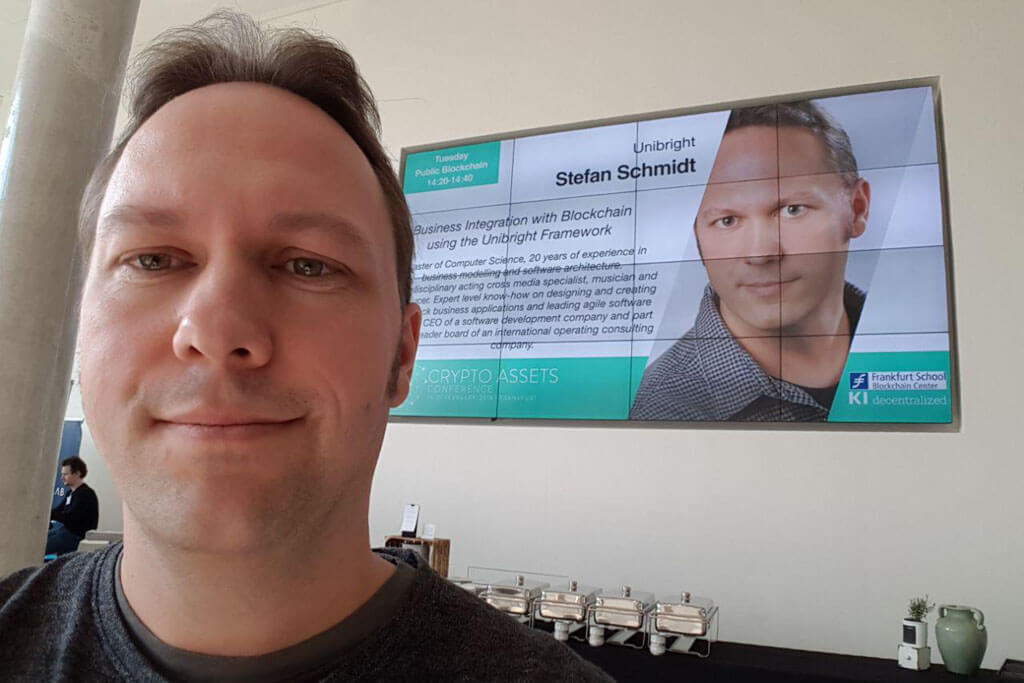

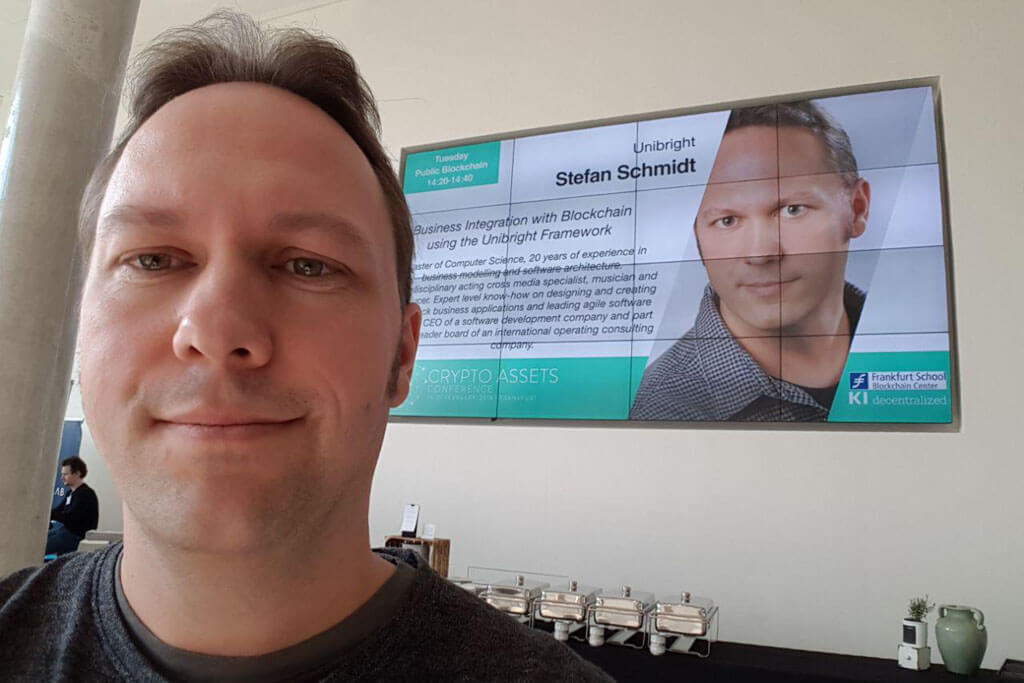

Blockchain-based Business Integrator UniBright Launches TGE on April 10th

A promising startup UniBright will facilitate the process of Blockchain adoption by businesses with the launch of its ICO on 10th April, 2018.

Stay ahead of the crypto curve with in‑depth coverage of the digital‑asset ecosystem. Here you’ll find the latest on new coin launches, regulatory shifts, wallet innovations and market movements across major chains. Whether you’re a seasoned trader or just exploring the space, our timely updates offer clarity on the crypto universe’s fast‑evolving landscape.

A promising startup UniBright will facilitate the process of Blockchain adoption by businesses with the launch of its ICO on 10th April, 2018.

Coinbase makes it clear that it still stands by the earlier decision of the “committee of internal experts” to not add Ripple to its platform, at the moment.

Lucyd has announced its strategic collaboration with SuperWorld, aiming to provide a social AR platform and developer tools on Lucyd Lens smart glasses.

Welcome Paymon, a platform working to enable crypto traders securely exchange assets, and crypto wallet holders make purchases and payments with ease.

Blockchain-based DATx, the product of collaboration between Cosima Foundation and Avazu, is to decentralize the current digital advertising structure.

ARK continues to develop its platform in total transparency, and is looking forward to present a new and improved version of the project.

The auction this month will consist of 14 separate blocks that comprise of a combination of two blocks of 500 BTC, 11 blocks of 100 BTC, and one block of 70 BTC.

Meet CREDITS, an open blockchain platform, designed to create services for blockchain systems using self-executing smart contracts and public data registry.

DATx, a blockchain-based advertising solution developed by Cosima Foundation, has finished its first successful TGE raising a total of 50,000 ETH.

Cosima Foundation has collaborated with Avazu, a leading advertising platform with global coverage, for the development of its blockchain platform DATx.

Buzzshow, a decentralized video social network, will give its users more privacy and the possibility for everyone to be trustfully rewarded.

Created for both borrowers and lenders, LendingBlock brings the traditional financial tools to the world of cryptocurrencies.

After having secured SCIC status in France, ARK is preparing to run the first official gathering for its ARK project, ARK Con, set on March 22, 2018.

Following a recent hack resulted into $533 million-worth theft of the NEM token from Coincheck, a group of 16 registered Japanese cryptocurrency exchanges joins forces to establish a self-regulatory body in April.

Social networks need no introduction today. They are everywhere. But what if we add some challenges to their concept? PROVOCO can show you the result.