First Blockhain Ecosystem of Israel Reached $2.5 million in Token Sale

The first “Kosher” ecosystem named BitCoen has been launched in Israel. The first token sale has reached $2 500 000.

Stay ahead of the crypto curve with in‑depth coverage of the digital‑asset ecosystem. Here you’ll find the latest on new coin launches, regulatory shifts, wallet innovations and market movements across major chains. Whether you’re a seasoned trader or just exploring the space, our timely updates offer clarity on the crypto universe’s fast‑evolving landscape.

The first “Kosher” ecosystem named BitCoen has been launched in Israel. The first token sale has reached $2 500 000.

The robotics firm Kepler Technologies has presented its very own blockchain-based platform aiming to build an international AI and robotics ecosystem.

Trading gets easier as a new platform is set to detect trends on crypto market by analyzing social media and using machine learning based predictions.

HADA DBank will fuse Islamic banking module with blockchain technology to let everyone enjoy the benefits of its transparency and risk sharing.

The MCC code changes made by the card issuers and the card networks resulted in charging extra fees to the customers.

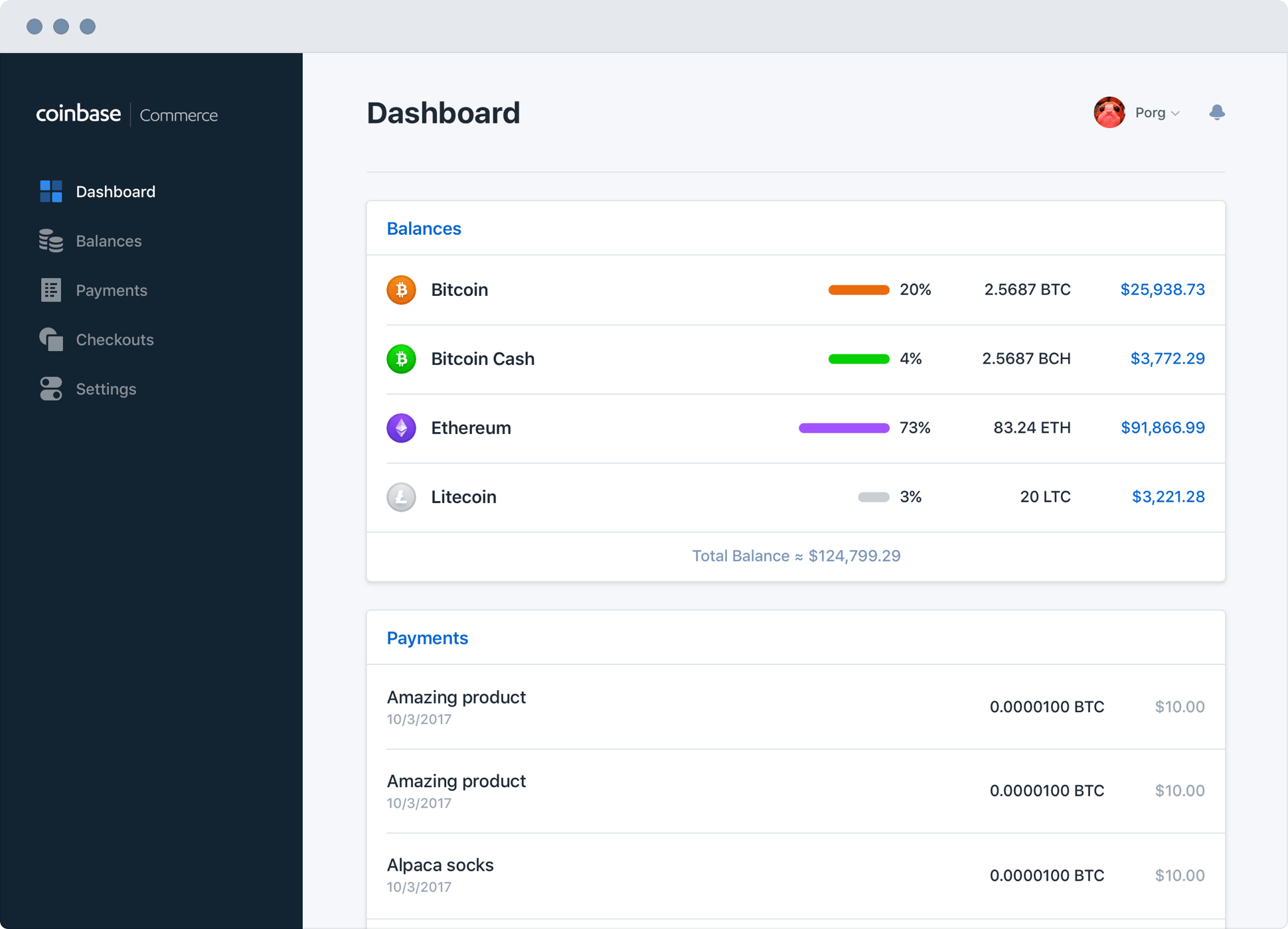

Coinbase, the largest cryptocurrency exchange and wallet provider in the U.S., has launched a PayPal-like plugin. Coinbase Commerce allows to make Bitcoin, Bitcoin Cash, Ethereum and Litecoin payments.

The company creates the platform where the best ideas of VR content will become actual simulations – and attracts first users offering 25% bonus during the pre-ITO.

ATF is the first token that allows the blockchain community to have easy access to advanced technologies in automated agro cultivation equipment manufacturing.

ARK announces its next update to API V2, fully RESTful and compliant to the JSON API specifications, facilitating and improving all the current processes.

The CFTC is looking for a collective effort from several private as well as government players in order to form the regulatory framework around cryptos while protecting investor’s interests.

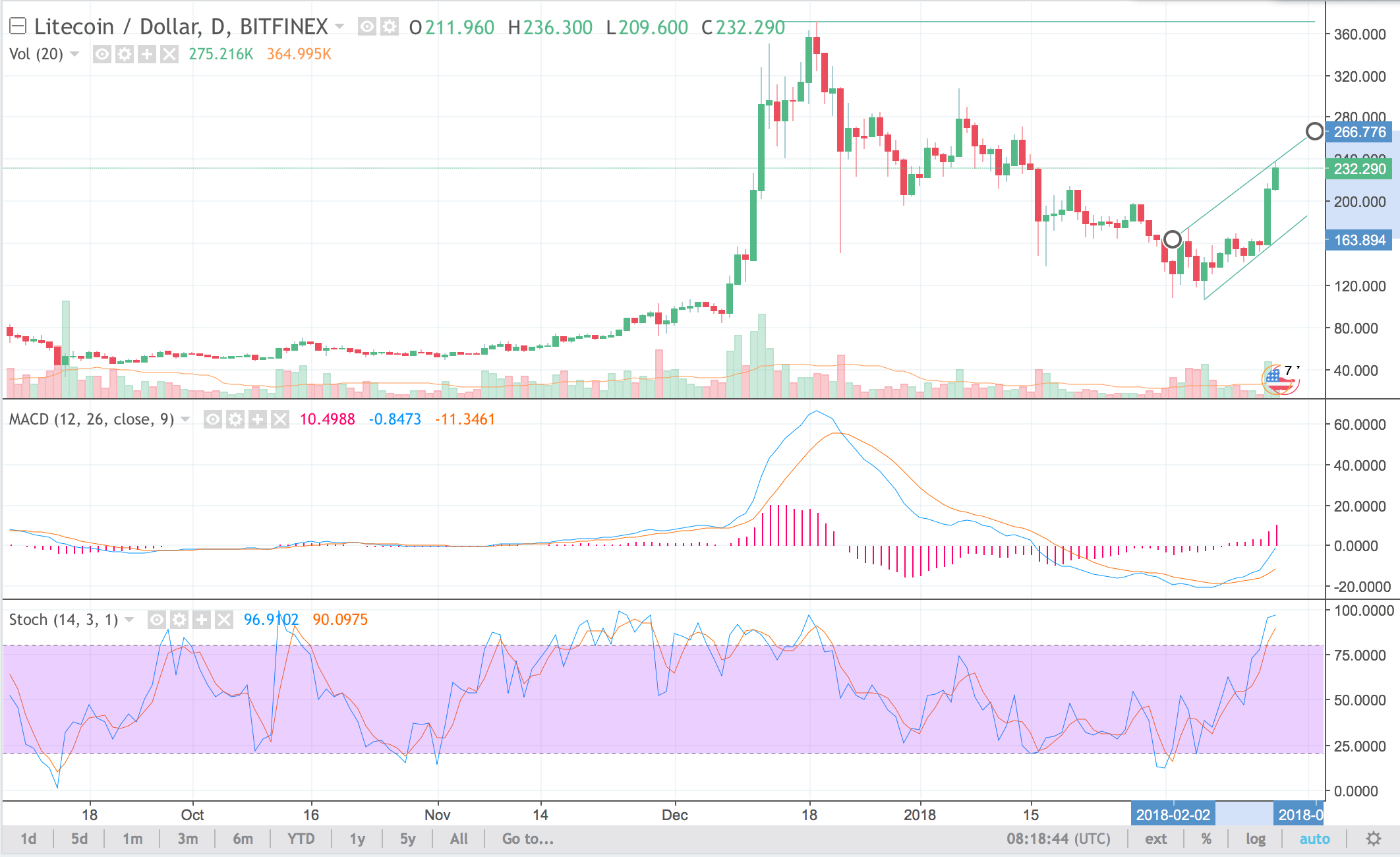

Please, check out weekly technical analysis of Litecoin (LTC) price prepared by Dmitriy Gurkovskiy, a chief analyst at RoboForex.

The Saudi Arabian Monetary Authority (SAMA) is the second biggest banking institutions to adopt blockchain technology after the Bank of England.

Aditus, the world’s first decentralized luxury access platform, had successfully completed the cryptocurrency payment at Art Stage 2018 expo in Singapore.

South Korea considers new approach to cryptocurrency regulation contributing to the new rise of Bitcoin.

The US largest cryptocurrency exchange, has made several important announcements in its latest blog post, mostly regarding PayPal withdrawals and accepting new US credit cards.