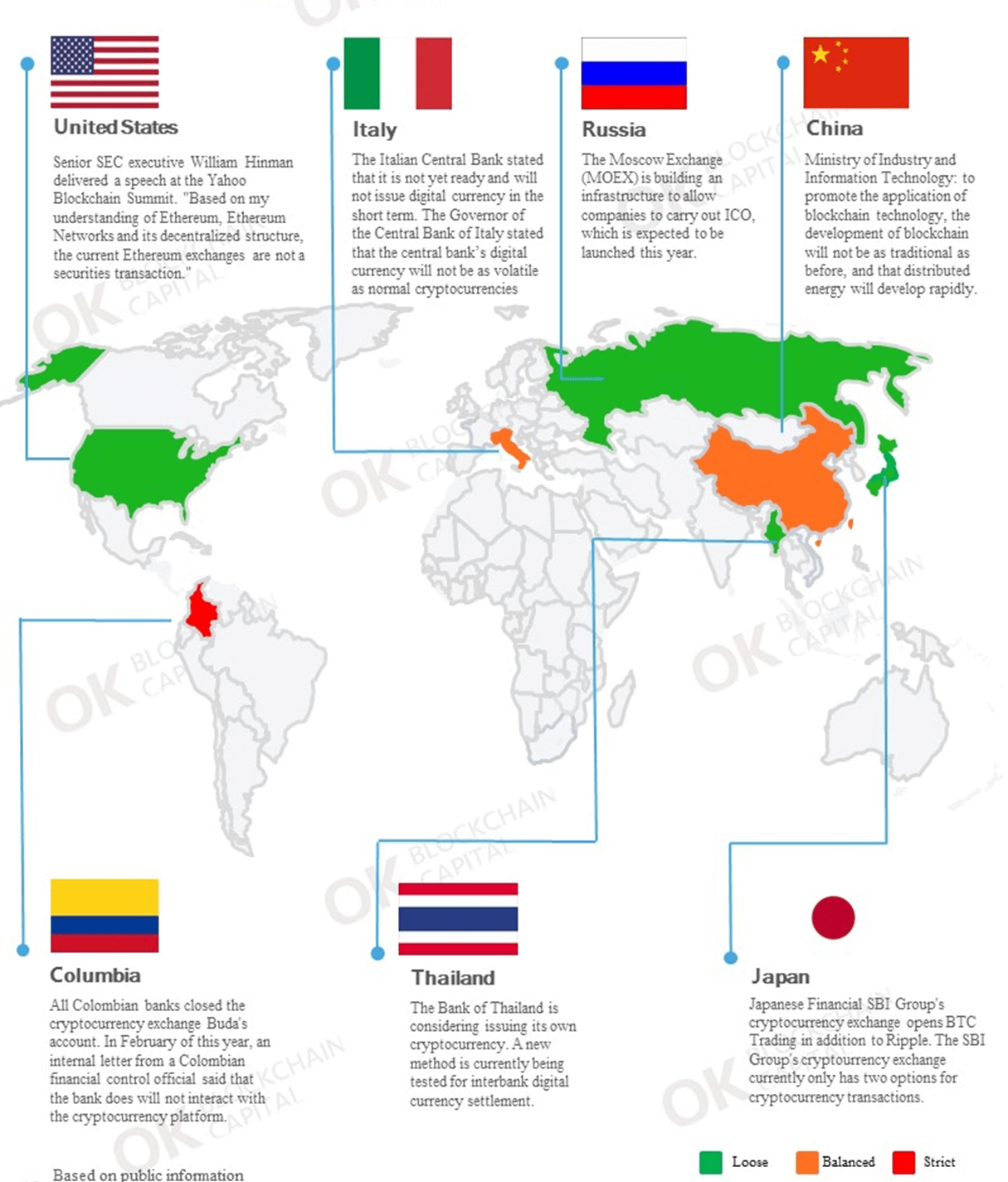

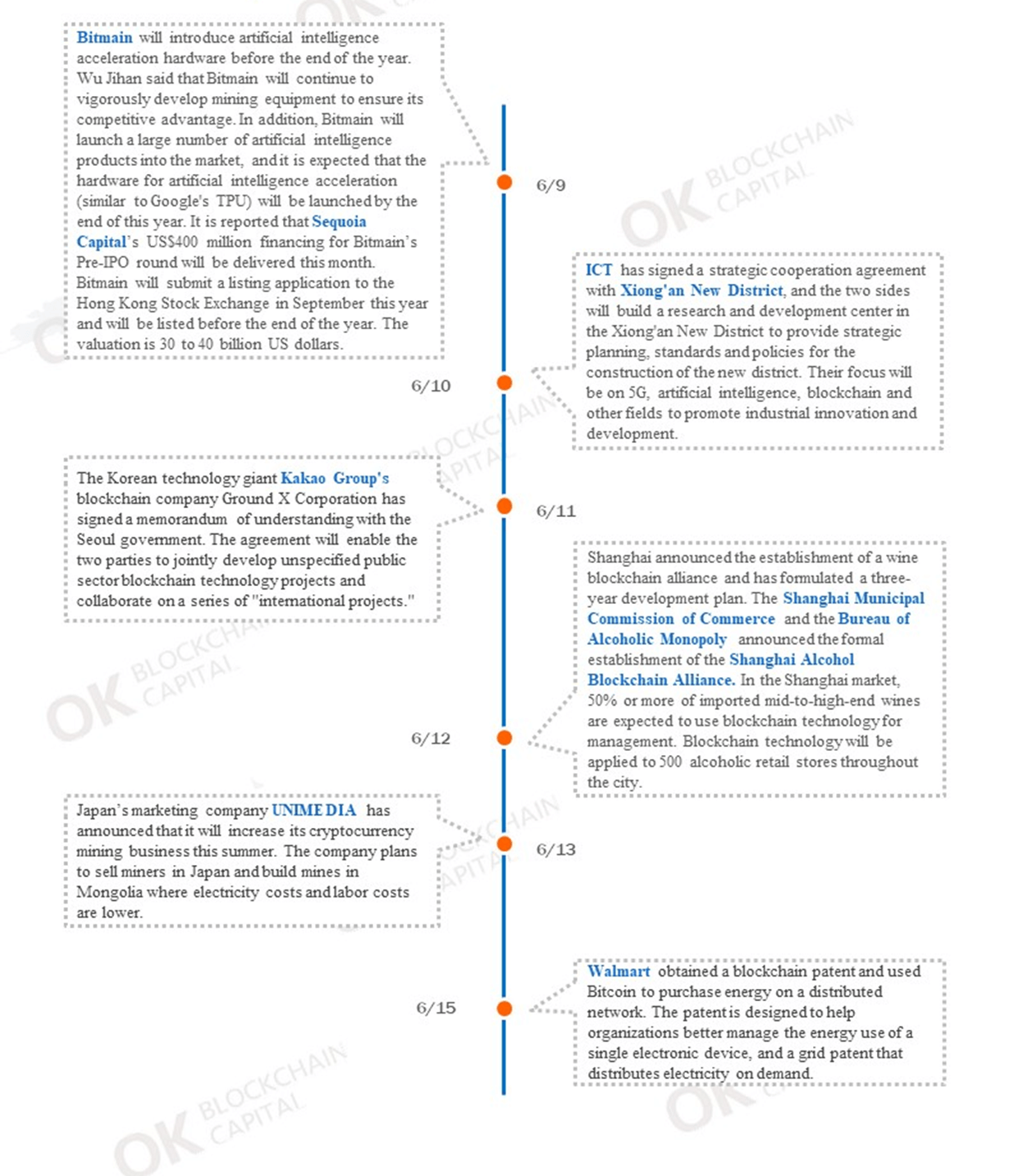

5. Important News on Global Governmental Policies this Past Week

6. Keeping Up with the Blockchain Giants

7. Hot Topic of the Week: EOS Main Network Launch

The voting rate of the EOS main network officially exceeded 15% on June 15. The EOS main network was activated and formally launched. The first batch of 21 EOS supernodes (block producer) were created. EOS Canada took the top spot in the vote, with more than 42.3 million votes and 3.3%. In addition, there are 8 Chinese nodes.

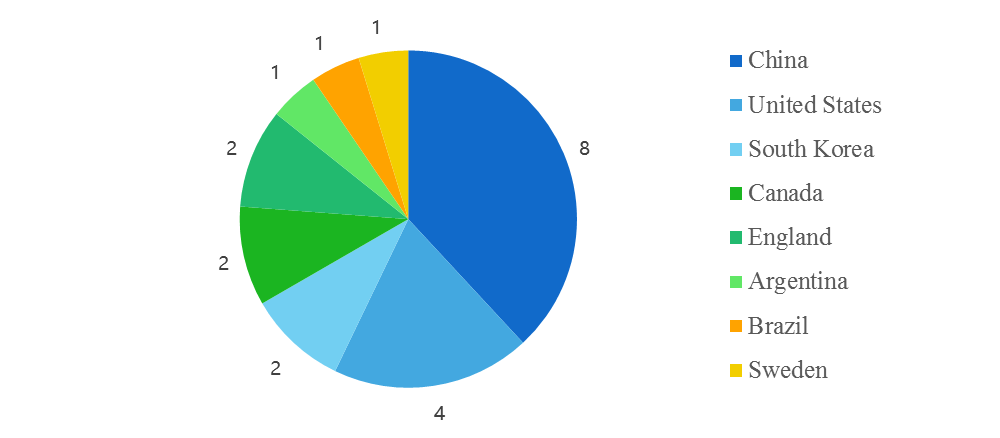

The chart below shows the current 21 BP country distributions:

Retrieval time: 17:00 Beijing time, June 15, 2018, Source: eosportal.

Table 1.4 21 EOS supernodes (June 6-15, 2018)

| Rank | Account | Country | Votes |

| 1 | eoscanadacom | Canada | 3.30% |

| 2 | eosauthority | United Kingdom | 3.28% |

| 3 | eosdacserver | China | 3.26% |

| 4 | eosnewyorkio | United States | 3.01% |

| 5 | eoscannonchn | China | 2.99% |

| 6 | eoscafeblock | Canada | 2.91% |

| 7 | eos24freedom | United Kingdom | 2.77% |

| 8 | bitfinexeos1 | United States | 2.76% |

| 9 | eosliquideos | United States | 2.70% |

| 10 | cypherglasss | United States | 2.63% |

| 11 | eossisgravity | China | 2.53% |

| 12 | argentinaeos | Argentina | 2.43% |

| 13 | eosyskoreabp | Korea | 2.35% |

| 14 | eoshuobipool | China | 2.35% |

| 15 | eosriobrazil | Brazil | 2.34% |

| 16 | eosswedenorg | Sweden | 2.28% |

| 17 | eosbeijingbp | China | 2.27% |

| 18 | eoseouldotio | Korea | 2.23% |

| 19 | eosstorebest | China | 2.06% |

| 20 | eosiomeetone | China | 2.03% |

| 21 | eosasia11111 | China | 2.02% |

Retrieval time: 17:00 Beijing time, June 15, 2018, Source: eosportal

Appendix

Table 1.5 Upcoming Crowdfunding Projects (June 16-22, 2018)

| Project | Token | Public offering launch date | Public offering close date | Field | Token Quantity | Public offering percentage* | Hard cap |

| Find Exchange | FEX | June 16, 2018 | June 30, 2018 | Finance | 112 million | 56% | 33 million USD |

| Path Network | PATH | June 16, 2018 | August 7, 2018 | Data service | 240 million | 60% | 47.6 million USD |

| Diamond Horse Performance Fund | DHP | June 16, 2018 | July 7, 2018 | Finance | 25 billion | 40% | 2500ETH |

| CVerification | CVER | June 17, 2018 | July 15, 2018 | Education | 186 million | 50% | 40,000 ETH |

| ViolaAI | VAI | June 17, 2018 | July 16, 2018 | IoT | 903 million | 37% | 12.5 million USD |

| PaidEx | PAD | June 17, 2018 | July 15, 2018 | Finance | 60.21 billion | 60% | 60 million USD |

| ServAdvisor | SRV | June 18, 2018 | July 18, 2018 | Consumerism | 169 million | 85% | 30,000 ETH |

| Pool of Stake | PSK | June 18, 2018 | July 20, 2018 | Asset management | 053 million | 76% | 8 million EUR |

| PREVISIONe | PVS | June 18, 2018 | July 8, 2018 | Prediction | 064 million | 64% | 25 million USD |

| Subaj Global Network | SBJ | June 18, 2018 | July 28, 2018 | Consumerism | 5 billion | 50% | 70 million USD |

| EIPlatform | EMI | June 18, 2018 | July 4, 2018 | Game | 075 million | 75% | 60 million USD |

| StoneToken | STTN | June 18, 2018 | July 6,2018 | Asset management | 7.25 million | 74% | 7 million USD |

| Paygine | PGC | June 18, 2018 | August 17, 2018 | Finance | 042 million | 27% | 30 million USD |

| ImmVRse | IMV | June 19, 2018 | June 22, 2018 | Entertainment | 300 million | 33% | 20 million USD |

| Aurum | AURUM | June 20, 2018 | August 21, 2018 | Consumerism | 300 million | 80% | 75,000 ETH |

| Reger Diamond | RDC | June 20, 2018 | July 20, 2018 | Consumerism | 22 million | 35% | 21.5 million USD |

| UChain | UCN | June 20, 2018 | June 23, 2018 | Public chain and protocol | 210 million | 40% | 12,000 ETH |

| Upfinex | UPX | June 20, 2018 | September 10, 2018 | Exchange platform token | 20 million | 57% | 4.2 million USD |

| SUPERIUM | SUM | June 20, 2018 | July 20, 2018 | Entertainment | 450 million | 90% | 50.94 million USD |

| Attrace | ATTR | June 21, 2018 | July 5, 2018 | Advertising | 500 million | 50% | 15.7 million USD |

| Terawatt | LED | June 21, 2018 | July 7, 2018 | Energy | 65,000 | 65% | 11.46 million USD |

| Phoneum | PHT | June 21, 2018 | July 21, 2018 | Cryptocurrency | 24.63 billion | 12% | 20 million USD |

*The ratio between public offering Token quantity and the total Token quantity of the project.

Main data sources: Icobench, Foundico, smith and crown, icodata, icodrops, coinschedule, icoadvert

Supporting data source: websites of the projects.

![Weekly Blockchain Industry Report [June 6 -15, 2018]](https://www.coinspeaker.com/wp-content/uploads/2017/11/blockchain-industry-report.jpg)