21Shares Launches Bitcoin & Ethereum ETPs Targeting Less Volatility

Amid the crypto market downturn, Swiss crypto ETP issuer 21Shares is now offering investors low-risk exposure via its BTC & ETH ETPs.

Everything you need for the flagship crypto: from price movements and halving cycles to institutional adoption, on‑chain metrics and market strategy around Bitcoin. Follow how Bitcoin’s narrative evolves, why it matters to global finance, and what shifts could impact its future role as digital gold.

Amid the crypto market downturn, Swiss crypto ETP issuer 21Shares is now offering investors low-risk exposure via its BTC & ETH ETPs.

Despite a bleak outlook, Novogratz believes that the Bitcoin “store-of-value” appeal will see it rise to $500K in five years.

Bitcoin has moved past its crucial resistance of 200-week EMA. But BTC needs to form a daily and weekly candle above it to confirm the uptrend.

The sell-off of Bitcoin is a way for companies to maintain their balance sheet.

Altcoins led by Ethereum have been the major contributors to the price rally. On the other hand, Bitcoin faces a strong resistance at its 200-week moving average.

With the impressive positive movements across crypto, shares of Coinbase increased by 9.07% to almost $59.

Despite the glimmer of hope in BTC and ETH rally, analysts and investors alike, remain unconvinced about its sustainability.

Bitcoin and Ethereum have shown a strong upside over the last weekend. A strong weekly closing can result in a further price rally ahead this week.

All thanks to increasingly progressive regulations and more institutional involvement in both countries, Germany and the U.S. claim top spot in new ranking of most crypto-friendly countries.

It was observed that the funds going to mixers primarily comes from Darknet markets, hackers, North Korean Lazarus Group, Defi protocols, centralized exchanges, as well as addresses connected to illicit activities linked to sanctioned countries.

Crypto market turned volatile following the US CPI inflation data on Wednesday. Owing to four-decade high inflation the Fed is likely to initiate aggressive QT measures which can force investors to move away from risk-ON assets like crypto.

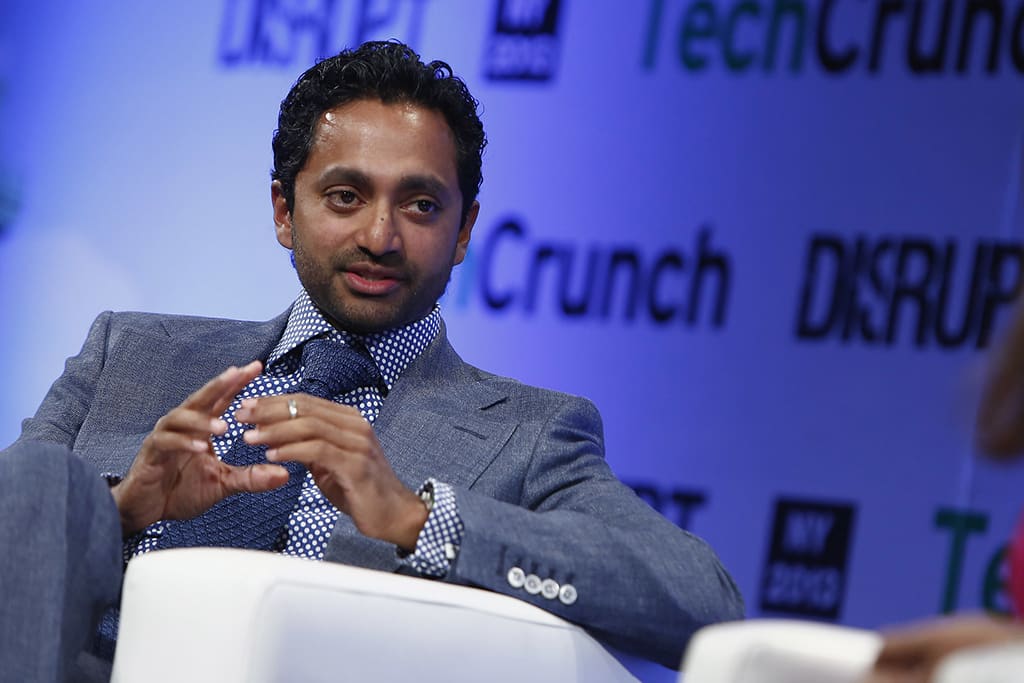

Chamath Palihapitiya spoke on Bitcoin and crypto issues, including inadequate regulation, off-chain transactions and high-risk staking.

The latest development from the regulatory body reportedly comes after the commission rejected Grayscale’s attempt to convert its Bitcoin trust into an ETF in June.

The SEC categorized Bitcoin Futures ETF and spot Bitcoin ETF as separate products.

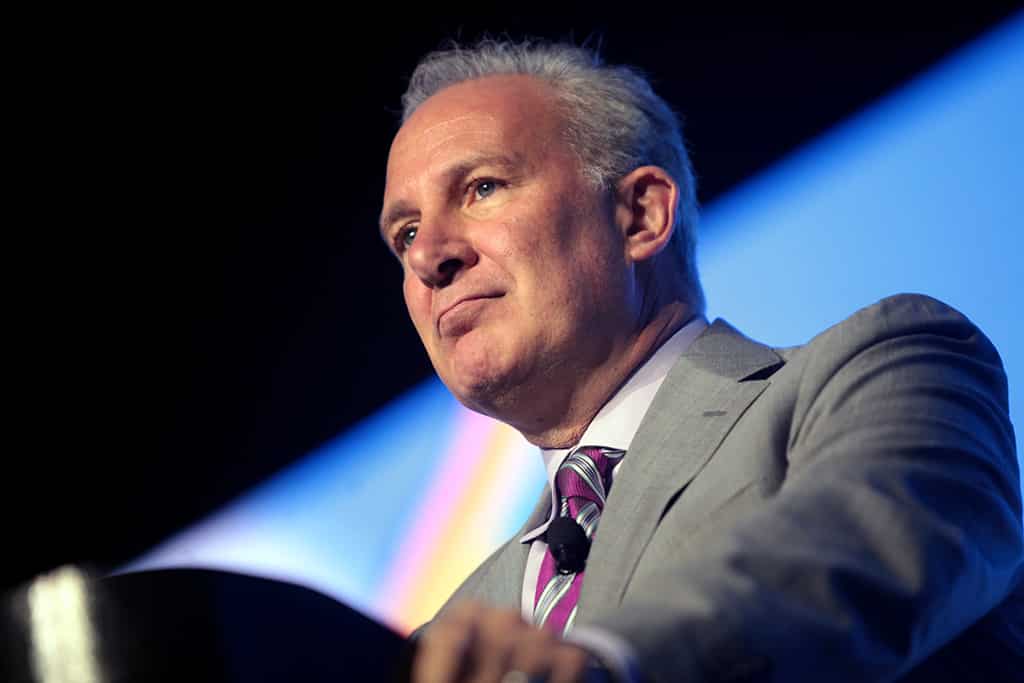

Bitcoin critic Peter Schiff said that he would be accepting BTC if that were to save customers of his now embattled bank Euro Pacific.