The major crypto continues falling on Thursday, trading at around $5,768, says Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

While crypto traders and investors are worried about the current situation, technically, Bitcoin is going along its long term downtrend, with yesterday’s fall being a strong move after a long consolidation phase. Thus, the lower boundary breakout was quite natural. The immediate downtrend target is the midterm channel support at $5,180, after which a short term pullback may be expected. If the support gets broken out, the price may well reach the major support at as low as $2,840.

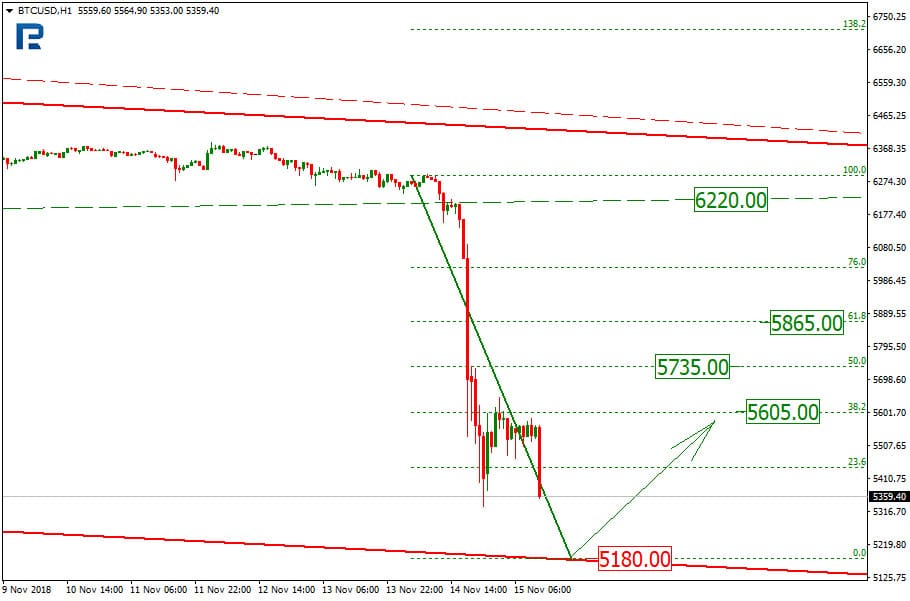

On H1, Bitcoin is trying to reach the support at $5,180. Once its hit, an ascending pullback will be likely to start forming, with the targets at 38.2% ($5,605), 50.0% ($5,735), and 61.8% ($5,865) Fibo. Reaching the major resistance at $6,220 is also possible.

The crypto market has worried much the investors lately, as the price sank very much down. The BTC market cap fell to $30B, while its price once reached $5,550, a new low this year. This happened just in a few hours, when the crypto lost as much as 12.50%. One reason for that is the Bitcoin Cash fork, where two new cryptos will be born. This made many market players move to BCH, which provoked a massive selloff over the entire crypto market. One the other hand, the market has been downtrending for long, so neither the selloff nor the panic is something someone should be surprised at.

There’s much talk in the market that, every time crypto protocols get changed or updated, the volatile prices are even more hard to predict. This time, it’s something absolutely new, as the BCH, being a hard fork itself, will now make two different coins, and nobody knows how the price is going to react.

As for Bitcoin, the number of BTC transactions has grown lately. Around 277,600 Bitcoin transactions are run daily, which is a multiple-month high after the hype in January. At the same time, it’s around two times lower than in November or December last year, when it was up to 500,000 per day.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Dmitriy Gurkovskiy is a senior analyst at RoboForex, an award-winning European online foreign exchange forex broker.