MEXC Futures Business Grows 1200%, Highlighting the Advantages of Liquidity and Fee Rate

In early December, the cryptocurrency exchange MEXC announced that its futures business made a significant breakthrough in 2022, with an average daily trading volume growth of 1200%. This data can be verified from third-party public data.

On December 20, CoinMarketCap‘s data showed that among the main exchanges, the daily trading volume of MEXC’s futures reached $2.4 billion, ranking fourth globally.

The main reason for the growth of MEXC futures business is that the exchange has reportedly continuously optimized the liquidity of the top 50 tokens by market cap since the beginning of this year. As a result, by the third quarter of this year, the liquidity of MEXC futures business had reached the leading level globally.

For futures traders, liquidity is the core indicator, which directly determines trading fees and experience. This is because the better the liquidity, the better the depth, the higher the turnover rate, the smaller the price difference, the lower the trading fees, and the faster the trading speed. At the same time, under extreme market conditions similar to March 12, 2020, futures products with high liquidity can avoid accidental “pin bar” patterns.

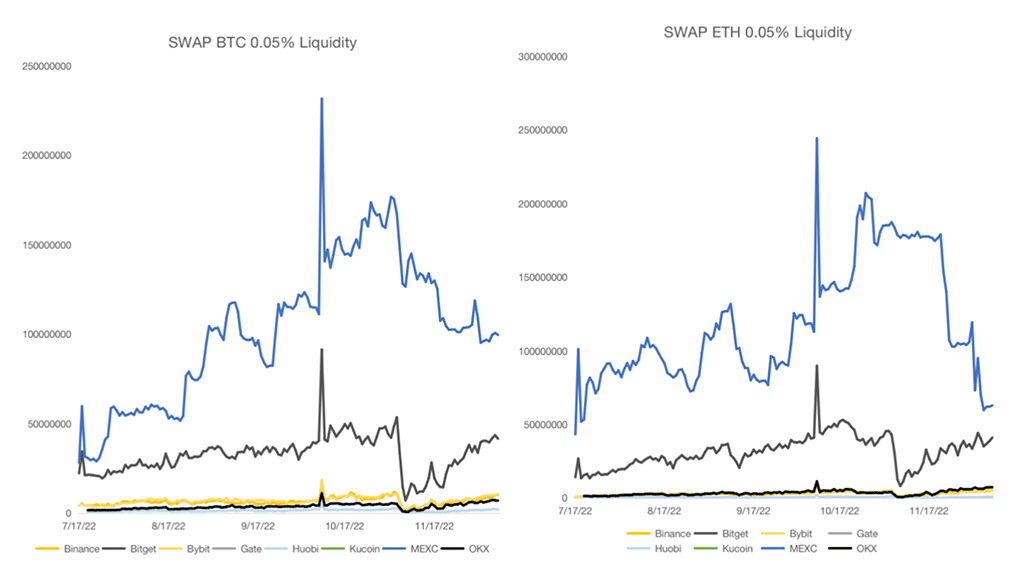

The figure below shows the futures liquidity data of BTC/USDT and ETH/USDT on main exchanges. From July to November, under the trading depth of 0.05%, the liquidity of MEXC and Bitget ranked first and second, respectively.

Liquidity Comparison Among Mainstream Exchanges

In addition to liquidity, the number of cryptocurrencies supported by the futures exchange and the trading fee rate are also comprehensive indicators considered by traders. One of the most important factors is the fee rate. The lower the fee rate, the lower the trading fee.

On Maker fees, Bybit’s fee rate is 0.01%, while Binance and others have a fee rate of 0.02%. On the other hand, MEXC reduced Maker fees to 0% from December 1 onwards, equivalent to giving up Maker fees and passing them on to futures users. On Taker fees, MEXC, Bybit, and Kucoin charge them at 0.06%, while Binance and Huobi have the lowest rate of 0.04%.

CoinGecko’s data shows that in terms of the number of trading pairs, Binance supports the most futures trading pairs, having 233 pairs at present. However, different trading pairs of the same cryptocurrency are listed on each exchange, such as BTC/USDT and BTC/USDC, etc. Excluding duplicate data, then MEXC has listed the most cryptocurrencies for futures products, with more than 179, while Binance has listed more than 137.

The number of listed cryptocurrencies is more apparently advantageous during the bull market. Because of the high frequency of project list during the bull market, there will be a time difference between different exchanges. For some traders, the futures trade of minor market cap cryptocurrencies can better meet their needs. However, with the end of the bull market, the frequency of project lists on the secondary market will gradually decrease, and the gap between the number of cryptocurrencies listed on each exchange will gradually decrease as well.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.