With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.

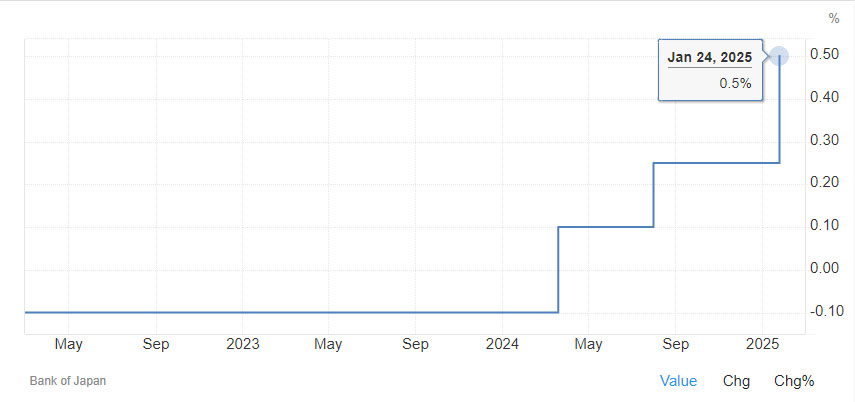

For the first time in 17 years, the Bank of Japan (BoJ) raised interest rates to 0.5%, a significant leap from its previous levels.

Edited by Julia Sakovich

Updated

3 mins read

Edited by Julia Sakovich

Updated

3 mins read

For the first time in 17 years, the Bank of Japan (BoJ) raised interest rates to 0.5%, a significant leap from its previous levels. This 25-basis point hike, aligned with market expectations, underscores a shift not seen since the 2008 financial crisis. Market anticipation aligned with the decision, as Bitcoin BTC $116 748 24h volatility: 4.6% Market cap: $2.32 T Vol. 24h: $70.83 B and major altcoins such as Ethereum ETH $2 974 24h volatility: 1.7% Market cap: $358.77 B Vol. 24h: $38.79 B recorded 3-6% gains.

Source: Trading Economics

Meanwhile, the US Dollar Index (DXY) declined, creating favorable conditions for potential bullish movements in cryptocurrency. During early Asian trading hours, the Japanese Yen gained strength against the dollar, signaling a period of heightened market activity.

Japan’s inflation data bolstered BoJ’s decision to hike rates. The Consumer Price Index (CPI) climbed to 3.6%, exceeding market expectations of 3.4% and sharply up from a prior 2.9%. These figures highlight mounting inflationary pressures in the Japanese economy.

This rate hike arrives against the backdrop of last year’s turbulence when a similar move by BoJ sent shockwaves through global markets. At that time, fears of the yen-carrying trade unwinding caused Bitcoin and altcoins to nosedive. However, today’s reaction is notably calmer, with major cryptocurrencies holding their ground.

Currently trading at $105,108, Bitcoin gained 3.30%, with trading volumes surging by 57% in the last 24 hours. Despite this growth, the cryptocurrency remains confined within a narrow range of $105,200 to $105,000. A breakout above $106,000 could pave the way for new highs of $110,000 or beyond.

At the same time, Ethereum surged by 6% to $3,394, while other altcoins like Solana, Cardano, Tron, and Chainlink posted comparable gains of around 4%. Unlike the panic seen in 2022, altcoins are showcasing resilience, hinting at renewed optimism in the crypto market.

A crucial element in Bitcoin’s outlook is its inverse correlation with the US Dollar Index. Should this relationship persist, analysts are optimistic about a potential “golden time” for Bitcoin.

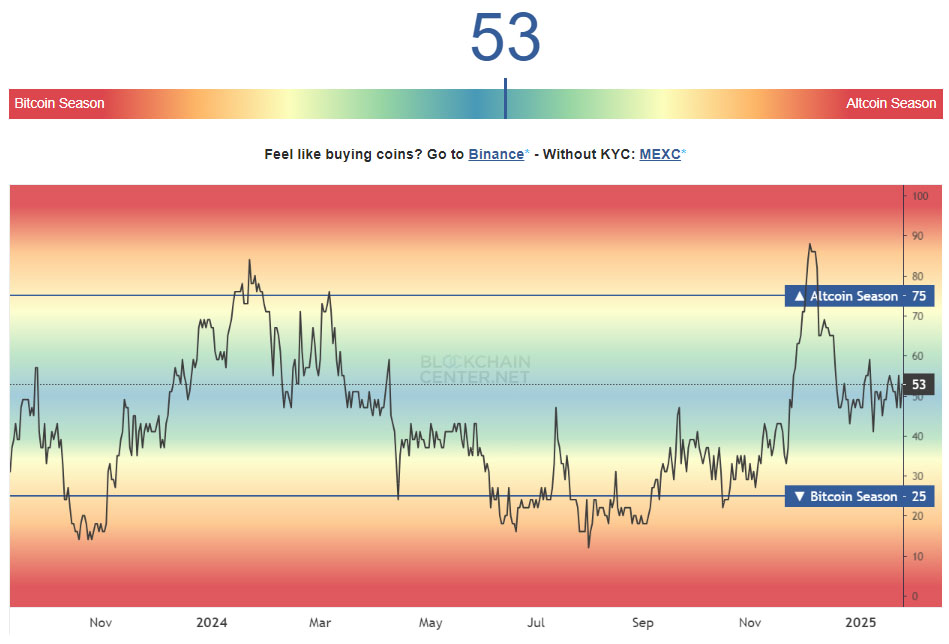

Source: Blockchain Center

In parallel, the Altseason Index has risen above 53, signaling growing confidence among investors. Renewed interest in digital assets, spurred in part by Donald Trump’s push for building a digital asset stockpile, could further propel altcoins into the spotlight.

Source: AlternativeBull

Crypto analysts are optimistic as altcoin markets appear primed for a massive rally. Historical trends suggest the possibility of a 500% surge, igniting hopes of reaching a $6.48 trillion market cap. With altcoin season reportedly on the horizon, investors are bracing for an explosion of parabolic growth patterns.

“If history repeats itself, a 500% pump will happens soon. Altcoin season is about to start and will send Altcoins yo the moon,” an analyst wrote.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.