Fidelity’s Bitcoin ETF (FBTC) has set a new record by attracting an astounding $405 million in a single day.

Surging Interest amidst Market Optimism

As Bitcoin edges closer to its all-time high, the surge in ETF inflows is a clear indicator of the positive sentiment engulfing the market. FBTC witnessed the most substantial net inflow day since its inception, bringing its total net inflow to an impressive $5.2 billion and holding 107,905 Bitcoin.

A Competitive Landscape

The entire ETF sector is experiencing a wave of activity, reflecting a broader market trend of significant institutional interest. On the same note, BlackRock’s IBIT also saw a notable increase, with an additional inflow of $420 million, raising their total net flow to a staggering $8.4 billion and holding 170,838 Bitcoin. Bitwise’s BITB wasn’t left behind, reporting a significant net inflow of approximately $91 million, marking their third-highest net inflow day.

Photo: SoSo Value

Contrastingly, GBTC faced a considerable day of outflows totaling $368 million. However, it’s worth noting that the outflows from the last three trading days have started to diminish, suggesting a potential shift in investor sentiment or strategic reallocations within the market. But GBTC’s total outflows remain significant at $9.3 billion, according to BitMEX. Other ETF issuers that experienced outflows included Invesco’s BTCO, which saw a $26 million outflow; VanEck’s HODL, which faced a $6 million outflow; and WisdomTree’s BTCW, which had a $3.2 million outflow, indicating consecutive losses.

[1/4] Bitcoin ETF Flow – 04 March 2024

All data in. Very strong day with +$562m net flow. Fidelity very strong with a record day

Not the best day for diversity, with smaller players BTCO, HODL & BTCW all having outflows pic.twitter.com/drCrg6EzsN

— BitMEX Research (@BitMEXResearch) March 5, 2024

A Clear Sign of Institutional Confidence

The influx of investments into Bitcoin ETFs, culminating in a total of $563 million on March 4, equivalent to roughly 8,338 Bitcoins, signifies a robust institutional endorsement of cryptocurrency. With Bitcoin ETFs accumulating a total of $7.9 billion, equivalent to 152,630 BTC, the landscape is set for further growth and innovation.

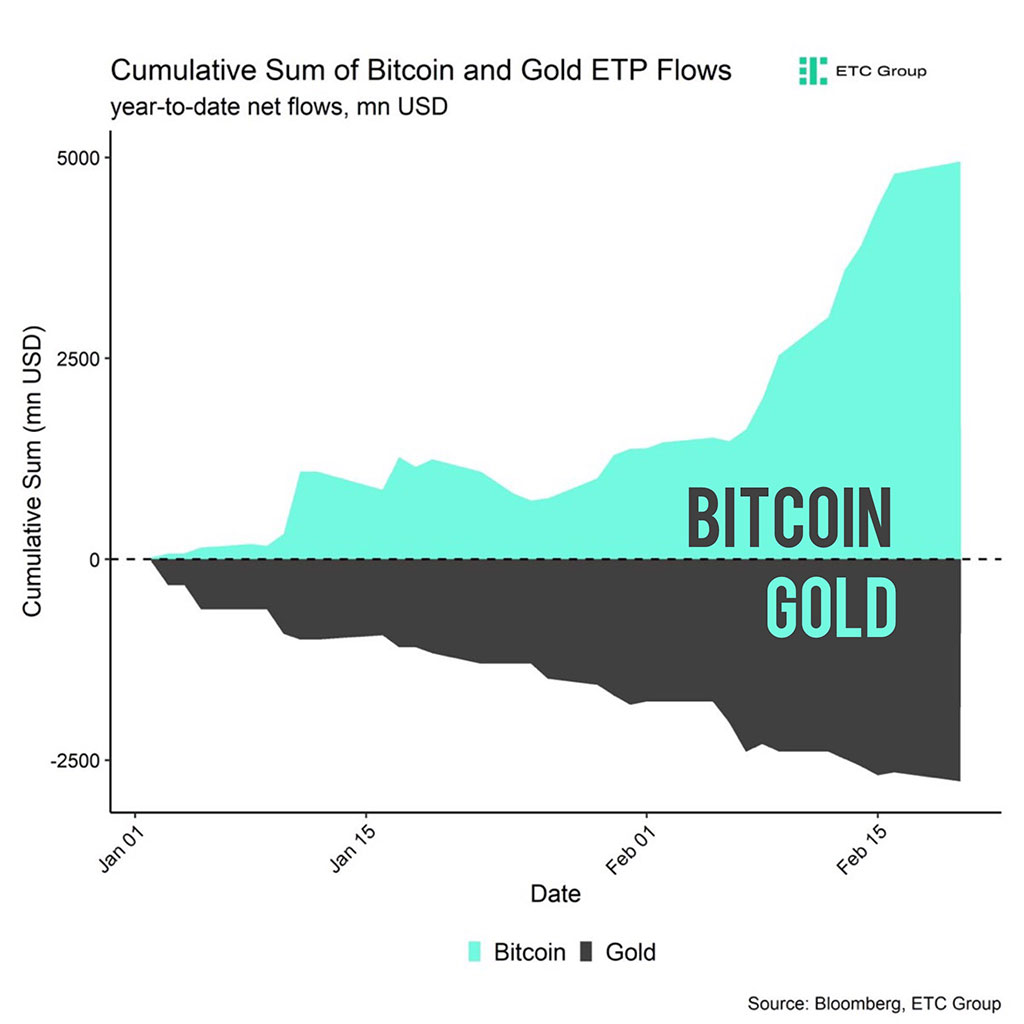

Since their introduction two months ago, spot Bitcoin ETFs have experienced net inflows amounting to $7.5 billion in BTC, even amidst outflows exceeding $9 billion. BlackRock’s IBIT has swiftly amassed $10 billion in assets under management, a milestone that took gold ETFs almost two years to achieve.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.