Ibukun is a crypto/finance writer interested in passing relevant information, using non-complex words to reach all kinds of audience. Apart from writing, she likes to see movies, cook, and explore restaurants in the city of Lagos, where she resides.

According to the 2022 IPO Prospectus, Jack Ma commands 50.52% of Ant shares through related entities.

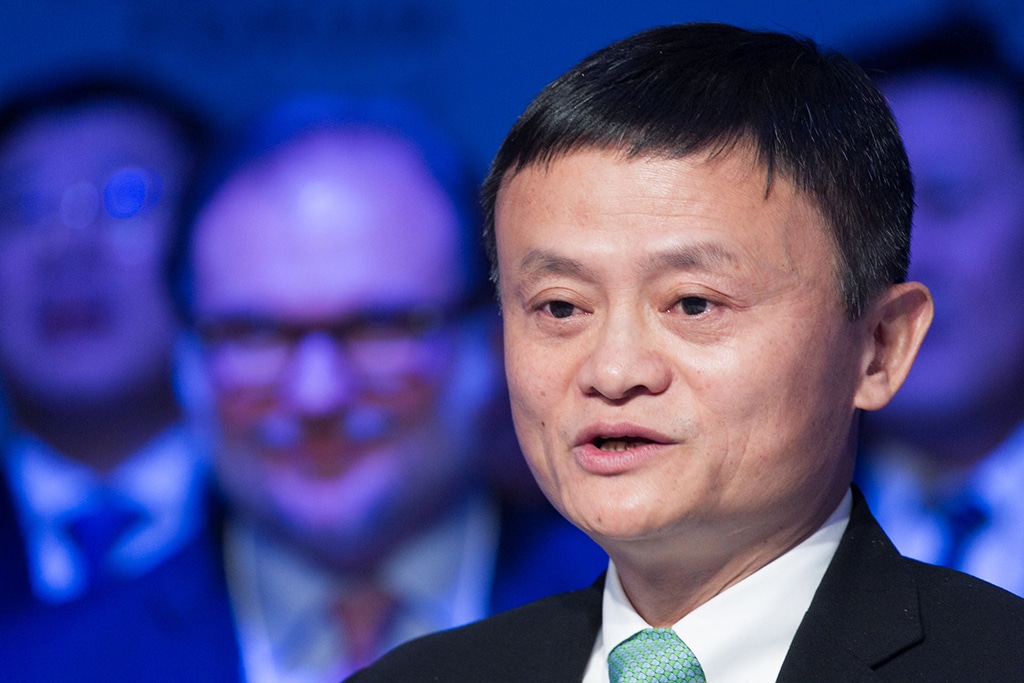

Chinese business magnate Jack Ma is planning to give up control of Ant Group, which is closely associated with his own company Alibaba Group Holding Limited. Although Jack Ma has only a 10% stake in Ant Group, the billionaire exercises authority over the company through other related entities as revealed in Ant’s IPO filing in 2020.

Ant Group is about to experience another significant turn in its restructuring if or when Jack Ma cedes control. The Chinese regulator called off the financial services company’s IPO in 2020, forcing the company to restructure. The authorities halted the public offering, which was going to be the largest public listing in the world. Subsequently, the regulator ordered Ant Group to go through a “rectification” process to subject the financial services company to similar financial regulators that control traditional banks.

Before the regulators switched into action, Ant Group has been consistently expanding due to a lenient regulatory environment. The Group established a lot of fintech businesses including Alipay. Since its inception, Alipay has grown to become a dominant business in the mobile payment market in China. However, all breakneck growth was suspended when Chinese financial authorities told Ant to “return to its roots in payments and bring more transparency to transactions.”

The authorities also requested that Ant Group obtain the necessary licenses for its credit business. In addition to protecting user data privacy, the company was asked to establish a financial holding company that holds sufficient capital. More of the regulator’s order was that Ant “revamp its credit, insurance, wealth management and other financial businesses according to the law; and step up compliance for its securities business.”

Coinspeaker reported last year that Ant Group was exploring options for Jack Ma to Divest Stake. Reliable sources said at the time that Ma’s exit could relieve the company of Beijing’s scrutiny.

According to the 2022 IPO Prospectus, Jack Ma commands 50.52% of Ant shares through related entities. This control makes the billionaire Ant’s largest shareholder. The Wall Street Journal reported that Jack Ma could cede control over Ant by transferring some of his voting power. According to the report, the Chinese billionaire could give some voting power to CEO Eric Jing and other officials. Ant, which plans to restructure into a financial holding company, has informed the regulators of Ma’s intention to relinquish control. Although the authorities did not demand the change, they gave their blessings.

The change in control could slow Ant’s plans to resume its IPO move. In June, the company said it has no plans to initiate an IPO. Rather it is focusing on moving ahead with its rectification work.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Ibukun is a crypto/finance writer interested in passing relevant information, using non-complex words to reach all kinds of audience. Apart from writing, she likes to see movies, cook, and explore restaurants in the city of Lagos, where she resides.