Bitcoin Wallets with at Least 1 BTC Fall as Digital Asset Eyes $100K Retest

Bitcoin may be consolidating near $102K, but under the surface, significant shifts in investor behavior are being witnessed. As per analyst Ali Martinez, wallets holding at least 1 BTC have declined by 5,000 over the past two months.

The number of wallets holding at least 1 #Bitcoin $BTC has dropped by 5,000 over the past two months! pic.twitter.com/SfjdjJxbyz

— Ali (@ali_charts) May 15, 2025

The decline is a sign that retail or smaller long-term holders might be taking profits or stepping back amid rising prices. Interestingly, this behavior aligns with broader on-chain trends.

Bitcoin’s LTH SOPR Soars

Bitcoin’s Long-Term Holder Spent Output Profit Ratio (SOPR) has surged from 1.3273 on March 12 to 2.27409 as of May 13, reflecting a 71.33% increase in realized profits.

On average, coins sold by LTHs have returned an impressive 227.41%, marking a strategic profit-taking phase. Historically, such SOPR peaks coincide with distribution phases, where seasoned holders secure gains prior to pullbacks.

Meanwhile, short-term holders (STHs) have re-entered profit territory since Bitcoin surpassed $99,000 on May 8.

Their SOPR has remained above 1, indicating sales are being made at a profit, but it hasn’t yet hit overheated levels (~1.03) that typically precede aggressive selloffs.

Bitcoin Forms Bull Flag: What’s Next?

As per the daily chart below, Bitcoin appears to be forming a bull flag on the daily chart. The flagpole began around $85K and peaked near $105K, giving a potential breakout target of $125K if confirmed.

The RSI remains elevated near 64, hovering just below overbought levels but not diverging, supporting the continuation case.

Meanwhile, the MACD remains in bullish territory with positive momentum, although a slight flattening of the histogram signals consolidation.

Bitcoin Bull Flag. Source: TradingView

However, traders should stay cautious in the short term. A breakdown from the bull flag could trigger a retest of the $99K–$100K support zone. If that level holds, it would likely reaffirm bullish sentiment.

But if broken, further downside could materialize quickly as LTHs continue locking in profits.

BTC Bull Taps Bitcoin’s Momentum, Secures Millions in Presale

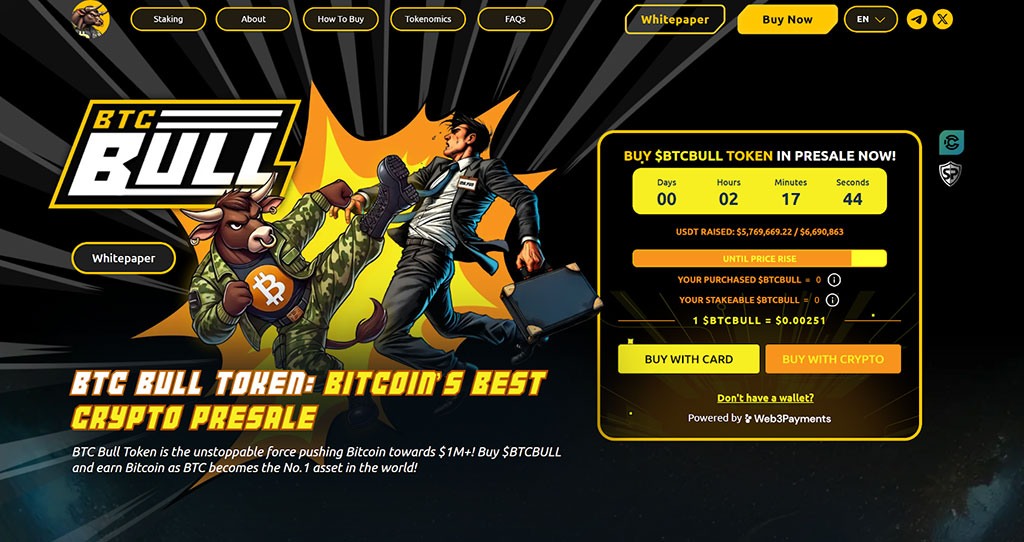

Capitalizing on the bullish momentum surrounding Bitcoin, BTC Bull ($BTCBULL) has raised a massive $5.76 million in its ongoing presale, suggesting substantial investor commitment.

As Bitcoin stampedes toward $250,000 and beyond, BTC Bull offers a unique opportunity to ride the momentum while earning BTC rewards.

Source: BTC Bull Token

By holding $BTCBULL, investors receive regular BTC airdrops tied to Bitcoin’s price growth, with a major airdrop planned when BTC hits $250K.

The token’s deflationary model further increases its value, with either a portion of the supply being burned or BTC airdropped every time BTC rises by another $25,000.

Simply visit the official BTC Bull website and connect a supported wallet like the Best Wallet to purchase BTCBULL at the current price of $0.00251, with 2 hours, 17 minutes until the next price increase.

Swap crypto or use a credit or debit card to complete the transaction.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.