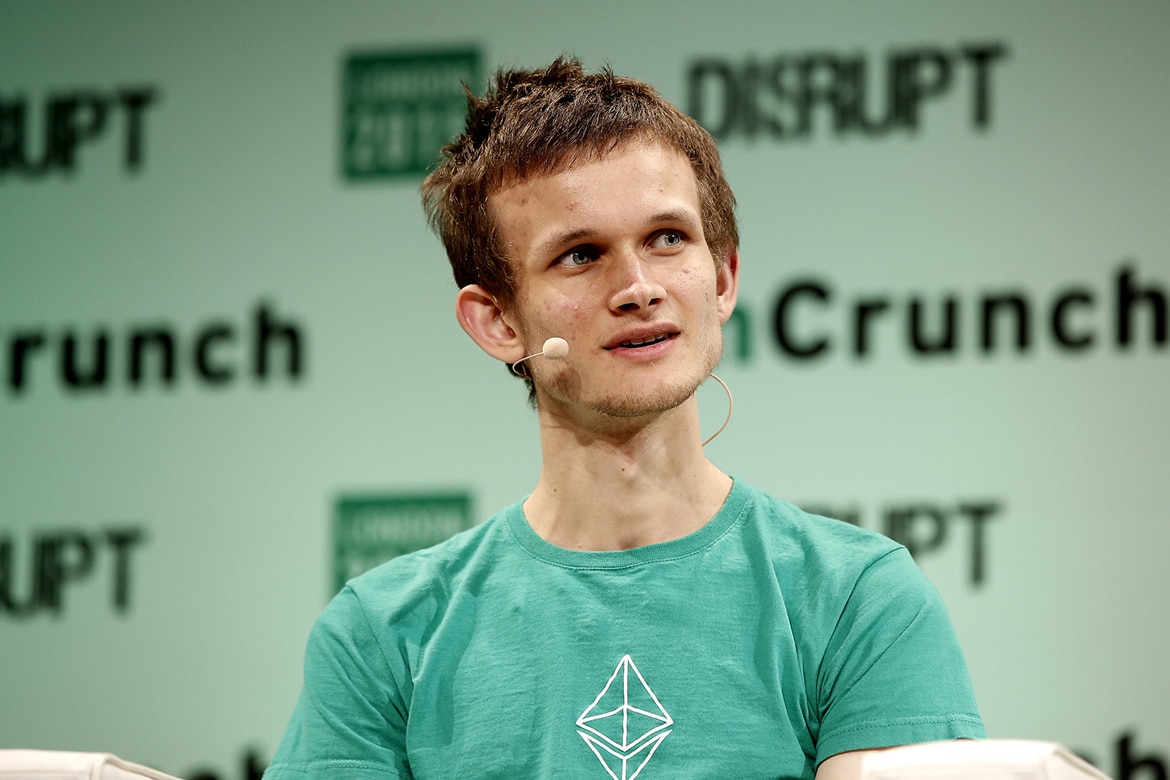

Ethereum’s Vitalik Buterin Wants Narrative around Crypto Change

Vitalik Buterin believes that the role of crypto has changed significantly since 2008. Today Bitcoin is not just “protest” money as it is said by CZ.

This news section spotlights emerging altcoins, project updates, tokenomics changes and ecosystem developments driving innovation in DeFi, Web3 and digital assets. Keep track of the next wave of digital currencies before they make headlines—and gain insights that matter in the altcoin sector.

Vitalik Buterin believes that the role of crypto has changed significantly since 2008. Today Bitcoin is not just “protest” money as it is said by CZ.

Bears are managing to prevent a very important resistance level in the daily chart of Bitcoin from being broken.

Bitcoin managed to reach $10,000 again but failed to go higher. Mike Novogratz explained that the current situation in the U.S. is the reason for its growth. However, now BTC is below $9,500.

In his latest tweet, Buterin has forecasted the success for the Layer 2 scalability of the Ethereum platform adding that there’s still some refinement and deployment left. However, Ethereum 2.0 launch has been delayed further owing to code bug.

Tether stablecoin owned by Bitfinex has announced the decision to integrate with a newly-launched OMG plasma network that is a plasma-based Ethereum sidechain.

Binance Futures will now provide users with historical data to assist with backtesting and trading strategies. It will be year-to-date tick level trading data that will include official records of trade times, prices, and quantities.

Bitcoin OTC trading is believed to surge in 2020 as today crypto derivatives exchanges provide clients with high transparency ratings and impressive security.

It has become known that two securities lawsuits previously filed against Ripple Labs have been consolidated by the court in California.

The plasma implementation sidechain scalability solution Matic blockchain has finally launched its mainnet. In the initial phase, the Matic blockchain will allow a limited set of validators and developers to launch their DApps.

The Xtrading news feed is dubbed as a powerful and reliable tool for real-time market monitoring and also in-depth analytics.

Binance Smart Chain will run parallel to the company’s existing Binance Chain. But in comparison with BC, it brings numerous features to the Binance ecosystem, the main of which is the support of smart contracts.

The Digital Dollar Project group published its first white paper, where they explained the need for a tokenized version of the U.S. dollar and some possible directions for creating this system.

Tycoon69 International aims to create a new digital economy and disrupt gift card business globally.

Charles Hoskinson has announced the launch date for the Cardano Shelley update. The Cardano Shelley mainnet hard fork will take place on 29 July 2020, the first ADA staking rewards in the mainnet can be earned from 18 August.

Zuckerberg explained that with Libra it could be easier for individuals to transfer money or pay for goods across national borders, which would be an advantage for both businesses and Facebook.