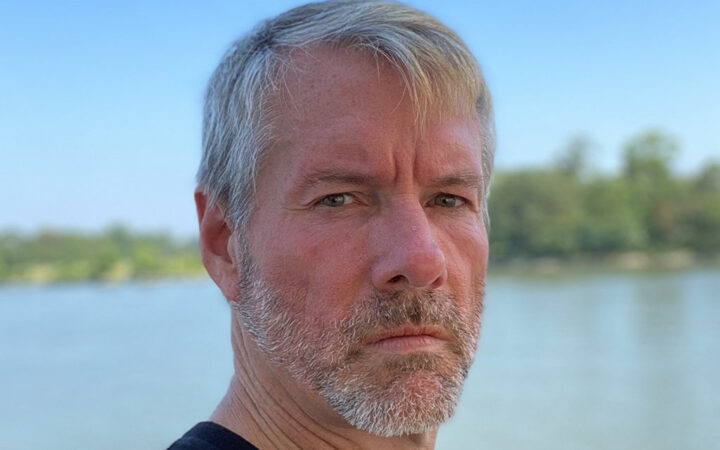

Michael Saylor Says Bitcoin Will 10x from Unprecedented Demand amid Institutional Involvement

According to Michael Saylor, Bitcoin will pump significantly after the SEC approves a spot ETF and demand for the king coin spikes.

Everything you need for the flagship crypto: from price movements and halving cycles to institutional adoption, on‑chain metrics and market strategy around Bitcoin. Follow how Bitcoin’s narrative evolves, why it matters to global finance, and what shifts could impact its future role as digital gold.

According to Michael Saylor, Bitcoin will pump significantly after the SEC approves a spot ETF and demand for the king coin spikes.

The Swiss banking industry has been incredibly receptive to crypto with many local banks adding cryptocurrency services to their offerings.

Fed chair Jerome Powell and the rest of the committee are convinced of slower economic growth in the coming quarters amid softening labor market conditions.

The company also shared what transpired in its finances during the third quarter in an earnings report.

There was a recorded rally among several stocks as the Federal Reserve decided that it would leave interest rates untouched.

Most predictions are optimistic about a Bitcoin bull run considering the expected spot ETF approval and the upcoming halving.

Market makers, crucial components of ETF ecosystems, are responsible for the creation and redemption of new ETF shares, ensuring that the ETF’s market price remains in line with the underlying assets it represents.

Bitcoin forms a “Golden Cross” pattern on the technical charts suggesting a bullish price actions going ahead.

Experts continue to speculate on what the SEC’s next course of action regarding crypto-based ETF applications could be.

As of late October, the SEC is reportedly reviewing eight to ten potential spot Bitcoin spot ETF filings.

With the imminent launch of Bitcoin spot ETFs, many institutions are also looking to gain increased exposure to BTC.

Analysts expect 10-20% of the Gold ETF money moving into Bitcoin post the BlackRock ETF approval i.e. $12 billion to $14 billion worth of inflows in BTC.

Meanwhile, Galaxy Digital estimates that a spot Bitcoin ETF could attract enough capital to drive the price of Bitcoin up by 74%.

With the US SEC opting not to appeal the Grayscale Investments case, amid ongoing application amendments, experts believe the approval of spot Bitcoin ETF is a matter of when and not if.

In anticipation of this pivotal event, there has been a substantial uptick in trading volume for products launched by ProShares and Grayscale.