This Vortex FX (VFX) price prediction guide explores prices predicted through 2026, 2030, and 2036, looking at the potential heigh...

11 Potential Coinbase Listings in 2026: What New Coins Could Be Coming

39 mins

39 mins From our research, Bitcoin Hyper leads the pack for a 2026 listing. Its technology and growing adoption make the coin very appealing to retail and institutional investors.

Other projects like Maxi Doge and BMIC are also drawing a lot of attention, thanks to their active communities, strong presales, as well as their readiness for the U.S. market.

New Coinbase listings can move markets almost overnight. If you know which coins are likely to be added next, you can spot such opportunities before most other traders.

Over the past months, we have analyzed over 60 crypto projects. Out of these, we identified 11 that truly stand out. In this guide, we will tell you more about the likely Coinbase candidates, as well as what you should consider before investing.

Disclaimer: These are only predictions based on research and market trends. A Coinbase listing is not guaranteed for any of the coins in this list. Always do your own research before investing.

Top Potential Coinbase Listings in 2026

Our analysis of Coinbase listing patterns points to several tokens that could be added in 2026. This watchlist highlights projects showing strong signals and momentum throughout the year.

| Coin | Coinbase-Listing Rationale |

| Bitcoin Hyper (HYPER) | Layer-2 ambition on Bitcoin, strong presale funding traction |

| Maxi Doge (MAXI) | Meme/community appeal, high retail interest potential |

| BMIC (BMIC) | Quantum-resistant wallet with a decentralized compute ecosystem |

| LiquidChain (LIQUID) | High-throughput L1 focused on liquidity routing and DeFi efficiency |

| Kaspa (KAS) | High-speed PoW Layer 1 aiming for instant confirmations and low fees |

| Hyperliquid (HYPE) | Revenue-generating DEX with deep volume and adoption |

| PEPENODE (PEPENODE) | Gamified mining coin with strong viral potential |

| SUBBD (SUBBD) | Content monetization token with Web3 creator ecosystem |

| Theta Network (THETA) | Leading blockchain cloud powering AI, video rendering, and streaming |

| Mitosis (MITO) | L1 network connecting DeFi across multiple blockchains |

| BlockchainFX (BFX) | Super trading app with 500+ assets from crypto and stocks to gold and forex |

Upcoming Coinbase Listings Watchlist in 2026 – Editor’s Picks

Our editors’ curated shortlist of speculative tokens showing early signals of a potential Coinbase listing ahead of the new year.

- First Bitcoin Layer 2 enabling fast, low-cost transactions

- Fixes Bitcoin’s speed and fee limitations with near real-time performance

- Enables a Bitcoin-native DeFi ecosystem

- Degen meme coin inspired by max-leverage trading

- A tribute to high-risk hustle — fueled by sweat and conviction

- Ethereum-born, culture-driven, aiming for multichain

- Quantum-resistant security infrastructure for wallets and enterprise use

- Uses deflationary tokenonomics, including burns, tied to quantum workload execution

- Staking and governance participation expand token utility

- Shared liquidity spanning Bitcoin, Ethereum, and Solana

- Improved trade execution through faster speeds and secure cross-chain capital movement

- Opens up greater cross-ecosystem connectivity for builders and developers

- Build your own virtual meme coin mining rig.

- 100% virtual and requires no additional computing power.

- Top miners get additional bonuses in Pepe, Fartcoin, and other meme coins.

- AI-Powered Virtual Influencers

- 20% APY Staking Rewards

- VIP perks: livestreams, BTS content, credits, and more.

- Connecting DeFi and TradFi in a singular exchange

- BFX holders earn USDT from platform trading activity

- Access to over 500 tradable assets, including commodities

- High-performance broker for pros and newcomers alike

- Rebates and buybacks come from VFX's own market activity

- 10% bonus on sign up and early staking access

Reviewing the Top Coins with Coinbase Listing Potential

Here’s a quick look at some of the latest tokens listed on Coinbase and a few that might be added soon.

1. Bitcoin Hyper (HYPER) – Bitcoin Layer 2 Meme Coin Built for Speed & Cross-Chain Utility

Bitcoin Hyper tries to give Bitcoin what it’s always lacked: real speed, smart contracts, and chain-agnostic utility. It is built as a Layer 2 solution using the Solana Virtual Machine (SVM). This means it aims to combine the security of the BTC blockchain with near-Solana-Level speed and low fees. Transactions, dApps, and even DeFi features are reportedly possible, a thing that alone sets it apart from many other Bitcoin-based projects.

Bitcoin Hyper Official Website. Source: Bitcoin Hyper

On top of this, the presale has already drawn a lot of attention. HYPER has successfully raised over $28 million at this point. These numbers suggest a growing demand from buyers. The native HYPER token has several intended uses: paying transaction fees, staking, network governance (via a future DAO), and access to premium features or dApps on the ecosystem.

If you are following the upcoming crypto ICO scene, Bitcoin Hyper is worth a close look: high-risk, high-reward, and a project that could really stand out if it executes on its roadmap.

Bitcoin Hyper Snapshot:

| Project | Bitcoin Hyper |

| Category | Layer 2 Meme Coin / BTC Cross-Chain Utility |

| Launch Date | Q1 2026 (Presale underway) |

| Chain | Solana Virtual Machine (SVM) + ERC-20 compatibility |

| Amount Raised | $30.21M |

| Current Exchanges | Currently in presale |

| Base App Support | No (targeting post-mainnet launch) |

| Coinbase Roadmap | No |

| Regulatory Profile | KYC-compliant presale, ERC-20 architecture aligned with U.S. norms |

| Listing Signals | BTC-linked utility, SVM multi-chain architecture, community traction |

| Coinbase Fit | High: aligns with Coinbase’s BTC Layer 2 interest, meme-friendly culture, and cross-chain support initiatives. |

| Time Until Next Price Increase | Loading...

|

2. Maxi Doge (MAXI) – Community-Focused Whimsical Dog Meme Coin

Maxi Doge is a viral new meme coin that harnesses the culture and spirit of the degen crypto trader. Its mascot, a jacked shiba inu dog who does nothing but trade cryptos at 1000x leverage, carries the torch of DOGE and SHIB but with a more relatable twist.

Maxi Doge presale homepage. Source: Maxi Doge

While MAXI is almost exclusively a meme coin, the team is clearly focusing on building a cohesive community with planned trading contests (with MAXI prizes), staking rewards of up to 72% APY, massive marketing campaigns, and a potential partnership with a top perps platform.

Maxi Doge Snapshot:

| Project | Maxi Doge |

| Category | Dog Meme Coin |

| Launch Date | Presale launched on 29/07/25 |

| Chain | Ethereum (ERC-20) |

| Amount Raised | $4.43M |

| Current Exchanges | Currently in presale |

| Base App Support | No |

| Coinbase Roadmap | No |

| Regulatory Profile | ERC-20 architecture aligned with U.S. norms |

| Listing Signals | Community growth, Successful raise of $15M hardcap |

| Coinbase Fit | High: aligns with Coinbase’s meme-friendly culture. |

| Time Until Next Price Increase | Loading...

|

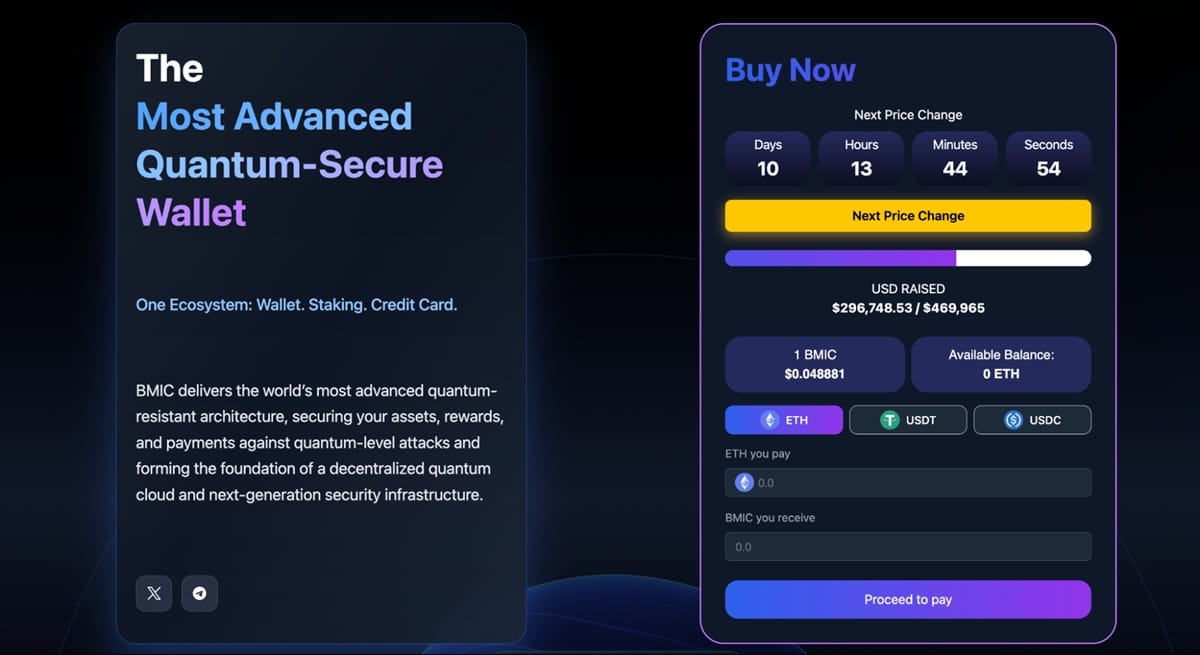

3. BMIC (BMIC) – Quantum-Resistant Wallet With a Decentralized Compute Ecosystem

BMIC aims to address one of the most pressing issues in the Web3 world: the potential threat that quantum computing poses to existing cryptographic systems. The project states that it is developing a “Quantum-Resistant Wallet” and a security layer built on post-quantum cryptography (PQC) and signature-hiding techniques.

BMIC believes this will safeguard digital assets and identities against future attacks. This security-centric strategy, along with its plans for a decentralized quantum cloud, could theoretically set it apart from traditional wallets that still rely on older encryption methods like RSA.

BMIC, a new Web3 wallet ecosystem that claims to address the huge threat posed by quantum computing. Source: BMIC

The project’s native BMIC token is currently in its presale stage and has raised close to $300,000. This token aims to serve as the ecosystem’s utility layer. For perspective, the BMIC whitepaper specifies that the token will facilitate payments for wallet services, grant access to enterprise security APIs, and be staked to boost network security

Furthermore, the team outlines a “burn-to-compute” mechanism in which tokens are destroyed to access quantum computing resources, which could potentially diminish the supply over time. From a broader perspective, BMIC is a good example of a high-risk, high-reward investment whose success will depend on its team’s ability to execute the roadmap goals.

BMIC Snapshot:

| Project | BMIC |

| Category | Quantum Security |

| Launch Date | Q4 2025 |

| Chain | Ethereum |

| Amount Raised | $296,000+ |

| Current Exchanges | Currently in presale |

| Coinbase Wallet Support | No |

| Coinbase Roadmap | No |

| Regulatory Profile | Smart contracts audited, targeting enterprise compliance |

| Listing Signals | Deflationary burn mechanics, unique security utility, enterprise focus |

| Coinbase Fit | Medium: Aligns with infrastructure security needs, though very early stage. |

4. LiquidChain (LIQUID) – Removing Reliance on Risky Bridges or Wrapped Tokens

LiquidChain is a newer, early-stage project with a clear ambition: to build a Layer 3 network designed to unify liquidity across Bitcoin, Ethereum, and Solana, three of the biggest ecosystems in crypto. The problem it’s trying to solve is very real and very complex. Liquidity and value are balkanized across chains, and moving value between them often involves clunky bridges or wrapped tokens.

LiquidChain presale homepage. Source: LiquidChain

At the moment, the project is still in presale and development, with the $LIQUID tokens being distributed ahead of a full launch. Development teams have published a roadmap and a lightpaper, and some smart contract audits have already been completed. This is a positive signal in early-stage crypto.

| Project | LiquidChain |

| Category | Multi-chain Layer 3 liquidity protocol |

| Launch Date | Presale / testnet phase |

| Chain | Layer 3 bridging BTC/ETH/SOL |

| Amount Raised | Early presale participation |

| Current Exchanges | Not yet live on major CEXs |

| Base App Support | Presale and SDK/API beta |

| Coinbase Roadmap | None publicly confirmed |

| Regulatory Profile | Cross-chain infrastructure focus |

| Listing Signals | Developer utility and unified liquidity thesis |

| Coinbase Fit | Medium/ Long-term (infrastructure + utility) |

5. Kaspa (KAS) – The PoW Network with High-Processing Capabilities

Kaspa is one of those projects that’s easy to underestimate until you actually dig into what it’s solving. Kaspa is a proof-of-work Layer 1 cryptocurrency that uses a Directed Acyclic Graph instead of a traditional linear chain. This is the fancy way of saying it can process many blocks at once rather than one after another. Such a design gives it much higher throughput than classic PoW chains like Bitcoin, and near-instant confirmations.

Kaspa’s technology has been actively developed since its launch in November 2021. It was fair-launched with no pre-mine or pre-sale, which definitely appeals to decentralization fans.

Right now, you can trade KAS on several exchanges like Kraken and KuCoin, but the token hasn’t hit Coinbase’s spot market yet. This is a gap that could make it a strong candidate for a future listing (if its momentum continues).

| Project | Kaspa |

| Category | PoW Layer 1 blockchain |

| Launch Date | November 2021 |

| Chain | Native PoW (BlockDAG/GHOSTDAG) |

| Total supply | 28.7B KAS |

| Current Exchanges | Various CEXs and DEXs like Gate, KuCoin, and MEXC |

| Base App Support | Yes (nodes, wallets, explorers) |

| Coinbase Roadmap | None publicly confirmed |

| Regulatory Profile | Open-source PoW network |

| Listing Signals | Fair launch ethos and growing adoption |

| Coinbase Fit | Medium/Speculative |

6. Hyperliquid (HYPE) – EVM Blockchain and Decentralized DEX and Perpetual Platform

Hyperliquid launched in 2023 as a decentralized perpetual futures trading platform and now also comprises a Layer 1 blockchain. The token, HYPE, made history as one of the biggest airdrops ever. Released in 2024, the HYPE HYPE $27.34 24h volatility: 3.2% Market cap: $6.51 B Vol. 24h: $307.24 M airdrop is currently worth around $11B and no tokens were reserved for VCs or private funding rounds.

The Hyperliquid Foundation homepage. Source: Hyperliquid

Following its DEX success, Hyperliquid released HyperEVM, a highly-scalable Ethereum-compatible Layer 1 network with a TVL of $4.8 billion. HYPE utility includes governance, staking, trading, and HyperEVM gas fees. HYPE’s DeFi and futures functionality may be the main reason why Coinbase has yet to list the token, but Paul Atkins, the chair of the SEC, recently called for an “innovative exemption” proposal for DeFi protocols, aligning with Trump’s vision for the US as “crypto capital”. The exemption is planned for Q4 2025, and if it is successful, a Coinbase listing may follow soon after.

Hyperliquid Snapshot:

| Projeect | Hyperliquid |

| Category | EVM Blockchain / Decentralized Exchange (Perpetual Futures) |

| Launch Date | DEX: 2023; HyperEVM Mainnet: February 18, 2025 |

| Chain | Hyperliquid Layer 1 (HyperBFT consensus), Ethereum-compatible (HyperEVM) |

| Amount Raised | HYPE airdrop approx $11B in value |

| Current Exchanges | Hyperliquid DEX (main trading venue); HYPE token traded on some CEXs (e.g., Kraken, Bitget) and DEXs (e.g., Uniswap – for swaps) |

| Base App Support | Yes (EVM-compatible wallets, including the Base App, are supported for connecting to trade on Hyperliquid) |

| Coinbase Roadmap | No |

| Regulatory Profile | Cons: Decentralized; operates without KYC; offers higher leverage than CFTC-approved platforms. Pros: Proactive CFTC submissions |

| Listing Signals | Large HYPE airdrop, no VC/private rounds, high TVL, top 10 blockchain by market cap, EVM compatibility, potential for SEC “innovation exemption.” |

| Coinbase Fit | High potential if “innovation exemption” for DeFi goes ahead. Aligns with Coinbase’s interest in scalable L1s and growing market traction. |

7. PEPENODE (PEPENODE) – Ethereum-Based Memecoin Where Users Mine Virtual Coins Through Gamified Nodes

PEPENODE brings crypto mining to everyone through a virtual server room where users purchase nodes, upgrade facilities, and compete for rewards. The project is built on Ethereum, and the protocol ties mining output directly to ETH block production, so participants earn based on real blockchain activity.

PEPENODE Official Website. Source: PEPENODE

The team designed PEPENODE as both a memecoin and a functional mining simulator. Players customize their setups with different node types and facility upgrades. The better your virtual hardware, the more PEPENODE you earn. With 70% of upgrade tokens burned permanently and a referral system that pays 2% to recruiters, the tokenomics create both scarcity and viral growth potential.

PepeNode Snapshot:

| Project | PEPENODE |

| Category | Memecoin / Virtual Mining Protocol |

| Launch Date | TGE following presale completion (targeting Q1 2026) |

| Chain | Ethereum (ERC-20) |

| Amount Raised | $2.61M |

| Current Exchanges | Presale phase – targeting Uniswap at launch, CEX listings planned |

| Coinbase Wallet Support | Compatible via the ERC-20 standard |

| Coinbase Roadmap | No official confirmation |

| Regulatory Profile | Whitepaper compliant with EU crypto-asset regulations |

| Listing Signals | Gamified utility, deflationary mechanics, Ethereum-native |

| Coinbase Fit | Medium: functional memecoin with clear utility, though the early-stage project needs to prove traction first |

| Time Until Next Price Increase | Loading...

|

8. SUBBD (SUBBD) – Content Monetization Token with Web3 Creator Ecosystem

SUBBD is a Web3-native content monetization token designed to help creators own, manage, and monetize their audiences across social and decentralized platforms. Built to support AI-driven fan engagement, tokenized creator communities, and cross-platform rewards, SUBBD brings together SocialFi, DeFi, and Web3 creator economies – a fast-rising trend among upcoming Coinbase listings.

SUBBD Official Website. Source: SUBBD

With a growing community of crypto-native creators and users in the U.S., KYC-compliant tokenomics, and an ERC-20 structure, SUBBD mirrors the emerging patterns of content-focused tokens making their way onto mainstream exchanges. As the SocialFi and fan-token ecosystems gain institutional traction, this new presale crypto aligns with Coinbase’s evolving listing priorities, positioning SUBBD among the new coins worth watching in 2026.

SUBBD Snapshot:

| Project | SUBBD |

| Category | Web3 Creator Economy / SocialFi / DeFi |

| Launch Date | TBA |

| Chain | Ethereum (ERC-20) |

| Amount Raised | $1.42M |

| Current Exchanges | TBA |

| Base App Support | No |

| Coinbase Roadmap | No |

| Regulatory Profile | KYC-compliant token sale, designed for U.S.-friendly compliance |

| Listing Signals | ERC-20, compliant tokenomics, strong U.S. creator community traction, alignment with SocialFi trends |

| Coinbase Fit | Mirrors prior SocialFi and fan-token trends (e.g. Audius), aligns with U.S.-driven Web3 creator economy focus |

| Time Until Next Price Increase | Loading...

|

9. Theta Network (THETA) – Decentralized Blockchain Cloud Powering AI, Rendering, and More

Theta Network is an established blockchain project building a decentralized blockchain cloud to power AI training, video rendering, and all sorts of other kinds of media and entertainment. Theta Network aims to connect users with computing bandwidth with those who need it, through a decentralized network governed by its token holders.

Theta Network Official Website. Source: Theta Network

The crypto community has expected Coinbase to list THETA for quite some time now, and the rumors are only intensifying as the AI and video rendering industries continue to grow exponentially. The project is quickly becoming popular with the largest institutions on the planet as well, with Google and Samsung running their own validator nodes on the network.

Theta Network Snapshot:

| Category | Decentralized Cloud for AI, Video Rendering, and Media |

| Launch Date | November 2017 |

| Chain | Theta Network |

| Current Exchanges | Binance, OKX, Bybit, KuCoin, Crypto.com |

| Base App Support | No |

| Coinbase Roadmap | No |

| Regulatory Profile | California-based company already listed on major KYC-compliant exchanges |

| Listing Signals | Rebounding price, increasingly passionate user base, major investors including Sony diving in, Google and Samsung run Theta validator nodes |

| Coinbase Fit | Need for GPU computing from AI industry is driving massive interest in Theta, strong liquidity, solid regulatory profile |

10. Mitosis (MITO) – Layer 1 Blockchain Uniting the Fragmented DeFi Ecosystem

Mitosis is one of the most exciting projects in the DeFi space right now because it has the potential to change the ecosystem entirely. Interoperability has long been one of DeFi’s biggest problems, with platforms split between dozens of blockchains, constraining capital efficiency and flexibility. Mitosis is essentially a liquid staking platform, but users can restake tokens across multiple different blockchains, which would otherwise be impossible.

Mitosis’ innovative programmable liquidity platform. Source: Mitosis

Mitosis fits right in with other tokens listed on Coinbase with a strong utility profile, high staking rewards, governance rights, and innovative technology behind it. It is still a new and relatively small token, but the platform’s Total Value Locked (TVL) is rising dramatically as investors search for more capital efficiency.

Mitosis Snapshot:

| Category | DeFi Interoperability |

| Launch Date | August 2025 |

| Chain | BSC |

| Current Exchanges | MEXC, Gate, KCEX |

| Base App Support | No |

| Coinbase Roadmap | No |

| Regulatory Profile | Audited |

| Listing Signals | Skyrocketing Total Value Locked (TVL), innovative technology |

| Coinbase Fit | MITO could revolutionize DeFi, offering strong utility, governance rights, and more |

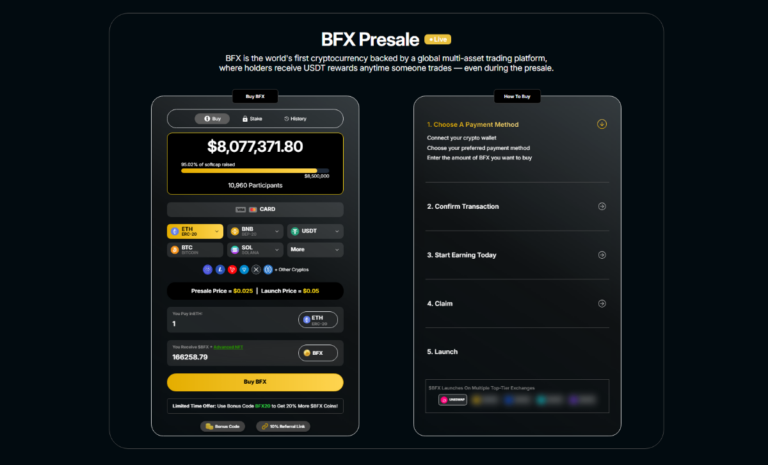

11. BlockchainFX – Building the First Crypto-Native Trading Super App

BlockchainFX is a new project with a bold goal: to break down the barriers that make it so difficult and frustrating to trade different types of assets, from crypto and commodities to stocks and forex. The plan is to build a single super app that allows users to trade over 500 different investments from all kinds of asset classes.

BFX presale homepage. Source: BlockchainFX

If the BlockchainFX team succeeds, it could cut down on a ton of lost time by allowing investors to stick to one platform instead of being forced to use 10 different apps to build a truly diverse portfolio. This would also make investors much more nimble, allowing them to make trades across totally different sectors in seconds. To sweeten the deal even more, up to 70% of the platform’s trading fees will be redistributed to holders of BlockchainFX’s native token, BFX, paid in both USDT and BFX.

BlockchainFX Snapshot:

| Category | Trading super app |

| Launch Date | Soon after presale ends |

| Chain | Ethereum |

| Current Exchanges | Currently in presale with multiple exchange listings planned |

| Base App Support | No |

| Coinbase Roadmap | No |

| Regulatory Profile | Audited |

| Listing Signals | Genuinely powerful concentration of utility and strong presale momentum |

| Coinbase Fit | BlockchainFX could change the trading platform market, inspiring a wave of super apps |

Key Takeaways

- In 2026, Coinbase interest is likely to skew toward DeFi, Layer 2, memes, and infrastructure.

- Base App support and Coinbase Custody are common, but not guaranteed pre-listing signals.

- The “Coinbase Effect” often brings short-term volatility; outcomes vary and aren’t assured.

- Compliance, liquidity, and active communities remain core screening factors.

- Roadmap posts typically precede listings; timing still depends on technical and legal readiness.

What Are Coinbase Listings?

US crypto exchange Coinbase regularly lists new tokens for trading to make sure that its users can access some of the largest, most innovative, and unique coins on the market. A Coinbase listing simply refers to the process of adding a crypto to the exchange, allowing its millions of users to trade it on the platform.

A listing on one of the largest exchanges in the world can be a massive boon for any coin. Firstly, it vastly increases the visibility, accessibility, and credibility of the token, putting it in front of Coinbase’s massive user base. It also helps boost its liquidity, which makes it easier to trade without suffering from price slippage.

What Are the Coinbase Listing Criteria?

Coinbase adheres to strict protocols and reviews assets before listing them, ensuring investors and traders aren’t exposed to risky or unstable assets. All project teams participate in a free, merit-based application process in which the same standards are used to evaluate every coin.

After applying, each project undergoes a business evaluation. Once an asset meets the business criteria, the Coinbase team conducts due diligence. Sometimes the team reaches out directly to the project team to collect additional information or share updates.

The team prioritizes certain assets for faster reviews to keep up with market sentiment because new tokens can spring up so quickly. Projects with specific criteria get reviewed faster, such as:

Business Criteria

The Coinbase team looks through several business criteria to decide which assets to review first. Assets with high demand, trading volume, and market cap get priority. They also look at the token’s popularity or anticipated liquidity, for example, assets with high token holder counts. The team also considers social media sentiment and behavior, the history of key project contributors, information on token distribution, and other quantitative and qualitative signals before selecting them for review.

Pre-Launch Assets

The team follows a unique set of business criteria to review new tokens that haven’t been launched yet. The pre-launch review ensures the credibility of the launch, and the trading is enabled for the investors as soon as it’s launched.

Technical Considerations

Coinbase prefers simpler asset types such as ERC-20 on Base, Ethereum, Optimism, Arbitrum, and Polygon, as well as SPLs and ARC-20s that require no complex integration. Other asset types and native blockchains can impact the efficiency of the evaluation as they require additional resources to support.

Core Review Criteria

The Coinbase team looks at three components – Legal, Compliance & Risk Mitigation, and Technical Security, ensuring investor protection.

Legal: Coinbase checks if the asset trading is considered a security in the places where the user is from. It ensures that the asset follows legal and regulatory frameworks.

Compliance and Risk Mitigation: To protect investors and traders, Coinbase examines on-chain activity and token distribution to make sure the assets are not associated with financial crime or other consumer safety risks.

Technical Security: The Coinbase team runs a security check to examine contract code, design, and operational risks, ensuring the assets are safe enough to get listed. They also evaluate a new blockchain’s technical design, consensus mechanism, network resilience, and governance model.

What Is the Coinbase Listing Process for New Cryptocurrencies?

By listing an asset on Coinbase, project teams can leverage millions of active traders on Coinbase. A Coinbase listing also confers significant legitimacy to an asset because the process requires multiple examinations and vetting by the Coinbase team.

Even if a project’s public statements, such as whitepapers, websites, and marketing material, contain minor instances of improper information or false promises, it could cause delays (or rejection) in the listing. Coinbase requests clear, factual risk disclosures from the project team in public documentation.

Coinbase lists no asset that submits an incomplete application. They also evaluate the degree of centralized control in a protocol’s technical architecture, including the presence of single points of control, ensuring investors’ safety and security.

We have broken down the Coinbase listing process into the following:

Step 1: Application Submission: First, the project team is required to submit an application at https://www.coinbase.com/listings and request a review from Coinbase. This step involves completing an online questionnaire to provide key information on team background, tokenomics, purpose, technology, and any third-party audits.

Step 2: Initial Business Review: This step includes a business evaluation where the team evaluates factors such as market demand, community traction, and the technical requirements for integration. This is a preliminary assessment in which the Coinbase team determines whether to proceed to the next assessment.

Step 3: In-Depth Analysis: This step includes a core review in which the Legal, Compliance, and Technical Security aspects are evaluated by Coinbase.

Step 4: Notifying the Issuers: Often, the project team is contacted by the reviewers via email, phone, or video calls. To get listed, a timely and complete response is expected from the project team.

Step 5: Listing: Once the project passes all the evaluation checks, it is approved and listed on Coinbase Exchange. The asset becomes available for trading after a technical integration. Depending on the regulations, some assets may be listed in some regions before others.

Step 6: Listing Timelines: Listing on Coinbase could take hours to months, depending on factors such as the asset’s complexity, consumer interest, project quality, the depth of review, and the completeness of the submission.

Tokens on Coinbase-supported networks typically get approved faster than the new or unsupported chains. The reason is that the Coinbase team builds dedicated integration from scratch for new blockchains and comprehensively audits each step of the process.

On average, Coinbase completes the core review in one week and enables trading within two weeks after approving the asset. However, typically it takes under 30 days.

Coins That Didn’t Make the Cut

Now, let’s dive into a few coins that, on paper, could be contenders for Coinbase listings, but didn’t quite make the grade for our top picks.

BlockDAG (BDAG)

BlockDAG is a newer infrastructure project built around a Directed Acyclic Graph (DAG) architecture rather than a traditional, linear blockchain. The idea is to allow multiple blocks to be processed in parallel, offering higher scalability and throughput.

Why it didn’t make our list: Despite the hype, BlockDAG is still very early-stage, with its mainnet yet to be proven. Coinbase historically picks assets with live networks, organic usage, and clearer decentralization signals.

Canton (CC)

Canton is a relatively new blockchain network that combines two of the hottest sectors in the crypto world today: privacy and real-world asset tokenization. The network is powered by CC, a utility and governance token that is used to pay for fees and reward app and infrastructure builders.

Why it didn’t make our list: Despite its sizable market capitalization, Canton is still a new token with a lot to prove before it can secure a Coinbase listing.

MemeCore (M)

MemeCore is a relatively new project with an ambitious goal: to build a new, purpose-built home for the meme coin ecosystem with a no-code launchpad, a decentralized exchange, and its own “Proof-of-Meme” consensus mechanism.

Why it didn’t make our list: MemeCore is one of the most unique tokens with a market capitalization of over $1 billion, but there aren’t enough signs to predict an upcoming Coinbase listing yet.

What Happens When an Asset Is Being Trialled?

Suppose the token passes compliance and technical reviews. In that case, it may enter the exchange in phased rollouts – often starting with limit orders only, restricted availability in certain regions, or gradual opening of trading pairs. It’s important to note that Coinbase never confirms potential listings before adding them to its roadmap, and many tokens with Wallet or Custody support do not progress to a full Coinbase exchange listing.

For investors tracking how to get listed on Coinbase and identifying Coinbase’s new tokens 2026, watching these signals can help spot opportunities, but always with caution, as not every token completes the journey to full listing.

How Often Does Coinbase Add New Coins?

Coinbase does not follow a fixed schedule – listings are driven by each token’s regulatory, compliance, and technical readiness, not by preset timing. As a result, Coinbase’s new listings sometimes happen multiple times in a month, while at other times, weeks may pass with no additions.

In January 2025, Coinbase CEO Brian Armstrong tweeted that with more tokens available than ever before, Coinbase needs to speed up its listing process. He suggests that this may look more like moving from an allow list to a block list with automated scans. Coinbase is still working on this, but we can conclude that Coinbase listings will become more permissive and expansive, with a greater number of tokens eligible for listing by default.

Coinbase’s recent acquisition of LiquiFi supports this intent, making it easier for new projects to launch coins in a way that complies with all the regulatory and technical requirements.

Coinbase regularly updates its Roadmap page, which signals upcoming Coinbase listings. There are typically just a few days in between the Roadmap announcement and listing. To stay ahead, you can track official sources like the Coinbase Blog, Coinbase Assets Official X Page, and CoinbaseSupport for the latest Coinbase roadmap updates and real-time listing news.

New Coinbase Listings for January 2026

Coinbase regularly adds new tokens to its platform, providing investors with access to fresh market opportunities. Previously, it released a list of assets that it was considering to list in the name of transparency, but it now simply updates its ‘Roadmap’ with coins that it has “affirmatively decided to list” already. You can visit the Coinbase Roadmap to see which tokens it is planning to list next.

Here’s a list of some coins that have just been added to the platform.

Live on Coinbase

| Coin | Category | Chain | Market Cap | Volume (7-day avg) |

| Jupiter (JUPITER) | Utility token | Solana | $525.6M | $17.9M |

| Plasma (XPL) | Utility token | Plasma Network | $246M | $122.2M |

| Beam (BEAM) | Utility token | Beam Network | $120.5M | $3.9M |

| Plume (PLUME) | Utility token | Plume Network | $46.5M | $11.1M |

| Humidifi (WET) | Utility token | Solana | $35.4M | $26.6M |

| zkPass (ZKP) | Utility token | zkTLS | $23.7M | $89.2M |

How Coinbase’s New Acquisition Could Change Everything

In October 2025, Coinbase acquired Echo, a crowdfunding platform that helped launch some of the most innovative projects in the market today, such as Ethena. Echo is one of the largest launchpads in the crypto market, allowing developers to raise funds from the community, with over $200 million raised for more than 300 projects.

Some analysts expect Coinbase to merge the platform with its exchange to offer a product similar to the Binance Launchpad, which also helps crowdfund new crypto projects. However, Echo’s founder, Jordan Fish, a popular crypto influencer who goes by “Cobie,” stated in an X post that it will remain separate from Coinbase for the time being. Nevertheless, in the same post, he noted that the Echo team will “likely introduce new ways for founders to access investors, and for investors to access opportunities into Coinbase itself.”

No one knows exactly what this will look like yet, but it seems certain that the acquisition will eventually lead to some kind of early-stage investing access for Coinbase users. Projects hosted by this new mechanism may be favored over other projects for Coinbase listings down the road as well, making this rollout especially important to watch for investors hoping to catch these listings early.

How We Picked These Potential Upcoming Coinbase Listings (Our Methodology)

We didn’t just throw darts at a board. Our team looked at data, trends, and real-world signals to pick the projects that could realistically appear on Coinbase this year. Of course, nothing is guaranteed. Exchanges can still list or pass on coins for all sorts of reasons. Still, the coins we talked about show the kind of traction and compliance signals Coinbase usually looks for.

1. Coinbase Wallet & Custody Support (35%)

Coinbase tends to test new tokens in its self-custodial wallet (the Base App) or its institutional custody platform before it adds them to the main exchange. This lets them see if there is demand, make sure the technology works, and double-check regulatory compliance.

Tokens that follow clean standards like ERC-20 or Solana’s SPL usually move faster through these tests. If a token already has wallet support, it is a strong hint that it could come to Coinbase next.

2. Activity on Other Exchanges (CMC & CG Tracking) (25%)

We looked at which coins are getting real trading volume on major exchanges like Binance, Bybit, and MEXC. A project that is active on multiple platforms shows it is technically solid and already gaining trust in the community.

We checked CoinMarketCap and CoinGecko for liquidity, exchange listings, and trading activity. This helps us determine if the token is real and not just hype.

3. Sector Momentum: What’s Trending in 2026 (25%)

Coinbase prioritizes tokens in high-demand sectors. For 2026, the trends gaining traction in listings are:

- AI and machine learning tokens

- Layer 2 scaling solutions

- Memecoins

- Trading bots & telegram utilities

- Modular blockchain infrastructure

- Interoperability protocols

- Meme coins with significant community support

We gave additional weight to tokens operating in these categories.

4. U.S. Regulatory Readiness (15%)

Coinbase, as a U.S.-regulated exchange, is highly selective when it comes to compliance. In our evaluation, we considered whether each project follows KYC/AML best practices, whether the team is U.S.-based or at least U.S.-friendly, and whether it has undergone public audits or provided regulatory disclosures.

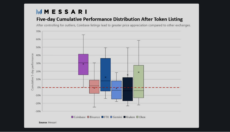

Why Coinbase Listings Matter (and What Is the Coinbase Effect?)

Many investors track Coinbase’s new listings closely – and for good reason. Being listed on Coinbase can offer significant advantages for crypto projects. But why do Coinbase listings matter so much?

The key benefits of a Coinbase listing include enhanced trust and visibility, especially in the U.S. market. Coinbase is one of the most regulated and compliant exchanges globally, making it a gateway for many retail and institutional investors. A listing often signals that a project meets high technical and legal standards, which can boost credibility.

Additionally, a Coinbase listing pump – known as the Coinbase Effect – is a well-documented phenomenon. Tokens often experience short-term price spikes, on average around 91%, after being listed on Coinbase, due to sudden exposure to millions of new potential buyers. For example, Shiba Inu (SHIB) and Arbitrum (ARB) both saw notable price increases following their listings on Coinbase.

A graph illustrating the 5-day token price performance after Coinbase listing, in comparison to other exchanges. Source: Yahoo Finance

While not every listing guarantees a pump, inclusion on Coinbase remains one of the most valuable milestones for any crypto project, and a key reason why savvy investors monitor Coinbase’s new listings and their potential market impact.

How to Track Coinbase Listings Before They Go Live

While Coinbase doesn’t confirm listings in advance, there are new listing signals, and public tools that may help you find new Coinbase listings early.

Below, you can find a list of our research-driven suggestions on how to track new potential coins to be listed on Coinbase.

Signals That Coinbase May List a Token

Certain Coinbase listing signals often appear before a full listing. The strongest signs that a coin will be listed include Base App support and a listing on Coinbase Custody. These are often early steps in Coinbase’s process. Other good signals: strong U.S. regulatory alignment, high market capitalization, strong community support, and listings on major centralized exchanges. While not guaranteed, these patterns are worth tracking.

Where to Find New Coinbase Listings First

To find new Coinbase listings, start with the official Coinbase Roadmap and Digital Asset Listings pages – tokens often appear there before an exchange listing. Also, follow the Coinbase Blog. For faster updates, many investors use Coinbase alerts via Twitter bots, DEX tracker bots, and crypto listing calendars. To see what coins are listed on the Roadmap, follow @CoinbaseAssets on X. Additionally, if you follow a project on their Telegram group, they may give advance notice of a Coinbase listing. However, with so many new crypto projects emerging daily, this can be challenging, and you may encounter false rumors.

How to Set Up Coinbase Listings Alerts

Catching a new Coinbase listing early can make a huge difference. This may allow you to get in before the hype hits. Luckily, there are a few simple ways to set up alerts so you don’t have to constantly refresh pages.

Follow official Coinbase channels

Start by following @CoinbaseAssets on X. This is Coinbase’s main account for announcing new listings. Turn on notifications so you get an instant ping when they post something new.

Use Google Alerts

Set up Google Alerts for phrases like “Coinbase new listing” or “Coinbase coin alert”. This way, you will get emails whenever something new pops up online. It’s an easy way to catch announcements outside social media.

Join Telegram or Discord bots

There are Telegram and Discord bots that track new listings and roadmap updates from exchanges. Stick to the well-known bots with good reputations. You can easily get alerts as soon as tokens are added or approved.

Add coins to the Coinbase Watchlist

Inside the Coinbase app, you can find the Watchlist feature. Add coins you are interested in. Once you do, Coinbase will notify you as soon as they are available to trade.

Keep an eye on wallet support updates

Sometimes, Coinbase adds a token to its Base app or custody wallets before a full exchange listing. This can be an early signal.

Coinbase New Listings Notifications

Here’s how to set up Coinbase’s new listings notifications:

Mobile:

- Follow @CoinbaseAssets with push alerts

- Add tokens to your Coinbase Watchlist

- Use Telegram alert bots like CoinMarketCap

Desktop:

- Set Google Alerts (e.g. “Coinbase listing tracker”)

- Use browser tools like CoinMarketCap Watchlist

- Check the Coinbase Roadmap and Blog regularly

These simple tools help you stay ahead of new coin alerts and listing updates.

What Is the Base App? (Formerly Known as the Coinbase Wallet)

The Base App, which was previously known as ‘Coinbase Wallet,’ is similar to a decentralized self-custody wallet such as Best Wallet, Phantom, or MetaMask.

Despite the rebrand, the wallet remains the same, running on Coinbase’s decentralized Layer 2 BASE blockchain, but the move comes as Coinbase wants to get more people using the Base App for everything. Like X and other companies before it, Coinbase wants its wallet to be a ‘super app’, or in this case, the ‘crypto everything app’.

New features include social network functions such as a news and social feed, messaging, a store for mini apps, and quick payments using USDC. And last but not least, crypto trading. The Base App contains an SDK to help builders make mini apps to run alongside it. The app will make it easier for microtransactions, such as tips for content creators.

The Base app will also be integrated with Shopify and other merchants as a quick way to pay, alongside PayPal, Google Pay, and more. Coinbase has said that it will offer a 1% cashback in USDC for certain stores. Coinbase’s aim seems to be, in part, to target consumers who may not yet be familiar with web3 or don’t currently want to trade crypto. Instead, they will use the Base app to integrate the blockchain into people’s everyday lives.

Base App Listings vs Exchange Listings

Understanding the difference between Base App and Coinbase Exchange listings is crucial for tracking a token’s progress toward a full listing.

A Base App listing means a token is supported in the Base App – a self-custody tool that allows users to store, send, and receive tokens directly, and can interact with the BASE blockchain. This integration indicates that the token has passed initial technical checks (such as EVM or SVM compatibility), but it is not currently tradable on the Coinbase Exchange. Still, it often serves as a first signal that a token is on Coinbase’s radar.

A Coinbase Exchange listing, by contrast, means the token is fully tradable on the Coinbase trading platform, complete with order books, liquidity, and access through standard Coinbase user accounts. If a user loses their password to their Coinbase Exchange account, the support team can assist them in recovery.

In many cases, tokens first appear in Base App before eventually being listed on the Exchange, but not always. For example:

- SHIB was supported in Base App months before it became tradable on the Exchange in 2021.

- IMX (Immutable X) was added to Base App and Custody first, then listed with full trading support.

- BONK, a Solana meme coin, appeared in Base App before being added to the Exchange as user demand surged.

This Wallet-first strategy gives Coinbase time to evaluate regulatory, technical, and market readiness before committing to a public listing.

Base App vs Exchange Listings – Key Differences

| Feature | Base App | Coinbase Exchange |

| Purpose | Self-custody and storage | Buying, selling, and trading |

| Availability | Base app only | Coinbase.com or the mobile app |

| Token support | Broader, earlier-stage tokens | Curated, trade-ready tokens |

| Listing signal | Often, a first step | Final step with liquidity support |

| Example tokens | BONK, SHIB (pre-listing), IMX | SHIB, IMX, ARB |

Tracking Base App support is a smart way to get ahead of potential Exchange listings – but it’s not a guarantee.

Check official support pages to track real-time status:

You can also refer to Coinbase’s official guide on listing prioritization:

Pros and Cons of Buying Coins Before a Coinbase Listing

Here’s a quick look at the early crypto investing pros and cons when considering whether to buy before a Coinbase listing:

Pros

- Potential upside from the Coinbase Effect. Prices often spike when a coin lists on Coinbase.

- Early entry point. Buying pre-listing can mean lower prices.

- Liquidity boost. Coinbase listings often drive higher trading volume and awareness.

Cons

- Listing delays or cancellations. Not all tokens with signals will be listed.

- Low liquidity pre-listing. Harder to enter/exit large positions.

- Misleading rumors. Not all Coinbase presale strategy tips are accurate; many coins are hyped without real progress.

- Regulatory risks. Unlisted tokens may face compliance challenges or legal uncertainty.

As with any strategy, buying ahead of Coinbase new listings comes with both potential rewards and risks, so how should you approach these opportunities overall?

Is Monitoring Potential Coinbase Listings Worth It?

As we’ve explored, a Coinbase listing can offer major visibility, trust, liquidity, and potential price momentum for a token. Many 2026 Coinbase listings will likely benefit from the exchange’s strong U.S. presence and institutional reach. However, we can only guess which coins will likely be listed next, and listings don’t necessarily help boost a coin’s price.

Speculating on upcoming Coinbase listings is even riskier than some other crypto investments because if the exchange passes on the token, many investors might lose interest, and its price could suffer significantly. If you do manage to preempt a major listing, you might be able to secure major profits, but timing, liquidity, and especially market sentiment all play major roles. These listings simply don’t guarantee success.

If you’re determined to catch Coinbase listings early despite the risk, the most effective approach is likely just to stay informed: monitor official listing signals, follow key market trends, and conduct your own due diligence before investing.

FAQ

What coins will Coinbase add next?

Where does Coinbase announce new listings?

How do I find upcoming Coinbase listings?

How often does Coinbase list new coins?

Does a Base App listing mean a coin will be listed on the exchange?

What is the Coinbase Effect, and is it real?

Is it smart to buy coins before they list on Coinbase?

How do I get notified when Coinbase adds a new coin?

References

- Asset Listing Process (Coinbase)

- 2025 Crypto Market Outlook (Coinbase)

- What Types of Crypto Does Wallet Support (Coinbase)

- Coinbase’s Calvert: Staying ‘Token Agnostic’ For New Listings (Bloomberg)

- Coinbase to list the Fartcoin, Subsquid, and PancakeSwap token (The Block)

- Increasing Transparency For New Asset Listings on Coinbase (Coinbase)

- Coinbase acquires Echo: Unlocking the future of onchain capital formation (Coinbase)

- Embracing decentralization at Coinbase (The Coinbase Blog on Medium)

- Coinbase’s new super app Base is a game changer – and could become a serious money maker (Fortune)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

BMIC (BMIC) is a presale project that wants to create quantum-resistant security for crypto wallets and digital assets. The team s...

Wondering how to buy crypto but not sure where to start? Our beginner's guide explains how and where to invest in digital assets l...

Fact-Checked By:

Fact-Checked By:

Otar Topuria

Crypto Editor, 30 postsI’m a crypto writer and analyst at Coinspeaker with over three years of experience covering fintech and the rapidly evolving cryptocurrency landscape. My work focuses on market movements, investment trends, and the narratives driving them, helping readers what is happening in the markets and why. In addition to Coinspeaker, my insights and analyses have been featured in other leading crypto and fintech publications, where I’ve built a reputation as a thoughtful and reliable voice in the industry.

My mission is to demystify the crypto markets and help readers navigate the noise, highlighting the stories and trends that truly matter. Before specializing in crypto, I worked in the IT sector, writing technical content on software development, digital innovation, and emerging technologies. That made me something of an expert in breaking down complex systems and explaining them in a clear, accessible way, skills I now find very useful when it comes to unpacking the intricate world of blockchain and digital assets.

I hold a Master’s degree in Comparative Literature, which sharpened my ability to analyze patterns, draw connections across disciplines, and communicate nuanced ideas. I’m particularly passionate about early-stage project discovery and crypto trading, areas where innovation meets opportunity. I enjoy exploring how new protocols, tokens, and DeFi projects aim to disrupt traditional systems, while also evaluating their potential risks and rewards. By combining market analysis with forward-looking research, I strive to provide readers with content that is both informative and actionable.