New Partnerships, Milestones and Developments, Hada DBank Moves Forward

Over the last few months the team at Hada DBank have been busy developing their blockchain technology in preparation for the banking platforms imminent launch.

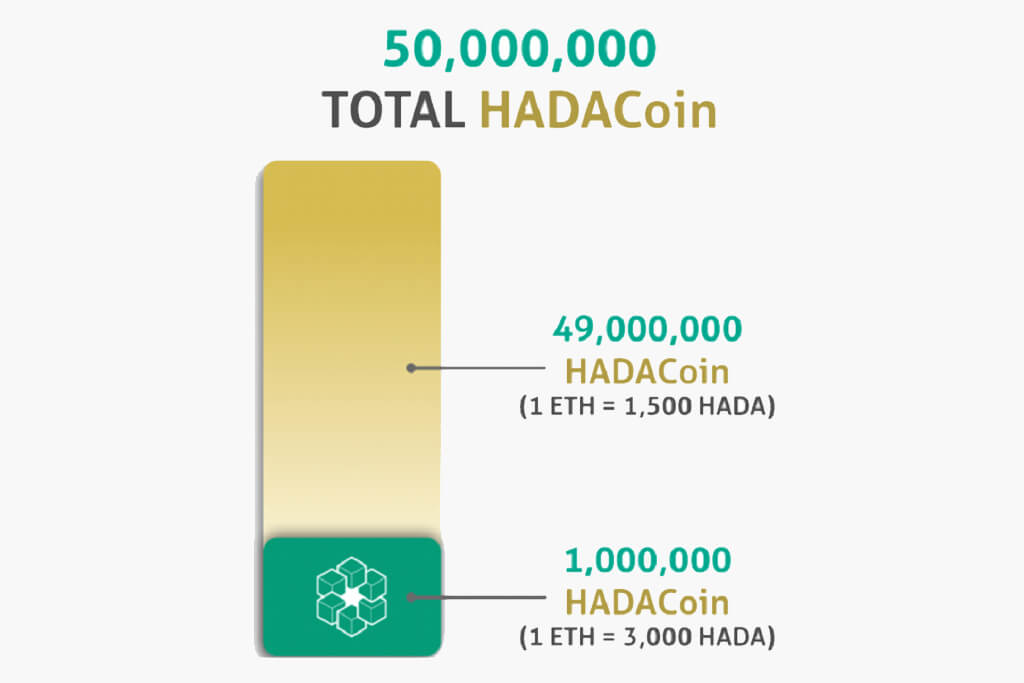

Hada DBank recently updated its HADACoins, redistributed the new tokens to all the token holders. The new update saw a significant update, offering enhanced security and functionality, as well as a more streamlined code to adhere to the current ERC-20 standard.

September also saw the establishment of another strategic partnership for Hada DBank. Secure Coin Broker (SCB) joins in as HADADBank OTC Partner. SCB is an institutional trading firm focused on providing two-way OTC transaction settlement for both private and institutional clients. The company are specializing in both large and small block trades with secure custodial services through escrow partners. SCB also offers turn-key white label software solution for ICO’s, exchanges and FX operators.

Michael Buchbinder, Partner Secure Coin Broker, stated:

“Secure Coin Broker is looking forward to working with Hada DBank and its clients offering them quick and easy ways to acquire or liquidate their digital asset holdings.”

On the matter of banking license, in October, the management has initiated the process to apply for a Euro Banking License from an EU Country Member. Hada DBank are currently in the final stage to select a consultant to assist them in obtaining the license, in which the duration is estimated around 6 months or more, pending procedures and documentation from the host country as well as approval by the European Central Bank (ECB).

With its HQ set to be based in Switzerland, registration of the stronghold will be done during the application of the EU Banking Licenses.

Hada DBank has also decided on making Indonesia it’s regional base for its the ASEAN market. Indonesia has a population of 290 Million, 227 million of which, are Muslims, and present the ideal target market for Hada DBank to grow and serve its South East Asia customers.

The Middle East & North Africa (MENA) are also very relevant markets, that Hada DBank is focusing their attention on as they look to develop in late 2018, early 2019. A MENA Regional Office will be announced by Q3 2019 once negotiations with potential investors in the region are completed.

Hada DBank is also currently in talks to venture into an academic partnership. Currently, they are looking into partnering with an international university to introduce a join certified programme at their university and establish a Lab at the university to train the students.

A 24-Month Expansion Plan has been drafted. Plans include to create a future technology hub in ASEAN region and expanding HADA brand into other sharia-compliance related FinTech projects i.e HADA Exchange at the Hub.

About Hada DBank

Set to revolutionize the world of banking, Hada DBank determines to fuse blockchain technology with Islamic Banking Module. Having recognized the challenges for customers in the current banking state, blockchain technology will ensure security and transparency, while Islamic Banking module will ensure ethical banking and investment.

Hada DBank believes in benefiting and putting clients interests first, rather than profiting without limit and ethics. ‘Caring & Personal’ are the two words that will be embedded in every aspect of Hada DBank’s corporate culture, product, and services.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.