TikTok Owner ByteDance Reveals that Its Annual Revenue Soars to $34.3B in 2020

As of December 2020, ByteDance’s active users were roughly 1.9 billion each month across all its platforms.

As of December 2020, ByteDance’s active users were roughly 1.9 billion each month across all its platforms.

Goldfinch aims to solve the issue with overcollaterization in the DeFi space while bringing together creditworthy loan providers and borrowers.

The losses that are seen in the Dow Jones Industrial Average, as well as other market trackers, can also be attributed to the rising inflation fears.

Together Canaan and Genesis Digital Assets will strive to deliver and ascertain ease in crypto agreements and transactions.

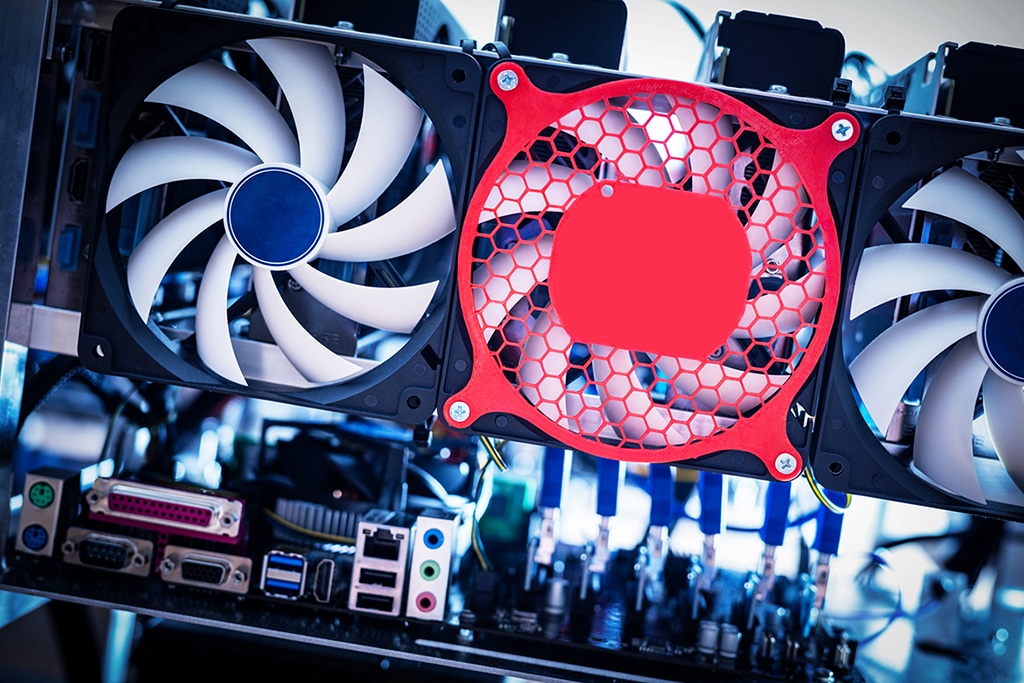

Bitcoin mining stocks have performed much better than Bitcoin has in the last one year. These stocks are rising despite China’s crackdown.

With the failure of Twitter to comply with the new rules, the Tech Ministry warned the firm earlier this month of “Unintended Consequences.”

The WOOF stock surge might also have been attributed to the announcement that Petco would virtually present at the Evercore ISI Consumer & Retail Summit.

With the upcoming listing, Krafton seeks to break the biggest debut record in South Korea, which is currently held by Coupang.

On Monday, Lordstown Motors stated that they will start customer deliveries in Q1 2022. RIDE stock is up.

The latest fundraise will help dYdX steer ahead its goals of platform improvement as well as solve matters related to liquidity provision on the exchange. dYdX is also looking to add more assets and launch a mobile app in the near future.

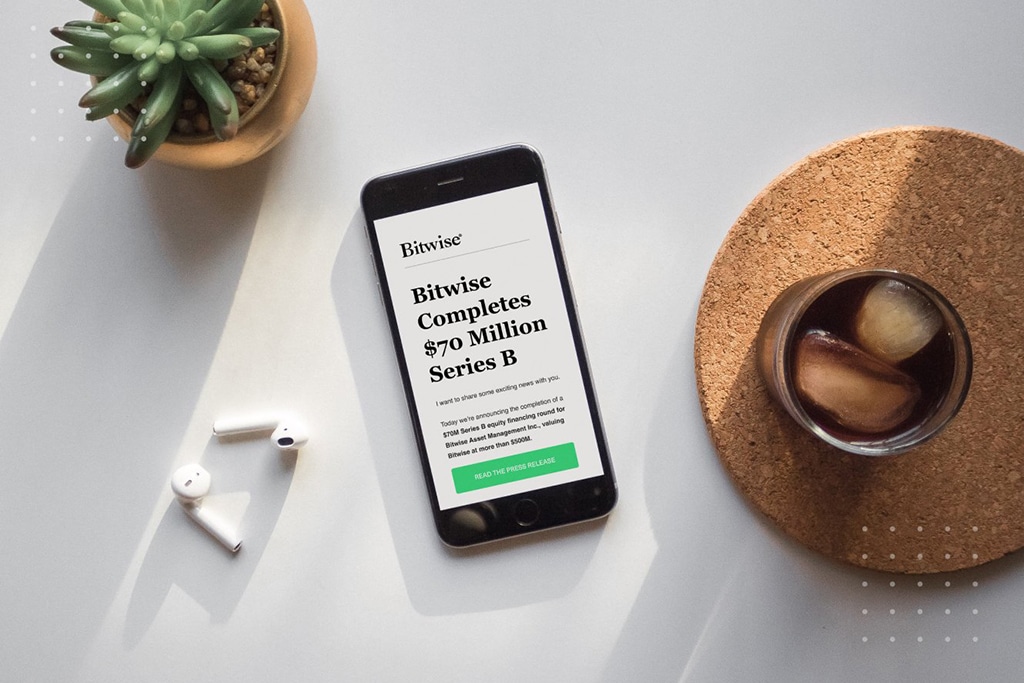

With the funding, Bitwise is looking to expand its offerings to more banks and asset management firms.

Amazon streaming hours on Prime Video are up 70% year-over-year and therefore, Luna is expected to positively impact sales.

Ramp is building in the cryptocurrency ecosystem, which Paypal has been able to enshrine in the world of ecommerce.

Brane Capital has revealed its plan to go public via the TSX exchange by end of the year 2021.

While anticipations are high, billionaire hedge fund manager Paul Tudor Jones warns that a wrong move or comment from the Fed Chairman Jerome Powell could spark a sell-off in risk assets.