Bitcoin Price Could Hit $1,000,000 by 2029, Says Perianne Boring

As the crypto market evolves, only time will tell if Bitcoin can truly reach $1 million by 2029, altering how investors view and interact with digital assets.

For the average millennial or at least anyone that pays attention to the business world, the term “cryptocurrency” would not seem like such a strange word. If that is, then the terms Bitcoin, Ethereum or at least Blockchain should ring a bell. One might wonder, why are these terms suddenly so prevalent, especially cryptocurrency news? Computing is getting rather pervasive and the society is leaning towards digital services. The finance world too isn’t spared as the disruption of technology into this sector has fostered the birth and development of Fintech organizations.

These Fintech organizations look to digitize payments and transactions, offering the same services that are currently in existence but in a better, efficient and more effective way.

Blockchain is the network upon which most of these cryptocurrencies operate on. The history of blockchain and bitcoin, in particular, does not have a definite story. In 2009, an individual or group of individuals known to be “Satoshi Nakomoto” developed and published the technology to allow people make digital payments between themselves anonymously without having an external party to verify or authorize the transfer of the currency being exchanged.

Although technologies like this might seem rather complex, understanding how Blockchain works is quite easy, given that one has a basic idea of how networks work. Blockchain is simply a database shared between several users, containing confirmed and secured entries. It is a network, where each entry has a connection to its previous entry.

This technology affords a very secure model whereby every record in the database cannot be tampered with. Apart from the stellar security that this network offers, the transparency and speed at which the network operates give it an edge over the conventional way of conducting transactions.

In simple terms, cryptocurrencies are just monies in digital form, transacted via digital means and over a digital network. The transfer of these currencies is utilized with cryptography and the aforementioned blockchain network. Up until the 2010s, cryptocurrencies were not really known until Bitcoin made its breakout and this gave rise to the birth of new cryptocurrencies.

Cryptocurrencies have had their fair share of bullish and bearish trends, going to show how unstable they can be. The latest cryptocurrency news reports lots of people predicting prices for various cryptocurrencies in the years to come but no-one can say for sure.

Blockchain, on the other hand, is making its way into pervasive computing, especially IoT, giving way for the development of new solutions that embrace data security and transparency.

As the crypto market evolves, only time will tell if Bitcoin can truly reach $1 million by 2029, altering how investors view and interact with digital assets.

The Indonesian government is keen to protect crypto investors from exploitative exchanges and ensure optimal tax collection.

The native BLUR token has also seen positive price movements.

The new 10x’s research extends beyond MicroStrategy, highlighting that several crypto-related stocks are trading close to fair value based on BTC price.

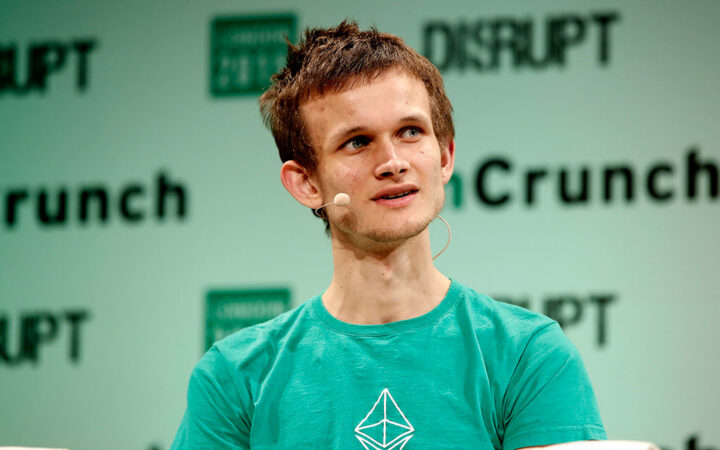

Buterin emphasized that these proposals provide credible ways to limit the number of signatures without compromising security or showing favoritism.

PancakeSwap put forward a proposal to reduce the maximum supply of its native CAKE token from 750 million to 450 million.

Trump’s recent sell-offs have triggered speculations that he may have lost interest in crypto and may be seeking to cash in on all of his holdings.

The recent gains of Ether mean that its price is now up 15% in one month compared to SOL’s 82%.

Analysts are characterizing MicroStrategy’s stock as akin to an “essentially a leveraged Bitcoin ETF” due to its exposure to the cryptocurrency.

Bitcoin mining inherently involves high energy costs due to the operation of supercomputers.

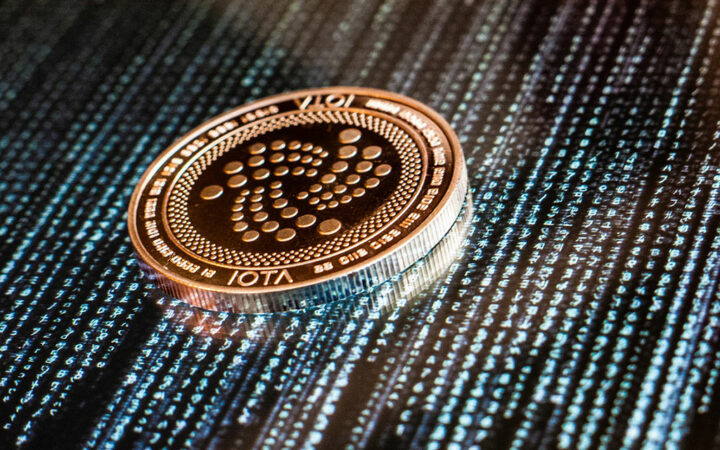

The timing for the launch of the ShimmerEVM Bridge is a perfect one, considering the broader expansion underway in the IOTA ecosystem.

While the average performance of crypto funds did not match the more than 150% rally in Bitcoin this year, the positive shift in fortunes is a promising development for the industry.

By compelling influential political leaders and bureaucrats to share their virtual currency investments, South Korea hopes to heighten transparency surrounding public-sector finances.

The “smart money index”, which measures the net bullish bets by institutional players through Chicago Mercantile Exchange (CME) Bitcoin futures, has reached an all-time high of over 13,700 in recent days.

The accidental double payment of settlement funds to Mt. Gox creditors adds a new chapter to the saga of one of the crypto industry’s earliest and most remarkable failures.