Senator Warren Wants OCC to Withdraw Crypto Guidance for Banks, Seeks Support from Colleagues

Concerns are being raised about how the OCC may have exposed the American banking system to the avoidable risks of crypto.

For the average millennial or at least anyone that pays attention to the business world, the term “cryptocurrency” would not seem like such a strange word. If that is, then the terms Bitcoin, Ethereum or at least Blockchain should ring a bell. One might wonder, why are these terms suddenly so prevalent, especially cryptocurrency news? Computing is getting rather pervasive and the society is leaning towards digital services. The finance world too isn’t spared as the disruption of technology into this sector has fostered the birth and development of Fintech organizations.

These Fintech organizations look to digitize payments and transactions, offering the same services that are currently in existence but in a better, efficient and more effective way.

Blockchain is the network upon which most of these cryptocurrencies operate on. The history of blockchain and bitcoin, in particular, does not have a definite story. In 2009, an individual or group of individuals known to be “Satoshi Nakomoto” developed and published the technology to allow people make digital payments between themselves anonymously without having an external party to verify or authorize the transfer of the currency being exchanged.

Although technologies like this might seem rather complex, understanding how Blockchain works is quite easy, given that one has a basic idea of how networks work. Blockchain is simply a database shared between several users, containing confirmed and secured entries. It is a network, where each entry has a connection to its previous entry.

This technology affords a very secure model whereby every record in the database cannot be tampered with. Apart from the stellar security that this network offers, the transparency and speed at which the network operates give it an edge over the conventional way of conducting transactions.

In simple terms, cryptocurrencies are just monies in digital form, transacted via digital means and over a digital network. The transfer of these currencies is utilized with cryptography and the aforementioned blockchain network. Up until the 2010s, cryptocurrencies were not really known until Bitcoin made its breakout and this gave rise to the birth of new cryptocurrencies.

Cryptocurrencies have had their fair share of bullish and bearish trends, going to show how unstable they can be. The latest cryptocurrency news reports lots of people predicting prices for various cryptocurrencies in the years to come but no-one can say for sure.

Blockchain, on the other hand, is making its way into pervasive computing, especially IoT, giving way for the development of new solutions that embrace data security and transparency.

Concerns are being raised about how the OCC may have exposed the American banking system to the avoidable risks of crypto.

Tech giant Meta has announced its Instagram NFT initiative on supported blockchains such as Flow, Ethereum, and Polygon.

In comparison to Dtravel, other booking sites charge around 15-20% and the owners and customers usually share the amount.

CME Group global head Tim McCourt said that there’s a growing demand for BTC and ETH derivative products in Europe and thus it makes sense to bring these products to its institutional clients.

After increasing more than 16% on the partnership news, Coinbase stock added 1.24% to $90.00 in after-hours trading.

Fairfax recently made two $35 million investments in multi-strategy digital asset investment firm Parataxis Capital and the VanEck New Income Fund.

Nansen is experiencing a shift in favor of business clients or B2B. The platform will most likely see more earnings in B2B sales than individual sales.

A former crypto executive at leading accounting and audit firm PwC has launched a crypto hedge fund in Dubai for institutional investors.

The founder of Hashed is looking for his new big investments in GameFi and believes that the virtual gaming world will unlock new economic opportunities as well as job opportunities in the market.

MasterCard’s CFO believes that the volatility of cryptocurrencies does not make them a good choice when it comes to payment settlements.

A former manager at Coinbase recently pleaded not guilty to charges of insider trading and wire fraud.

The introduction of web3 technology to the international coffeehouse’s rewards program could potentially drive mainstream blockchain and NFT adoption.

The report estimates that a total of $880,235 worth of USDT, $441,357 worth of SAND, $344,376 worth of DAWN, $280,181 worth of MATIC, $258,108 worth of APE, $257,990 worth of OMG among others were transferred.

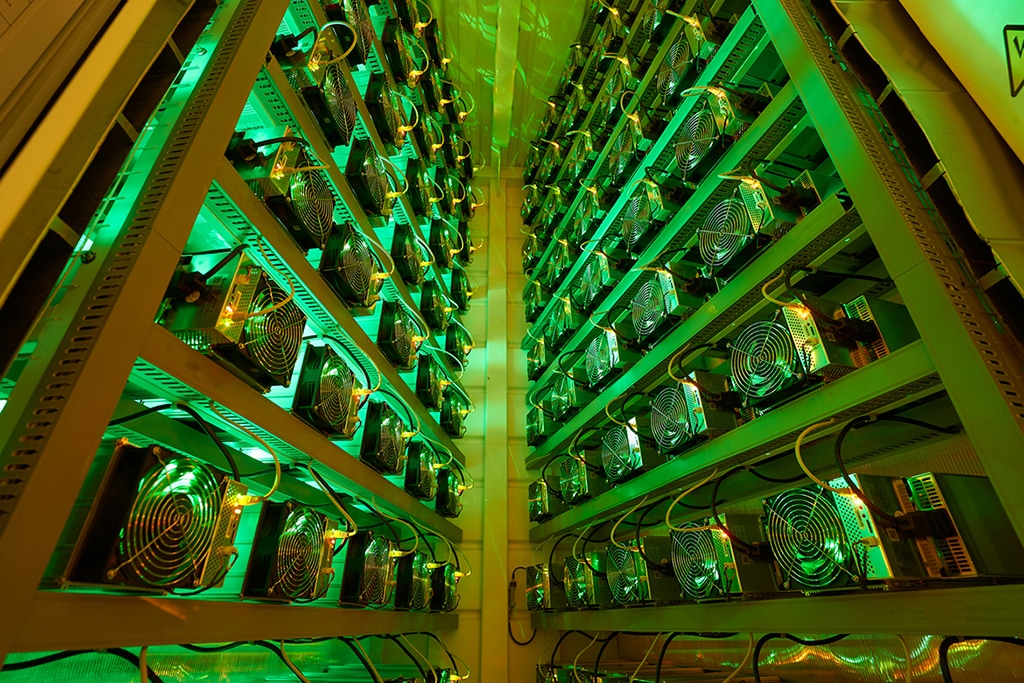

Riot Blockchain reduced mining operations in Texas last month, as the state coped with surging energy demand amid a heatwave.

Tenacious Tacos is also ready to reveal its native token, where all owners can proclaim a preset amount of $StrEATS Cred, with a particular bonus amount being allotted to those who minted but did not list or sell their Tenacious Taco NFT.