B2Broker Update Adds NDFs, Decreases Margin Requirements, and Enhances Liquidity Packages

B2Broker has announced the introduction of Non-Deliverable Forwards (NDFs), reduced margin requirements, and enhanced liquidity packages. This update is designed to further strengthen the company’s comprehensive asset coverage and risk management solutions, offering an even more attractive and diverse portfolio to its broad customer base.

NDFs Now Available

B2Broker has added NDFs to its already sizable selection of asset classes. NDFs are an excellent method for enterprises engaging in cross-border trading, especially those doing business in emerging regions where access to local currency forwards may be limited.

NDFs are a cost-effective way for businesses to manage currency risk by agreeing to swap the difference between a fixed rate and the current rate at a future date.

By structuring NDFs as Contracts for Difference (CFDs), B2Broker has changed the industry standard and sped up the settlement process from T+30 to T+1. The customary settlement durations associated with conventional NDFs will no longer be necessary, and settlement risks will be greatly mitigated thanks to this novel method.

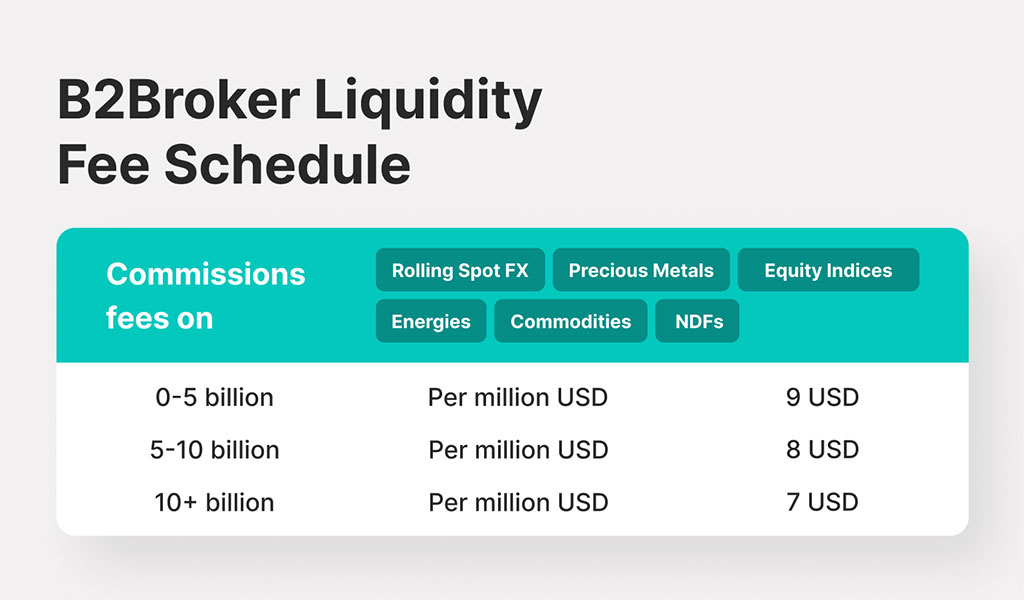

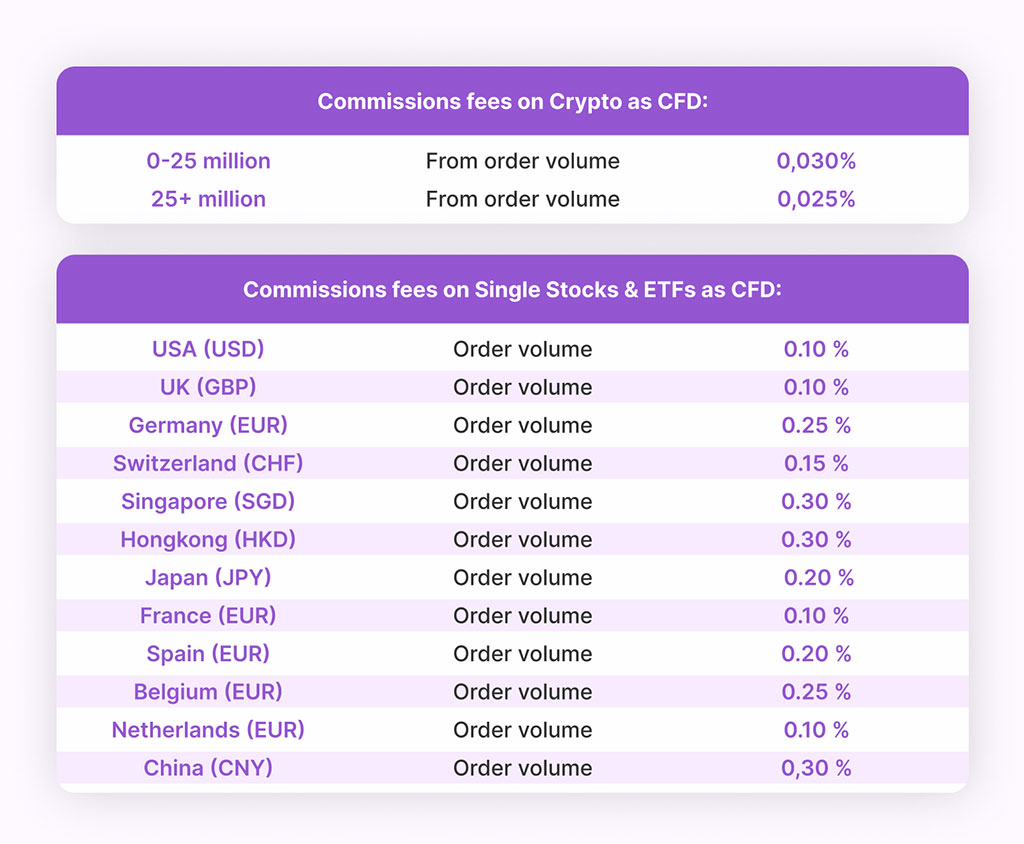

B2Broker, with some of the most competitive commission fees in the industry, is committed to serving a diverse set of clients, from individuals to institutions.

Broad NDF Currency Selection

B2Broker supports a wide range of NDF currencies, allowing clients to hedge currency risk in various emerging markets. The list of supported NDF currencies includes:

- USD/BRL

- USD/CLP

- USD/COP

- USD/IDR

- USD/INR

- USD/KRW

- USD/TWD

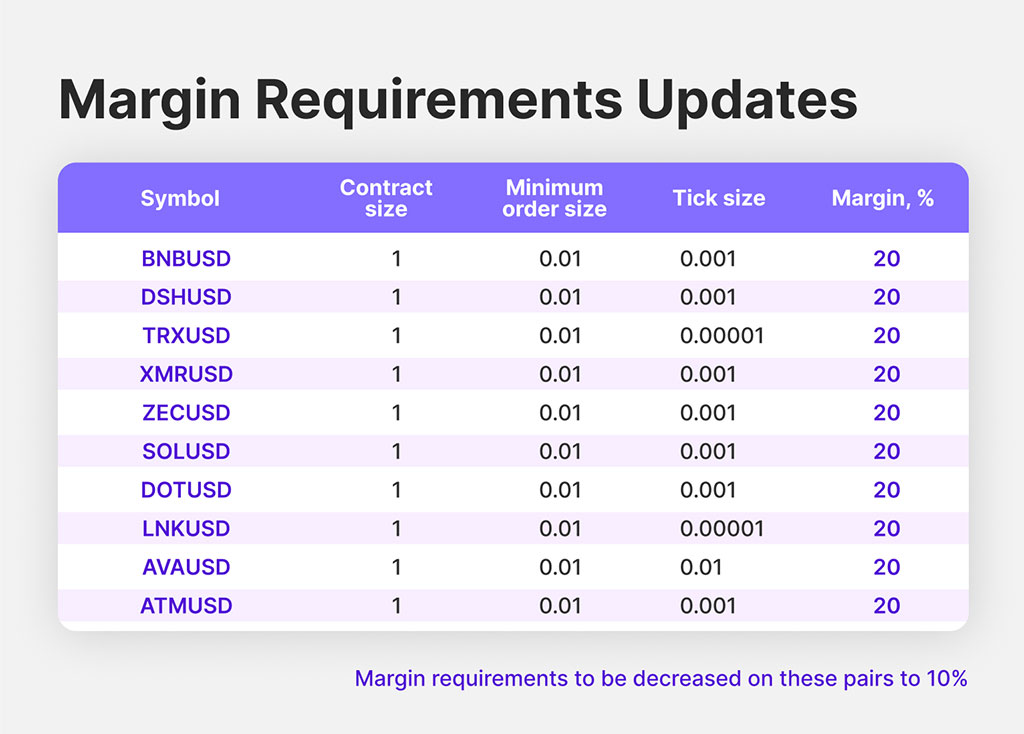

Margin Requirements Lowered

B2Broker has also lowered margin requirements on an additional ten cryptocurrency pairs to provide clients with increased leverage. The move will see a reduction from 20% to 10% on pairs including:

- BNB/USD

- DSH/USD

- TRX/USD

- XMR/USD

- ZEC/USD

- SOL/USD

- DOT/USD

- LNK/USD

- AVA/USD

- ATM/USD

Enhanced Liquidity Packages

B2Broker has also augmented its Prime of Prime (PoP) institutional liquidity packages, a testament to its commitment to continuous improvement and service excellence. Clients now can access Prime Margin Account connections with reputable platforms like OneZero, PrimeXM, and Centroid, ensuring accurate market execution and full transparency.

The setup of Prime Margin Accounts is offered free of charge, and clients can take advantage of 24/7 technical support.

Final Takeaway

With the introduction of NDFs, lowered margin requirements, and upgraded liquidity packages, B2Broker offers unparalleled liquidity solutions in all the major asset classes, including Rolling Spot FX & Precious Metals, Equity Indices, Energies, Commodities, Crypto, Derivatives/CFDs, Single Stocks/CFDs, ETFs, and NDFs.

This update again solidifies B2Broker’s position as a champion in the B2B financial services and packs it with an unmatched set of offerings for FX and crypto institutions.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.