Taking strong interest in blockchain, cryptocurrencies, and IoT, Tatsiana Yablonskaya got deep understanding of the emerging techs believing in their potential to drive the future.

Apple Pay leads the market of contactless payments in the USA by the latest estimates.

CEO Tim Cook promoted the Apple Pay services at the conference this week. According to Cook, 3 million retail locations in the US now accept Apple Pay. This enables people to make purchases by simply waving the phone near certain point-of-sale registers – hence the term “contactless.”

Cook withheld the exact number of people using Apple Pay but revealed that the number of estimated monthly active users last month rose more than 450 percent year over year. Apple had said earlier that the service picks up a million new users each week and accounts for more than five times the transaction volume from a year ago.

Although Apple now struggles with the decrease in iPhone and iPad sales, the number of people using Apple Pay is growing both in the US and abroad. The company has taken on the payments market hoping to add ways to make its devices more appealing, and more revenue streams. The service is now available in nine countries – the US, the UK, Switzerland, Canada, Australia, China, France, Hong Kong and Singapore. Cook underlined that more than half of Apple Pay transactions are from non-US markets.

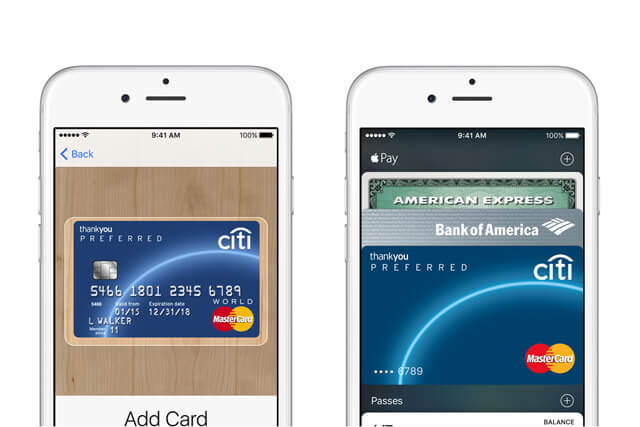

Apple launched Apple Pay in Switzerland only at the beginning of July, marking the second European launch after the United Kingdom. Users in Switzerland got a possibility to use Apple Pay by setting up their Visa and MasterCard bank cards in Apple Wallet. The service is available only for users of iPhone with integrated NFC chip – iPhone 6, iPhone 6s or iPhone SE.

iOS users in Switzerland can use Apple Pay through more than 100,000 contactless terminals all over the country. As for now, three banks – Bonus Card, CornerCard and SwissBankers – have signed up to support the service. To check if a bank card is eligible, you can just try to add the account in the Apple Pay app.

Apple had intensive negotiations with banks in some countries. Thus, banks in Canada and China opposed to the high transaction fees that Apple had stipulated.

Now, Apple has some challenges coming from Australia. Although the company forbids the installation of third-party mobile payment systems on its devices, three of the country’s largest banks insist on the right to install their own mobile payment apps on the iPhone.

Apple Pay was launched in 2014 as a service that lets people pay for goods with iPhone6 or Apple Watch. There are alternatives on the market of contactless payments for Android users as well. Samsung Pay and Google’s Android Pay also encourages people to facilitate the process of buying goods.