LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

Best New Cryptocurrencies in 2026 – Recently Launched Coins & Investment Watchlist

35 mins

35 mins Based on our research, Bitcoin Hyper is the top new cryptocurrency to invest in February 2026, still a speculative call.

Other top picks from over 75 new coins surveyed include Maxi Doge, a meme coin designed to go viral with the gym-and-leverage crowd, and BMIC, a burgeoning wallet ecosystem that aims to protect digital assets from upcoming threats.

This guide tracks and reviews the best new crypto coins in 2026, using our methodology to evaluate momentum, tokenomics, builder activity, and community data.

Upcoming New Crypto Launches to Watch

These upcoming cryptocurrency releases offer early investors the opportunity to purchase new crypto coins while they are in presale before they list on major exchanges.

- First Bitcoin Layer 2 enabling fast, low-cost transactions

- Fixes Bitcoin’s speed and fee limitations with near real-time performance

- Enables a Bitcoin-native DeFi ecosystem

- Degen meme coin inspired by max-leverage trading

- A tribute to high-risk hustle — fueled by sweat and conviction

- Ethereum-born, culture-driven, aiming for multichain

- Quantum-resistant security infrastructure for wallets and enterprise use

- Uses deflationary tokenonomics, including burns, tied to quantum workload execution

- Staking and governance participation expand token utility

- Shared liquidity spanning Bitcoin, Ethereum, and Solana

- Improved trade execution through faster speeds and secure cross-chain capital movement

- Opens up greater cross-ecosystem connectivity for builders and developers

- AI-Powered Virtual Influencers

- 20% APY Staking Rewards

- VIP perks: livestreams, BTS content, credits, and more.

- High-performance broker for pros and newcomers alike

- Rebates and buybacks come from VFX's own market activity

- 10% bonus on sign up and early staking access

Newly Launched Crypto Coins – February 2026

The table below lists some of the most recently-launched crypto coins in February 2026, with information including listing status, launch date and the blockchain they are built on.

| Coin Name | Launch/Listing Date | Status | Blockchain | First Exchange (Confirmed) |

|---|---|---|---|---|

| Openverse Network (BTG) | Jan 2, 2026 | Listed | Layer 0 | Gate.io (BTG/USDT) |

| HODL (HODL) | Jan 2, 2026 | Listed | Binance Smart Chain | MEXC |

| CodexField (CODEX) | Jan 2, 2026 | Listed | Binance Smart Chain | Gate.io |

| Depinsim (ESIM) | Jan 5, 2026 | Listed | Binance Smart Chain | Binance Alpha, KuCoin, MEXC, Bitget, SuperEx |

| Brevis (BREV) | Jan 6, 2026 | Listed | Ethereum | Binance Alpha |

| Juris Protocol (JURIS) | Jan 8, 2026 | Listed | Terra Classic | AscendEX |

| CatWifMask (MASK) | Jan 8, 2026 | Listed | Solana | GroveX Exchange |

| Score11 (SCR) | Jan 23, 2026 | Listed | Binance Smart Chain | Coinstore |

| Verified Emeralds (VEREM) | Jan 26, 2026 | Listed | Binance Smart Chain | Biconomy.com |

| Sanity United (SUT) | Jan 27, 2026 | Listed | Ethereum | BitMart |

Key Takeaways for New Crypto Coins

- Bitcoin Hyper (HYPER) builds a Bitcoin Layer 2 with Solana speed, with over 1.3B tokens staked in presale.

- Maxi Doge (MAXI) targets high-leverage traders and gym culture with 25% supply for exchange deals.

- BMIC (BMIC) is addressing a real vulnerability that most wallets have not even thought about yet.

- Buying early means lower prices and potential 10x-100x gains as new projects build real products and attract wider adoption.

- When choosing crypto, prioritize projects with working products, new projects remain highly speculative despite bull market conditions.

Upcoming Crypto Coins – Reviews and Analysis

After analyzing multiple upcoming projects, we selected the top presales and in-progress crypto worthy of consideration.

WARNING: Cryptocurrency presales involve a high level of risk and may result in the loss of your entire investment. Projects reviewed in this section may be in early development stages, with limited operating history and unproven teams or technology. Nothing on this site constitutes financial, investment, or legal advice. Always conduct your own research and consult a qualified financial professional before participating in any crypto presale.

1. Bitcoin Hyper (HYPER) – Bitcoin Layer 2 with Solana-Grade Speed

Bitcoin Hyper is a new Layer 2 network for Bitcoin, built using the Solana Virtual Machine (SVM). Its main goal is to transform Bitcoin from just a transfer mechanism into a platform that can handle fast transactions, run smart contracts, and host decentralized apps. The HYPER token is serving as the staking power offering 40% APY, securing the network, and rewarding validators. It also allows developers to build and run applications within the SVM, effectively connecting Bitcoin’s vast liquidity to exciting, programmable new uses.

Our View (Otar): The $31.41M raised shows demand, but there’s no testnet, no public code, and anonymous developers. The 40% staking APY is unsustainable, and with fierce Bitcoin Layer 2 competitors already out there, I believe, this is speculation on promises until they ship actual working infrastructure.

Bitcoin Hyper tokenomics focuses on the treasury (25%) and marketing (20%). Source: Bitcoin Hyper

Key Points on Bitcoin Hyper:

- Why It Stands Out: BTCFi TVL hit $6.2B, while 99% of Bitcoin’s $1.7T remains unused in DeFi.

- Target Audience: Bitcoin enthusiasts seeking DeFi access inside the BTC ecosystem, and investors focused on generating staking returns.

- Risks & Considerations: Faces 80+ Bitcoin Layer 2 competitors; lacks a public testnet; audits don’t cover infrastructure.

| Chain | Solana / Ethereum |

| Category | Layer 2 / DeFi / Meme |

| Utility | Staking / DeFi Access |

| Community | Over 22K followers on X and Telegram |

| Price | $0.01367550 |

| Next Increase | Loading...

|

2. Maxi Doge (MAXI) – Meme Coin for High-Leverage Traders

Maxi Doge combines Doge meme aesthetic with gym and trading culture. The MAXI token powers the project’s ecosystem. It gives access to the Maxi Doge Alpha Group, a community where retail traders share high-risk, high-reward “degen” strategies.

MAXI is also used for staking with 72% APY, funding community contests, and supporting initiatives linked to exchange collaborations. A specific portion of the supply goes into the MAXI Fund, which is explicitly dedicated to securing major partnerships with futures platforms and exchange integrations.

Our View (Otar): It’s a meme coin banking on gym bros who trade 1000x leverage. This is a niche audience at best. The 25% allocation for “futures platform partnerships” is vague, and there’s no confirmation that these deals exist. The staking rewards look attractive, but meme coins live and die by hype cycles, and this one’s trying to merge two very volatile communities.

Maxi Doge’s tokenomics are mainly focused on marketing (40%). Source: Maxi Doge

Key Points on Maxi Doge:

- Why It Stands Out: Dog-themed meme coins command $30B+ market cap; targets a high-leverage trading niche.

- Target Audience: Degens, high-risk traders, and bodybuilding enthusiasts seeking extreme narratives.

- Risks & Considerations: 25% of supply depends on unconfirmed futures platform deals; the leverage theme could face regulatory pushback.

| Chain | Ethereum |

| Category | Meme / Extreme Trading Culture |

| Utility | Staking / Community Contests / Platform Access |

| Community | Around 8K followers on X and Telegram |

| Price | $0.00028030 |

| Next Increase | Loading...

|

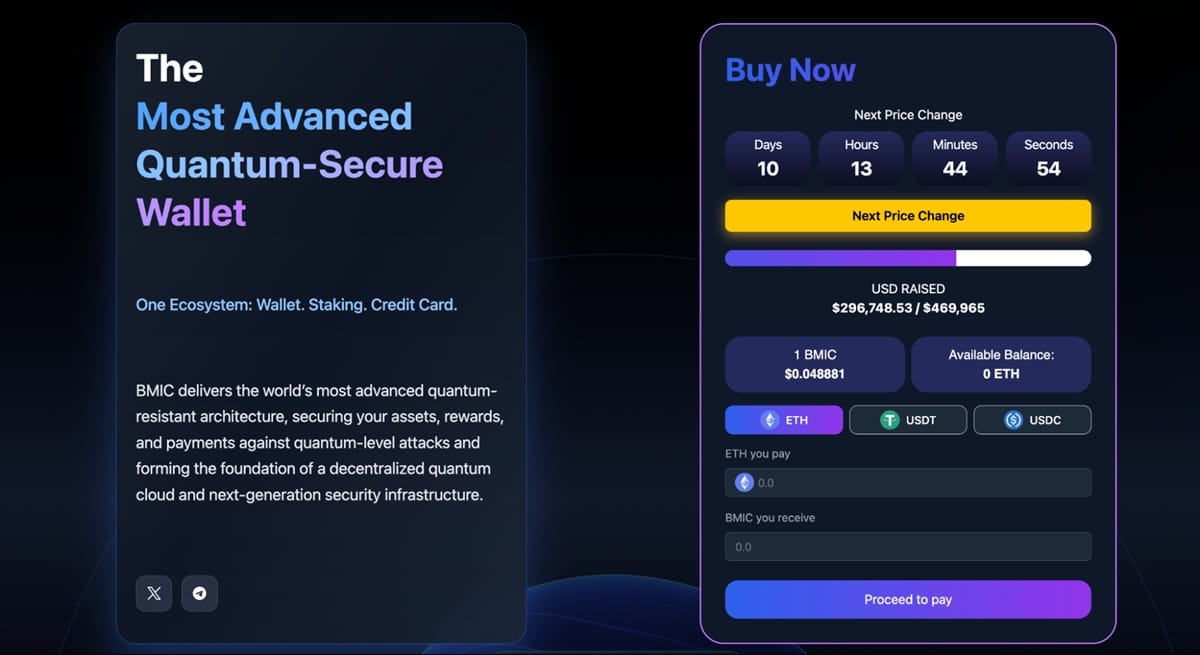

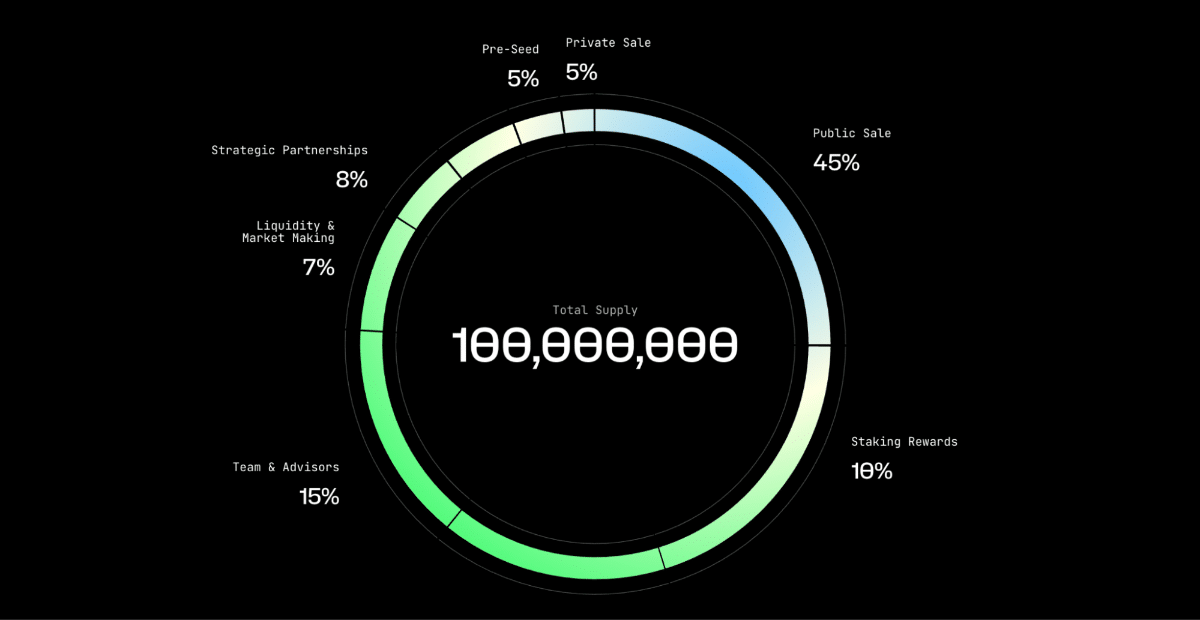

3. BMIC (BMIC) – A New Wallet Ecosystem Quantum-Proofing Digital Assets

BMIC’s mission statement is to build a crypto wallet ecosystem to mitigate the realistic risk that quantum computers currently pose. The project says that it uses “NIST-approved” algorithms and a signature-hiding architecture to safeguard digital assets against potential quantum threats.

BMIC, a new Web3 wallet ecosystem that claims to address the huge threat posed by quantum computing. Source: BMIC

The BMIC token can facilitate wallet access, provide staking rewards, and enable governance. Looking ahead, the team intends to develop enterprise APIs and a decentralized compute network that links leading quantum providers.

Our View (Otar): The quantum security aspect is conceptually solid, but BMIC is still in its early stages. The wallet’s alpha release isn’t slated until 2026, and the presale has raised about $300,000 to date. The project’s roadmap is quite ambitious, extending to 2028 with plans for mainnet and enterprise deployments. But until the actual infrastructure is operational, investing right now is essentially a bet on the team’s ability to deliver.

Key Points on BMIC:

- Why It Stands Out: Targets a real vulnerability that most wallets have not addressed yet.

- Target Audience: Those who prioritize security and are preparing for a future with sophisticated quantum computing.

- Risks & Considerations: No official product has been developed yet, as the roadmap extends until 2028.

| Chain | Ethereum |

| Category | Security |

| Utility | Staking/Compute Access |

| Community | Over 7,000 followers on X and Telegram |

| Price | $0.048881 |

4. LiquidChain (LIQUID) – Layer 3 Unifying Bitcoin, Ethereum, and Solana Liquidity

LiquidChain is a Layer 3 blockchain made to unify liquidity across Bitcoin, Ethereum, and Solana without using wrapped tokens or traditional bridges. The protocol verifies states from all three chains directly through cross-chain proofs, allowing users to swap, lend, and interact with DeFi across networks from a single interface.

LiquidChain’s tokenomics allocate 35% to development and 32.5% to marketing. Source: LiquidChain

The LIQUID token powers transaction fees, staking rewards, offering over 4100% APY during presale, and governance. The platform aims to solve fragmented liquidity by creating unified pools accessible to developers building cross-chain applications.

Our View (Otar): The unified liquidity concept addresses a real problem, but it’s too early without a mainnet. The high staking APY is obviously unsustainable and exists purely to promote early adoption. Cross-chain infrastructure is technically complex, and LiquidChain faces established competitors.

Key Points on LiquidChain:

- Why It Stands Out: Layer 3 approach to multi-chain liquidity without wrapped tokens; uses Solana-speed execution environment.

- Target Audience: Multi-chain traders and developers seeking unified access to Bitcoin, Ethereum, and Solana liquidity.

- Risks & Considerations: Very early stage with minimal funding; no live mainnet; technical complexity of coordinating three blockchains; unsustainable staking rewards.

| Chain | Ethereum (Layer 3) |

| Category | Layer 3 / Cross-Chain Infrastructure |

| Utility | Transaction Fees / Staking / Governance |

| Community | Almost 8K social media following |

| Price | $0.01265 |

5. Remittix (RTX) – PayFi Protocol Bridging Crypto to Global Banking

Remittix is creating a crypto-to-fiat payment network that will process digital asset conversion into bank deposits. The platform claims it will reduce fees to 1%, a big undercut compared to the 5-10% charged by traditional services. But this core system isn’t fully live yet.

Currently, they’ve launched a beta wallet app on the App Store for basic crypto transfers and storage. The native RTX token powers transaction fees, staking rewards, and governance once the main system becomes operational. Major exchanges like BitMart and LBank have already confirmed listings, even though the exact launch dates remain unannounced.

Our View (Otar): The funds raised ($28M+) obviously show investor interest, and the wallet beta proves the team can ship something. But it is hard to say anything in advance, before the core payment functionality is live. With 50% of supply going to presale buyers who face zero vesting, I expect heavy selling pressure at launch.

Remittix’s tokenomics focus heavily on presale (50%) and marketing (15%). Source: Remittix

Key Points on Remittix:

- Why It Stands Out: Beta wallet is live on Apple App Store; targets the $630B remittance market if full platform launches successfully.

- Target Audience: Users seeking cheaper cross-border payments, but full functionality isn’t available yet.

- Risks & Considerations: Core payment features unproven; no confirmed banking partners; competes with established players like XRP and Stellar; 91% token liquidity at launch creates significant dump risk.

| Chain | Ethereum |

| Category | PayFi / Cross-Border Payments |

| Utility | Transaction Fees / Staking / Governance |

| Community | 30K+ community members across X and Telegram, 2 CEX listings confirmed |

| Price | $0.119 |

6. SUBBD (SUBBD) – Web3 Token for the Creator Economy

SUBBD is a Web3 platform for direct creator monetization. It combines Social-Fi mechanics with AI tools like voice cloning, image generation, and automated scheduling. Payments run peer-to-peer with lower fees than traditional platforms.

The SUBBD token handles transactions, rewards engagement, and enables fan participation. Staking offers 20% APY. The platform claims to support 2,000+ creators with 250M combined followers.

Our View (Otar): Getting creators to leave established platforms for a Web3 alternative is a tough task. Usually, they need consistent income, not token speculation. The 2,000 creators claim sounds impressive, but there’s no verification of actual revenue or engagement. AI influencer tools are trendy now, but regulatory crackdowns on AI-generated content could kill the model.

With SUBBD anyone can create and customize his own AI influencer to earn. Source: SUBBD

Key Points on SUBBD:

- Why It Stands Out: Social-Fi platform merging AI content tools with tokenized creator-fan interactions.

- Target Audience: Web3 creators and fans seeking low-fee, reward-based engagement models.

- Risks & Considerations: Competes with established platforms; AI content may face regulatory scrutiny.

| Chain | Ethereum |

| Category | Web3 Creator Economy / Tool |

| Utility | Staking / Access / Rewards |

| Community | 46K+ followers on social media |

| Price | $0.05747500 |

| Next Increase | Loading...

|

7. Vortex FX (VFX) – AI-Powered Forex Trading on Solana

Vortex FX is a licensed forex broker that aims to create a bridge between traditional forex trading and decentralized finance (DeFi). In the whitepaper, the project has stated its goal of redistributing revenue generated by AI-powered automated trading

directly to VFX token holders. The platform also plans to launch crypto debit cards and staking rewards. According to the team, half of the roughly $150,000 in monthly rebate income will flow back to holders through staking rewards and buybacks.

Our View (Otar): We believe that backing yield with tangible broker revenue sets Vortex FX apart in a landscape typically crowded with inflationary tokens. Also, the promised annual yield of up to 67% is quite ambitious. That said, as is the case with any automated trading bot, the historical performance shown on their website doesn’t really offer an assurance about what lies ahead.

45% tokens are set aside for the public sale, and 15% for the team. Source: Vortex FX

Key Points on Vortex FX:

- Why It Stands Out: Claims to generate yield from actual broker fees and volume

- Target Audience: Forex traders and DeFi investors looking for passive yet automated trading strategies.

- Risks & Considerations: High APY sustainability; regulatory complexity of Forex; reliance on the AI’s long-term performance.

| Chain | Solana |

| Category | Forex, Trading, RWA |

| Utility | Staking, fee rebates, buybacks, platform access |

| Community | X (500), Telegram (700) |

| Price | $0.11 |

February 2026 Market Overview: Key Trends Driving New Crypto Coins

The crypto market in February 2026 shows careful optimism while Layer 2 and DeFi grow fast. With Bitcoin around $67,149.73 after decreasing from its October peak, new crypto coins are launching into a market balancing recent volatility with long-term potential. Below, we break down the key trends that shape this month’s market.

Investor Sentiment and Institutional Adoption

Bitcoin trading at around $67,149.73 has renewed inflows across digital assets. Exchange-held supplies remain tight, supporting a bullish outlook. Institutional activity adds credibility: new spot Bitcoin and Ethereum ETFs are live, while senior executives, such as the former Commerzbank CEO joining DeFi Technologies, signal growing mainstream engagement.

Presales Evolving Into Structured Investments

Presales are no longer treated purely as speculative bets. Research from Bitget and CoinCentral shows that investors increasingly see them as strategic early-stage allocations, with defined entry costs and incentives. This maturity strengthens the pipeline for credible new crypto coins in 2026.

Layer 2 Scaling and DeFi Expansion

Ethereum L2s like Arbitrum and Optimism now handle a large share of DeFi activity, while ZK rollups commonly reach 70+ TPS, several times Ethereum’s base layer. On Bitcoin, native scaling experiments such as Babylon are gathering momentum, and on Ethereum, restaking frameworks like EigenLayer and broader modular designs are drawing in builders and liquidity, reinforcing the cross-ecosystem push toward cheaper, faster on-chain execution.

Long-Term Market Growth Outlook

The structural case for new crypto remains strong. Precedence Research projects the DeFi market will grow from $32B in 2025 to $1.5T by 2034, a ~54% CAGR. This forecast underscores long-term demand for emerging protocols, tokens, and scaling solutions.

What Users Say

Aggregated discussion from Reddit and X over the past 60 days revealed mixed sentiment on new launches. Traders praise strong fundamentals but worry about token unlocks and whether platform success actually benefits token holders.

- Discussions about Ethena center on the gap between protocol strength and token performance. While USDe became the third-largest stablecoin, the token is down over 80% from its all-time high, with whale holdings dropping $28 million worth, and concerns about transparency around recent withdrawals.

- Users praise Drift Protocol for fast execution and safety features during volatile markets, but question why $23M in protocol revenue hasn’t translated to token value. DRIFT is down 82% yearly, with circulating supply expected to triple by May 2027.

- The $314M token unlock generates intense debate around Hyperliquid, with community members urging transparency while others argue the team earned their tokens. Despite concerns, supporters point to $3 trillion in trading volume and $800M revenue as proof of adoption.

- Aster community discussions focus on DefiLlama’s October delisting over suspected wash trading. Just six wallets control most of the supply, and this raises manipulation concerns. Despite CZ’s endorsement and explosive early gains, skeptics question whether growth is genuine or caused by coordinated buybacks and paid promotions.

The project’s trajectory is often guided by the community’s sentiment, but it doesn’t guarantee outcomes. Token performance ultimately depends on utility, market conditions, regulatory developments, and other factors.

How to Evaluate New Crypto Coins

Several foundational factors can help you make a more measured decision when assessing newly launched or upcoming crypto projects.

- Clear documentation, public team information, and well-defined tokenomics can indicate how openly a project operates.

- The audit status of smart contracts may help identify technical risks, although audits do not guarantee security.

- Reviewing token unlock and vesting schedules is also essential, as large future unlocks can impact supply and price dynamics.

- Finally, understanding liquidity availability, including where and how tokens can be traded, can provide insight into potential volatility and exit risks.

How We Picked the Best New Crypto Projects to Watch – Our Methodology

We score every candidate across seven factors. Each project gets a 0–5 score per factor; we multiply by the weight and sum to a 100-point composite. Only projects with a total score ≥ 70 make our “watch” list.

This guide uses a condensed, article-specific 7-factor scorecard that maps to Coinspeaker’s broader framework. For the full, site-wide methodology and policies, see Coinspeaker Methodology: How We Rank Crypto Assets.

Clear & Verifiable Use Case (20%)

We confirm that the problem and solution are real, testable, and not just slides. Evidence we look for: public demos, beta/testnet, code, or credible partner integrations.

For example, Bitcoin Hyper positions itself as a Bitcoin L2 using Solana’s Virtual Machine to target theoretical 65,000+ TPS; this claim is sourced to project materials and coverage and should be treated as project-reported / unaudited until mainnet benchmarks land.

Tokenomics & Supply Design (20%)

We review max supply/caps, emissions, unlocks, circulating share at listing, treasury/market-making budgets, and staking mechanics. Outsized future unlocks are a risk; balanced allocations signal runway.

Roadmap Delivery & Disclosure (15%)

We check what’s shipped versus promised, update cadence on public channels, and whether delays are acknowledged with revised ETAs and artifacts (test releases, audits, docs). Consistently missing milestones without disclosure is a red flag.

Exchange Access & Liquidity (15%)

Listing venue and tradable depth determine execution risk. We compare CEX vs DEX exposure and 24h volumes. As of October 22, 2025, Binance’s reported spot volume is approximately $28 billion, according to CoinMarketCap, compared to Raydium’s approximately $62 million, a stark liquidity gap. Binance also reports over 275 million registered users (reach matters for discovery).

Market Cap & Valuation Context (10%)

We bucket projects by cap to set expectations on risk/return. Small caps can move faster but cut both ways; larger caps trade steadier. As of October 22, 2025, Ethena (ENA) has a market cap of around $3.3 billion, according to CoinGecko, while Drift Protocol (DRIFT) has a market cap of $182 million. These are references for “higher-cap vs mid-cap” context, not buy/sell calls.

Narrative Fit & Sector Tailwinds (10%)

We map each token to prevailing themes (AI, RWA, perps infra, satirical finance/memes, etc.) and use recent market studies to judge momentum. Example: CoinGecko’s Q2 2025 report and narrative recaps frame which sectors drew flows.

Early Market Traction (10%)

We look for credible signals around launch: sustained post-listing volume, orderly books, and absence of obvious wash-trading. Bitcoin Hyper (HYPER) shows strong early traction with 1B+ tokens staked and significant capital raised, indicating genuine community interest, but sustaining momentum beyond the initial hype is the real test.

How we apply the framework (in brief)

Screen: must have basic disclosures (litepaper/whitepaper, tokenomics, roadmap, contract info).

Score: 0–5 per factor using the evidence above; apply weights; compute the composite (0–100).

Cross-checks: prices/volumes from CoinGecko or CoinMarketCap; exchange reach from official pages; if a datapoint is project-reported, we label it as such and seek independent corroboration when available.

Benefits of Buying New Cryptocurrencies

We’ve discussed our methodology for picking new crypto coins with 1000x potential. Next, we’ll explore the benefits of buying new digital currencies.

Early Project Investors Get a First-Mover Advantage

First-mover advantage refers to investing early, backing new concepts and innovative technologies before the broader market catches up. Consider an investor buying Microsoft stock in 1986, long before computers became mainstream. Microsoft’s stock has increased by over 380,000% since its initial public offering (IPO), providing early backers with substantial returns.

The same concept applies to new cryptocurrencies – investors risk funds on innovative solutions that are not yet widely adopted. Early investors gain market exposure at a more attractive price point, enabling long-term growth as the latest development milestones are achieved.

Target High Returns

Up-and-coming crypto projects often launch with low valuations, allowing investors to target high returns. A GlobalData report shows Ethereum’s market capitalization was just $80 million in 2015. Ethereum hit a $540 billion valuation in 2021 – a massive return for early adopters.

Cathie Wood, founder and CEO of ARK Invest, predicts a $20 trillion crypto market capitalization by 2032. This highlights the long-term growth potential when investing in new cryptocurrencies with strong fundamentals.

Another example is Solana, launching on exchanges in April 2020 at $0.67 per SOL. Solana hit an all-time high of $294.33 in January 2025, a growth of 439x in under five years. Investors risking just $1,000 when Solana launched would have made $439,000 at the market peak.

Incentives for Early Investors

New crypto projects often provide incentives to early backers, helping them stand out in this highly crowded market. A common example is staking rewards, with huge APYs typically available during the initial few months. Bitcoin Hyper, which is currently in presale, offers 40% APY for early participants. Investors can stake HYPER tokens directly through the website, with over 1 billion tokens already staked by early participants showing strong community commitment.

Price incentives are sometimes offered by new cryptocurrencies, too, especially when investing in early-stage events. Many new projects increase prices every few days, rewarding early backers with the lowest price. Exclusive access can be reserved for early holders, too.

Broad Portfolio Diversification

New digital currencies are also beneficial for portfolio diversification. Investors have a significant choice, not only because of the sheer quantity of new launches but also the wide selection of industries and narratives. Diversification ensures that investors avoid becoming overexposed to any single project, which can mean significant losses if it isn’t successful.

A better strategy is investing in several different tokens from each selected category. Consider an investor with $5,000 who seeks exposure to new cryptocurrencies. They’re interested in five investing categories – RWA, Layer 2 networks, meme coins, AI, and decentralized finance (DeFi). That investor could allocate $1,000 across several new projects from each category to reduce risk, while still offering exposure to high-growth markets.

For investors specifically interested in low-priced tokens, penny crypto under $1 often presents high-risk, high-reward opportunities.

Where to Buy New Crypto Coins

Finding and buying new cryptocurrencies requires knowing where to look. The market offers several platforms, and we will try to help you choose one:

Crypto Launchpads – Early Access to Presales

Crypto launchpads connect early-stage blockchain projects with investors through Initial Exchange Offerings (IEOs) and Initial DEX Offerings (IDOs). These platforms vet projects before listing them, reducing scam risks while giving you first-mover access.

Binance Launchpad has launched multiple major projects, like Axie Infinity, The Sandbox, and Polygon, before becoming household names in crypto.

Here are some other top launchpads:

Best Wallet features an “Upcoming Tokens” section where you can buy early-stage tokens directly through the app, with only audited projects listed.

MEXC Launchpad offers multiple token sale formats with lower entry barriers.

DAO Maker uses a lottery system with over 315,000 verified users and strong project vetting.

Most launchpads require you to hold their native token, complete KYC verification, and stake to access sales.

Decentralized Exchanges (DEXs) – Immediate Trading Access

DEXs let you trade cryptocurrency tokens directly from your wallet without intermediaries. Unlike centralized exchanges, DEXs list new tokens immediately after launch, often hours or days before major platforms.

Key advantages of using DEXs:

- It provides earlier access. Tokens appear on DEXs before centralized listings.

- No KYC required. You can trade immediately after connecting your wallet.

- It has lower fees. Pay only gas fees and small protocol fees (typically 0.1-1%).

- You have access to thousands of tokens not available on CEXs.

However, DEXs carry higher risks, including rug pulls and honeypot scams. Always verify liquidity pool locks, check for smart contract audits, and research projects thoroughly before investing.

Centralized Exchanges (CEXs) – Mainstream Listings

Major centralized exchanges offer the safest environment for buying new cryptocurrencies, but tokens reach these platforms later in their lifecycle.

Binance

Binance lists 1-10 new tokens monthly, with historical data showing tokens gained an average of 41% within 24 hours of announcement. The exchange uses Launchpad and Launchpool programs to introduce vetted projects, though only about 11% of newly listed tokens had positive returns.

Learn about upcoming Binance listings

Coinbase

Coinbase listings average gains of 91% within the first five days, creating what’s known as the “Coinbase Effect”. The exchange prioritizes regulatory compliance and lists primarily ERC-20 and SPL tokens that meet strict technical and legal standards.

Check potential Coinbase listings

Kraken

Kraken is highly selective, listing only 300+ tokens despite processing $665 billion in annual volume. The exchange publicly discloses upcoming listings on its official assets page, making it easier to track new additions.

Monitor upcoming Kraken listings

Listing Tracking Tools

Experienced investors don’t wait for official announcements. Use these methods to spot potential listings early:

CoinMarketCap’s “Recently Added” shows new tokens in reverse chronological order with pricing data and contract addresses.

On-chain analytics platforms, Birdeye, DEXTools, and DexScreener, track new token launches within seconds of deployment.

Exchange listing roadmaps, like Kraken publicly shares its listing roadmap, though inclusion doesn’t guarantee approval.

Follow official exchange accounts and crypto communities on X and Telegram for early signals.

Where to Store New Crypto Coins

When it comes to storing crypto, you have three main choices: a custodial wallet on a CEX like Kraken, or a hardware wallet like Trezor.

Custodial Wallet

These wallets are kept safe by another entity, such as Binance or Coinbase. They provide you with extra protection, as they will help you recover your password if you forget it. But on the other hand, the maxim remains true: ‘not your keys, not your crypto’.

Self, aka Non-Custodial Wallets

Wallet providers like MetaMask provide decentralized Web3 wallets, often needed to buy tokens before CEX listings or to participate in airdrops. With these wallets, you are your own bank; the responsibility for keeping the private keys safe is yours.

Hardware wallets

These are another type of self-custodial wallet, which keeps your crypto extra safe by not being connected to the internet (except when you want to use it). Examples include Trezor and Margex.

Wondering which wallet is best for you? Read our full guide on how to choose a crypto wallet.

Risks of New Crypto Launches

This section details the key risks of buying new cryptocurrencies and how to mitigate them effectively.

Many New Cryptocurrencies Are Pre- or Mid-Development

Crypto launches are often brand-new projects in the pre- or mid-development stage. There are no guarantees that the utility offering, such as a new Layer 1 blockchain or a DeFi ecosystem, will ever be built. Investors risk money believing a working product will eventually arrive, but operational challenges can prevent completion.

New projects often need vast resources to meet development targets, so one risk is that funds become depleted. Investors should factor these risks into the valuation, similar to investing in a growth stock from an emerging industry. New cryptocurrencies without any development evidence should have a much smaller market capitalization than those closer to a Mainnet launch.

High Volatility and Potential for Sharp Price Declines

All cryptocurrencies are highly volatile, particularly when compared to blue-chip stocks like Coca-Cola, Pfizer, and Microsoft. New crypto tokens present significantly greater volatility, especially when projects have small market capitalizations. This is due to market depth – the amount of traded dollars required to shift the market price by a certain amount.

Small-cap cryptocurrencies don’t require substantial buying or selling pressure to see large pricing swings. This is why new cryptocurrencies rise and fall much faster than established projects with bigger valuations.

The key takeaway is that investors can lose serious amounts when buying new cryptocurrencies. You should only risk amounts you’re prepared to lose.

Higher Probability of Investing in Scam Tokens

Most crypto scams happen in the early stages. Within hours of a coin being launched, people start to buy it, and then the founder, developers, or other people in their network run with the money. Rug pulls are among the most common scams in the crypto space. Project founders build hype with fake promises only to withdraw liquidity from the DEX pool. The market price crashes, leaving investors with worthless tokens.

Investors can mitigate rug pull risks by verifying whether the liquidity pool has been locked and for how long. Founders are unable to withdraw liquidity during the lock period, so it’s a critical safeguard.

Pump and dump scams are also common with the newest crypto projects. Insiders artificially pump the token’s price, encouraging legitimate investors to buy, assuming they’ve found a potential gem. The founders eventually sell their tokens, profiting from victims and causing the price to crash.

Pump and dump risks are harder to mitigate, but the best practice is to avoid making investments purely because of price action. The better strategy is to focus on strong fundamentals, like use cases and development progress.

Investors should also understand honeypot scams before buying new cryptocurrencies. The founders create a smart contract with malicious code, unidentifiable by the untrained eye. This allows them to perform functions that disadvantage existing investors, such as creating additional tokens above the capped supply (which can then be sold). Honeypots often restrict token sales, meaning only the founders retain the ability to sell.

The best way to avoid honeypot scams is to verify whether the smart contract has been audited. Reputable auditing companies can identify contract vulnerabilities, so scammers avoid them. However, even audited smart contracts can be malicious, so they’re never a guaranteed safeguard against scams.

Beyond smart contract security, storing your tokens in a secure crypto wallet with proper backup procedures protects against exchange hacks and platform failures.

Broader Market Conditions

Broader market conditions have a major influence on price performance, particularly new cryptocurrencies with unproven or underdeveloped use cases. Bearish cycles, where sentiment is weak for extended periods, often result in most cryptocurrencies losing value, regardless of their fundamentals.

Investors should remember that risk-management principles like diversification can’t defend against market forces. Staying in the market long-term is the only way to avoid short-term volatility. Bitcoin declined from about $69,000 in late 2021 to under $16,000 a year later, only to hit an all-time high of $109,000 in January 2025. This shows that even the world’s most popular and valuable crypto witnesses extreme volatility.

Risks vs Reward Analysis for New Cryptocurrencies

Below is a quick, apples-to-apples view of upside vs risk for the projects covered. Simple signals only: where the return could come from and what can derail it.

| Token | ROI Potential | Risk Score | Key Risk Factor |

| Bitcoin Hyper | High | Medium | Layer 2 competition |

| Maxi Doge | High | High | Meme momentum dependency |

| BMIC | High | High | Still in its early stages |

| LiquidChain | High | High | No live mainnet |

| Ethena | Medium | Medium-High | Derivatives and regulatory risk |

| Remittix | Medium | High | Unproven banking partnerships and 91% token liquidity at launch |

| SUBBD | Medium-High | High | Creator migration hurdle |

| Vortex FX | Medium-High | High | Undisclosed team, reliance on real trading performance and regulatory exposure |

| Drift Protocol | Medium | Medium | Derivatives market stress |

| Hyperliquid | Medium-High | Medium-High | Liquidity concentration and exchange competition |

What this means: According to CoinGecko (snapshot from December 5, 2025), Layer 2 ecosystems now account for roughly $122 million in TVL, with Base leading the pack, and the Layer 2 coin category sits around $11 billion in market cap. That backdrop supports L2 narratives and experiments such as Bitcoin Hyper, where liquidity often rotates toward higher beta ideas when infrastructure segments expand.

How to Find New Crypto Coins

This section discusses the top strategies seasoned investors use to find new crypto coins coming out.

CoinMarketCap’s ‘Recently Added’

CoinMarketCap is the de facto website for crypto pricing data, boasting over 340 million monthly visitors. Thousands of new cryptocurrencies launch daily, but only a small percentage are added to CoinMarketCap’s database.

The “Recently Added” section shows new cryptocurrencies in reverse chronological order – clicking one presents valuable crypto news and up-to-date information.

Investors can view the token dynamics, including the total and circulating supplies, network standard (e.g., ERC20), and the contract address. Pricing data, including market capitalization and volume, is also shown. CoinMarketCap also provides links to the project’s website so that investors can evaluate whitepapers and roadmaps independently. Also, monitoring upcoming Binance listings gives insight into which tokens are being vetted for major exchange exposure.

Analyze On-Chain Data

On-chain data extracts information from the blockchain and presents it in an easy-to-view format. New cryptocurrencies appear on blockchain ledgers immediately after launching on DEXs, allowing investors to view them within seconds.

Several platforms provide on-chain data from multiple crypto ecosystems, including Birdeye, DEXTools, and DexScreener. These platforms are free, but premium features (like real-time tracking) require subscriptions. Investors should use the available filters to find potential projects, considering the sheer number of launches.

Birdeye filters, for instance, include price changes, market capitalization, holders, watchers, total supply, and volume. Specific blockchains can be targeted too, such as Solana, BNB Chain, Arbitrum, Ethereum, and Base.

Investors should create filters aligning with their risk appetite and goals. Risk-averse strategies should avoid new coins launched within the past few days. These come with higher volatility and increased risk of scams.

Explore Social Media for Trending Cryptocurrencies

Millions of investors use X, formerly Twitter, to find the next big crypto. Projects frequently trend on X before blowing up – potential signs include increased mentions, high engagement levels, and “Likes” or shares from influential people. Investors can search key terms like “new crypto”, focusing on posts with the most views and comments. This strategy should only be used as a baseline; independent research is crucial.

Reddit is also a valuable source when assessing potential crypto gems. Its unique audience isn’t afraid to call out potential scams or unrealistic development targets, so check whether existing threads mention projects you’re interested in.

Existing and Upcoming ICOs

New cryptocurrency releases use initial coin offerings to raise funds – investors secure a first-mover advantage before exchange listings. Crypto Presales can be extremely high risk, as they’re often brand-new projects without proven use cases.

There’s no pricing history either, so investors should proceed with caution. See a list of current ICOs here.

That said, these early-stage sales also present high-growth opportunities; most offer discounted prices and a micro-cap valuation.

Many successful projects, including those with the largest market capitalizations, use these fundings before launching on exchanges. A good example is Ethereum; early-stage investors paid just $0.31 per ETH in 2014; the ETH price hit almost $5,000 in 2021.

Is It Legal to Invest in New Cryptocurrencies?

The regulations for new cryptocurrency investments are different across the globe. Let’s have a look:

US Rules on New Crypto Investments

The US achieved regulatory clarity in 2025. The GENIUS Act (July 2025) created the first federal stablecoin framework with 100% reserve backing requirements.

The CLARITY Act transfers digital asset jurisdiction from the SEC to the CFTC, with the CFTC overseeing decentralized digital commodities.

United Kingdom

The UK published draft legislation in April 2025, bringing crypto exchanges, custody services, and stablecoin issuance under Financial Conduct Authority (FCA) regulation. All crypto trading platforms must obtain FCA authorization and establish a UK physical presence.

European Regulations

The Markets in Crypto-Assets (MiCA) regulation became fully applicable across EU member states on December 30, 2024. Crypto Asset Service Providers must obtain licenses with strict requirements, including full liquid asset backing, transparency reports, and capital requirements.

Asian Approaches to Crypto Markets

- Singapore has clear regulatory frameworks with MAS standards for stablecoins.

- Hong Kong has issued Virtual Asset Trading Platform Licenses since mid-2023.

- Japan recognizes crypto as legal property under the Payment Services Act.

- China has strict restrictions on domestic crypto exchanges.

Do You Pay Taxes on New Crypto Coins in 2026?

Yes, you owe taxes on new cryptocurrency transactions just like any other crypto. Buying, selling, or trading new tokens triggers taxable events that must be reported.

Regional Tax Rules for New Crypto Coins

Tax treatment can be very different based on where you live.

- The United States treats crypto as property with federal taxes on all trades. Brokers must report sales via Form 1099-DA starting January 2025

- Europe has a capital gains tax in most countries. For example, France taxes gains at 30%, Italy at 26%

- Singapore exempts capital gains tax and applies 17% income tax only when cryptocurrency is recognized as business income

- Japan imposes progressive rates up to 55% on crypto gains, with proposals to lower to 20% under review

- India applies a flat 30% tax rate with an additional 1% TDS

To stay compliant, track every transaction from day one using the crypto tax software of your choice and consult specialists in your country if needed.

Conclusion

New cryptocurrencies are projects launched recently that offer early-stage investment opportunities before they list on major exchanges. They carry a higher risk than established tokens but provide potential for bigger returns when backed by working products, clear use cases, and verifiable community traction.

Based on our analysis, Bitcoin Hyper stands out as a Bitcoin Layer 2 targeting high-throughput DeFi, while Ethena offers an established alternative with its $2B market cap synthetic dollar protocol.

New crypto investments are extremely volatile and speculative. Verify smart contract audits, check for locked liquidity pools, and diversify across multiple projects to reduce exposure if a single token fails. Always conduct independent research before committing funds.

FAQ

How often are new crypto coins released?

What is the best new cryptocurrency to invest in?

Is it better to buy new cryptocurrencies?

Are new cryptos risky?

How do I find new cryptocurrencies before they launch?

References

- Big Tech’s New AI Obsession: Agents That Do Your Work for You (Bloomberg)

- Ethereum’s Market Capitalization History (2015 – 2023, $ Billion) (GlobalData)

- What is a Rug Pull: Types, How to Avoid Them (Finance Magnates)

- Ex-Commerzbank CEO Joins DeFi Technologies Amid Growing Institutional Interest (Bloomberg)

- Ethereum L2 Adoption & DeFi Scaling Trends, Q1 2025 Report (Messari)

- Bitcoin Supply on Exchanges Hits Multi-Year Low as Long-Term Holders Accumulate (Glassnode)

- Layer 2 Dominates DeFi Transaction Volume in 2025 (DeFiLlama)

- DeFi Market Size Forecast Worldwide 2025–2034 (Statista)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

The team behind IPO Genie has not yet announced an end date for the presale.

AI cryptocurrencies combine blockchain with artificial intelligence to power decentralized machine learning networks, GPU computin...

Fact-Checked by:

Fact-Checked by:

Otar Topuria

Crypto Editor, 39 postsI’m a crypto writer and analyst at Coinspeaker with over three years of experience covering fintech and the rapidly evolving cryptocurrency landscape. My work focuses on market movements, investment trends, and the narratives driving them, helping readers what is happening in the markets and why. In addition to Coinspeaker, my insights and analyses have been featured in other leading crypto and fintech publications, where I’ve built a reputation as a thoughtful and reliable voice in the industry.

My mission is to demystify the crypto markets and help readers navigate the noise, highlighting the stories and trends that truly matter. Before specializing in crypto, I worked in the IT sector, writing technical content on software development, digital innovation, and emerging technologies. That made me something of an expert in breaking down complex systems and explaining them in a clear, accessible way, skills I now find very useful when it comes to unpacking the intricate world of blockchain and digital assets.

I hold a Master’s degree in Comparative Literature, which sharpened my ability to analyze patterns, draw connections across disciplines, and communicate nuanced ideas. I’m particularly passionate about early-stage project discovery and crypto trading, areas where innovation meets opportunity. I enjoy exploring how new protocols, tokens, and DeFi projects aim to disrupt traditional systems, while also evaluating their potential risks and rewards. By combining market analysis with forward-looking research, I strive to provide readers with content that is both informative and actionable.