By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

- ETH/USD tech analysis

- Ethereum 2.0 is being developed actively but the date of the launch is yet unknown

- ECC will issue a token for the ETH blockchain

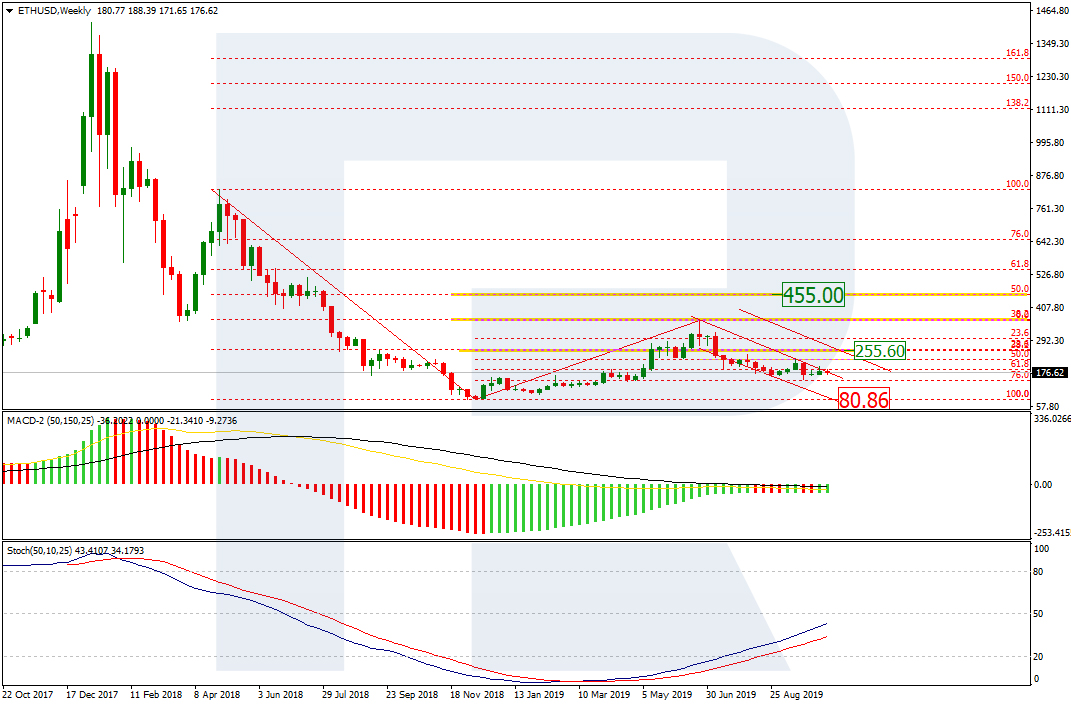

On W1, the Ethereum demonstrates a new impulse of decline in the long-term trend. The aim of that impulse in the short term might be this year minimum of $80.86, reached, however, only after a pullback. Further decline of the quotations is confirmed by the descending of the MACD lines. At the same time, the Stochastic lines are still heading upwards, which signifies that the fight between the bulls and bears is going on.

Photo: Roboforex / TradingView

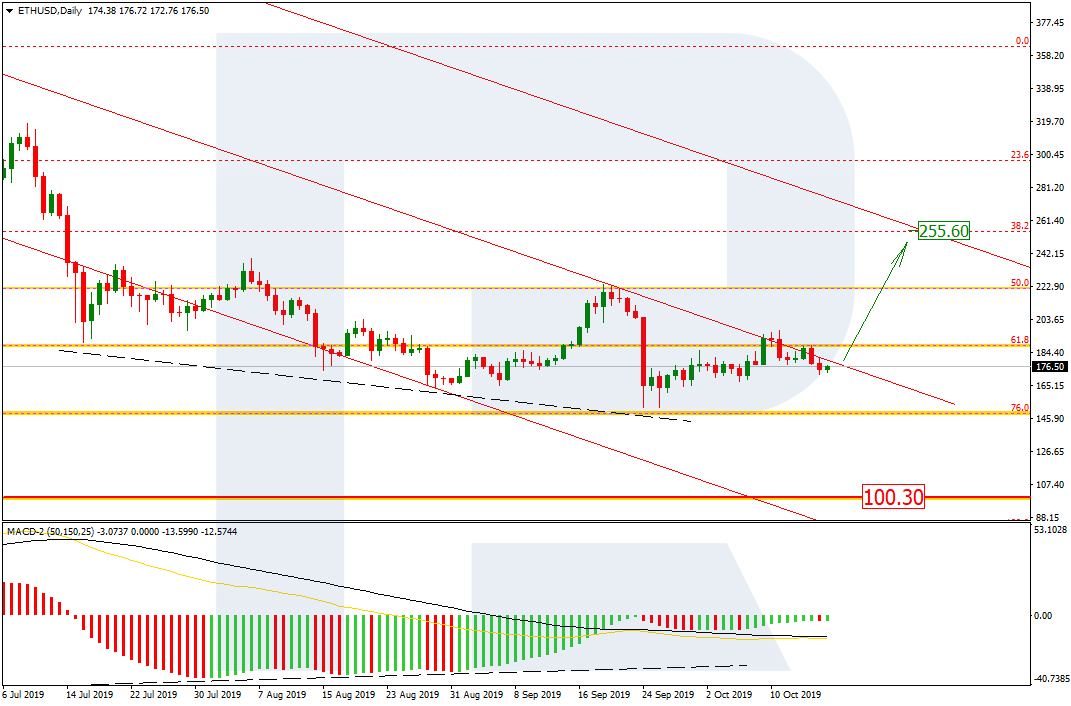

On D1, the ETH/USD is testing the resistance line of the current channel after a divergence on the MACD. In such a situation, both a breakaway of the resistance line and a bounce off it should be considered possible. In the case of a breakaway, the quotations may rise to the projection resistance level of $255.60. And in the case of a bounce, the trend may keep developing to the psychologically important level of $100.03.

Photo: Roboforex / TradingView

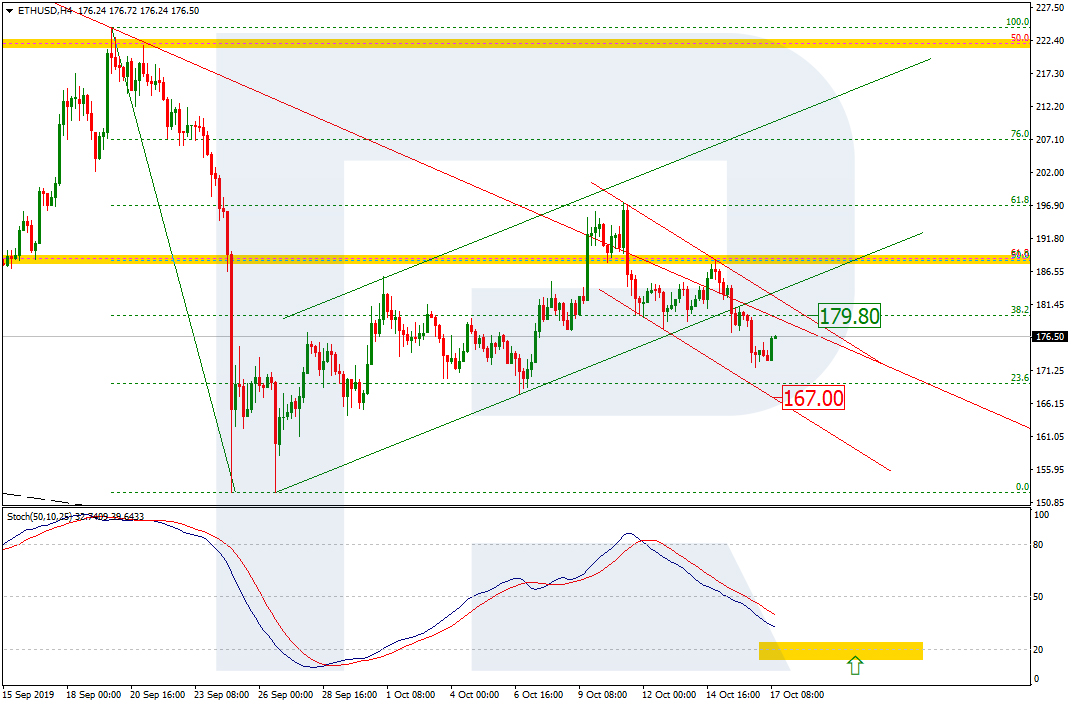

On H4, we can see a descending channel followed by a decline on the Stochastic. The local goal of the decline is on the support line at $167.00. Upon reaching the oversold area and forming the Gold Cross, a new impulse of growth may be expected. As an additional signal of growth, we may consider a breakaway of the resistance line of $179.80.

Photo: Roboforex / TradingView

On the verge of the appearance of the Ethereum 2.0 Vitalik Buterin has told that there are certain difficulties in the process of its development but the work is going on pretty actively. In his speech on Devcon V in Osaka, Japan, Buterin shared some details of the works but said nothing in particular.

The exact date of the launch has not been revealed neither by Buterin nor by other representatives of the company. On Devcon V it was mentioned that the launch might be scheduled for 2020, but this is just a guess. On the whole, investors share quite positive expectations of Ethereum 2.0: as cryptocurrency market players say, the work is aimed at the creation of an infrastructure that will later be used for the extension of the range of operations involving commercial and public blockchains.

However, while some are still developing new products, others introduce new solutions to real life. The Electric Coin Company (ECC) is planning to issue a token for the Ethereum blockchain. It will go under the ticker ZEC. The ECC is the creator of the cryptocurrency ZCash, and such an integration is purposeful. By this, the parties are trying to attract new investors, demonstrating maximal decentralization of the instrument.

The new coin may be used in the process of work with automatized loans or with financial products that feature more privacy. This might seem very appealing to the market.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Dmitriy Gurkovskiy is a senior analyst at RoboForex, an award-winning European online foreign exchange forex broker.