Honduras Economic Zone Accepts Bitcoin as Unit of Account

Bitcoin may now be used to determine the market value of goods and services in the region.

Everything you need for the flagship crypto: from price movements and halving cycles to institutional adoption, on‑chain metrics and market strategy around Bitcoin. Follow how Bitcoin’s narrative evolves, why it matters to global finance, and what shifts could impact its future role as digital gold.

Bitcoin may now be used to determine the market value of goods and services in the region.

Despite the uncertainty in traditional markets, Bitcoin’s resilience may be supported by the anticipation of the launch of a spot ETF in the United States.

Hayes, confident in his trading abilities, plans to capitalize on the imminent correction by attempting to “top-tick” the market in late February.

Bitcoin mining firms have been racing to expand their businesses ahead of an expected approval of a spot Bitcoin ETF.

Nearly 28K Bitcoins have been deposited in crypto exchanges in the past week led by BTC miners thus signaling possible price correction in the short term.

Some institutions are hesitant to buy Bitcoin directly due to challenges in the crypto markets, such as security risks and regulatory uncertainty. BTC DRs aim to address these concerns.

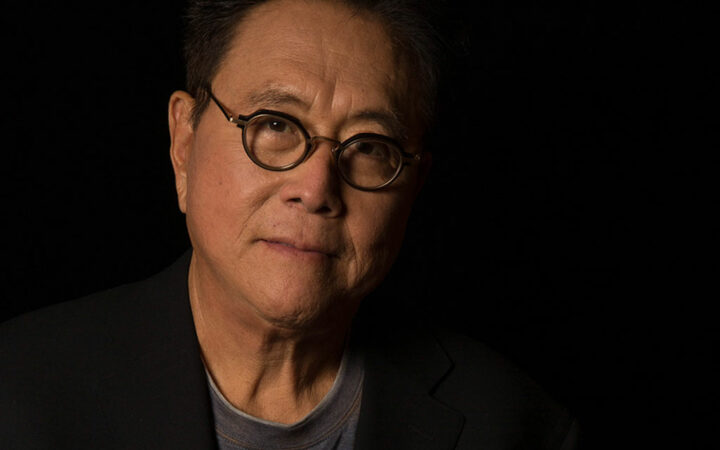

Kiyosaki’s Bitcoin recommendation comes amid a high level of confidence that the US SEC will soon begin approving spot Bitcoin ETFs.

The Fed rate cuts could lead to monetary easing allowing fresh funds to flow into risk-on assets such as Bitcoin and other cryptocurrencies.

Bitcoin miners are preparing for this year’s 50 percent reduction in block reward by updating their mining hardware and software as experts predict significant profits by EOY.

The Matrixport founder believes that, in the long run, BTC will maintain its position as a store of value and a risk-hedging asset, surpassing gold.

On January 2, Bitcoin hit $45,000, which was the highest level it had reached since April 2022.

JAN3 founder Samson Mow has said that companies that issue spot Bitcoin ETFs should provide on-chain addresses to prove their Bitcoin reserves.

Today Bitcoin is widely accepted in the United States, the United Kingdom, Asia-Pacific nations such as Hong Kong, Singapore, Thailand, the Middle East, and some European markets.

As per his share sale plan, Michael Saylor will be selling 5,000 MSTR stocks daily over the next four months to raise MicroStrategy’s Bitcoin holdings.

The Mad Money host described the recent Bitcoin rally above $45K as a remarkable comeback that was unexpected.