US SEC Approves Grayscale’s Ethereum ETF Filing

Initially submitted on October 2, 2023, the proposal aims to convert the Grayscale Ethereum Trust, the largest Ethereum investment vehicle globally, into an ETF.

For the average millennial or at least anyone that pays attention to the business world, the term “cryptocurrency” would not seem like such a strange word. If that is, then the terms Bitcoin, Ethereum or at least Blockchain should ring a bell. One might wonder, why are these terms suddenly so prevalent, especially cryptocurrency news? Computing is getting rather pervasive and the society is leaning towards digital services. The finance world too isn’t spared as the disruption of technology into this sector has fostered the birth and development of Fintech organizations.

These Fintech organizations look to digitize payments and transactions, offering the same services that are currently in existence but in a better, efficient and more effective way.

Blockchain is the network upon which most of these cryptocurrencies operate on. The history of blockchain and bitcoin, in particular, does not have a definite story. In 2009, an individual or group of individuals known to be “Satoshi Nakomoto” developed and published the technology to allow people make digital payments between themselves anonymously without having an external party to verify or authorize the transfer of the currency being exchanged.

Although technologies like this might seem rather complex, understanding how Blockchain works is quite easy, given that one has a basic idea of how networks work. Blockchain is simply a database shared between several users, containing confirmed and secured entries. It is a network, where each entry has a connection to its previous entry.

This technology affords a very secure model whereby every record in the database cannot be tampered with. Apart from the stellar security that this network offers, the transparency and speed at which the network operates give it an edge over the conventional way of conducting transactions.

In simple terms, cryptocurrencies are just monies in digital form, transacted via digital means and over a digital network. The transfer of these currencies is utilized with cryptography and the aforementioned blockchain network. Up until the 2010s, cryptocurrencies were not really known until Bitcoin made its breakout and this gave rise to the birth of new cryptocurrencies.

Cryptocurrencies have had their fair share of bullish and bearish trends, going to show how unstable they can be. The latest cryptocurrency news reports lots of people predicting prices for various cryptocurrencies in the years to come but no-one can say for sure.

Blockchain, on the other hand, is making its way into pervasive computing, especially IoT, giving way for the development of new solutions that embrace data security and transparency.

Initially submitted on October 2, 2023, the proposal aims to convert the Grayscale Ethereum Trust, the largest Ethereum investment vehicle globally, into an ETF.

Recent reports also suggest that a significant number of employees were laid off earlier this month, with sources indicating that approximately 300 people lost their jobs.

As Bitcoin extends its rally to $35,000 clocking over 100% gains for 2023, let’s take a look at some crypto firms that have outperformed Bitcoin.

The transaction is part of SHPGX’s efforts to provide a solid response to the Shanghai municipal government’s requirements to use the digital yuan in cross-border trade.

Since its launch, the TON Believers Fund collected a substantial amount of TON tokens. To be precise, it gathered 1,317,379,088 TON coins.

The US SEC is therefore expected to review Grayscale’s application to convert its GBTC to a spot Bitcoin ETF without prejudice.

If approved, the Bitcoin ETF is poised to revolutionize the accessibility of the crypto market for investors, offering a simplified avenue to invest in BTC without grappling with the intricacies of managing digital assets on crypto exchanges.

Bitcoin (BTC) price rallied to this year’s high of about $35k during the early Asian market amid speculation of spot ETF approval in the United States leading to high short positions being liquidated.

To demonstrate the potential of UDPN, Standard Chartered’s SC Ventures and Deutsche Bank conducted a trial.

Blockaid’s primary objective is to protect users from a range of security threats, including fraud, phishing, and hacking.

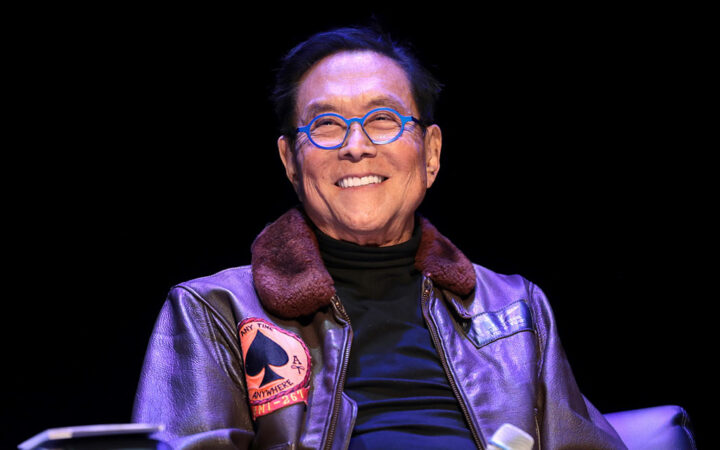

The author of Rich Dad Poor Dad expects the prices of Bitcoin (BTC), Gold, and Silver to rally in the near future as every government around the world prints more money pushing inflation to a multi-year high.

Morgan asserts that XRP sales fail to meet at least two of Howey test prongs, making the SEC’s case weak. With the facts apparently not aligning with the Howey framework, he sees little room for the SEC to overturn the earlier judgment.

Rise in the US Treasury Yields put pressure on the market resulting into bearish weekly start on Wall Street. Yields surge past 5% with Fed planning for higher-than-longer interest rates.

Bankman-Fried’s legal team, led by Mark Cohen and Christian Everdell, has encountered difficulties in presenting a coherent narrative to the jurors.

By November, all Orb operators are expected to be paid entirely in WLD rather than USDC.